Learn how to protect your retirement savings.

How Central Bank Digital Currency Will Affect Your Privacy

Welcome to the Central Bank Digital Currency Era! That’s right: The Fed is moving to make its own digital currency and have no doubt that it will become the new currency standard in the not-so-distant future.

The creation of digital assets like bitcoin still has many people believe that such assets will set us free from the tyranny of central bankers, but when it comes to governments and central banks the reality is the exact opposite. The technology driving cryptocurrencies will be used to create central bank digital currencies (CBDCs) to deepen the hold and overwatch of banks and governments over your money and actions.

Worst of all, central bankers with our current fiscally irresponsible government will soon have their eyes on all of your assets. Let me explain.

Your assets are trackable

The digital era has made money, investments, and assets more trackable than ever before. Not only can the government track your investing and spending, but they can do so with lightning speed. Every transaction that goes through your bank or investment account is trackable. Instantly.

The only assets they cannot track are the non-digital, physical assets that you don’t need to register (so not your real estate or home) and can keep outside of the financial system, such as cash and physical assets like gold. But with CBDC, physical cash will no longer exist — all your dollars will be digital and trackable. No more hiding your greenbacks in your mattress.

If you are banking on stocks, bonds, cash savings, and real estate to give you the retirement you always dreamed about, just remember that the government has their eyes on all these assets. They know exactly what you own, and if they are unhappy with your actions, they can freeze or even confiscate each one of these assets with the touch of a button.

Stocks and bonds

Transactions on Wall Street are recorded and reported publicly. You can see what Donald Trump is investing in if you really want to. This means that your portfolio isn’t private if it is invested entirely in the stock and bond markets.

If the public can track it, the government is obviously paying attention too. The only question remaining is if you care that the government can see what’s in your portfolio.

Savings

If it’s electronic, it can be tracked. Even if you don’t regularly access your savings account online, the banks and the government know exactly how much money you have accumulated, how much you spend with these accounts, and what you spend your money on.

Savings accounts may actually be the most trackable asset you have. While it’s good to have liquid assets like this in case of a rainy day, you need to be careful of laws enacted under Obama that allow the banks to legally confiscate your funds and give you bank shares in times of distress.

Real estate investments

Anyone who has even tried to research living off-the-grid knows that the US government knows who owns every square inch of American soil. All of your real estate investments are tracked closely by the government, which is how they calculate property taxes, for instance.

But the government can do much more than tracking. Think about it: The government can claim land that is privately owned by American citizens and turn it into public land. So, even if real estate is a physical asset that cannot be hacked, the government still knows exactly what you own and how much it’s worth, and it can legally take your real estate away if it needs it.

Digital currency

With digital currency, we’re looking at a paradigm shift in the financial markets. Bitcoin and other cryptocurrencies have paved the way for digital currencies, which have become a popular speculative asset around the world. Digital currencies are supposedly untrackable, but it is actually possible to track these assets.

It’s only a matter of time before the government passes bills so that they can closely monitor these assets. And it has already begun — there are laws obligating us to report our holdings in cryptocurrencies.

What is a central bank digital currency?

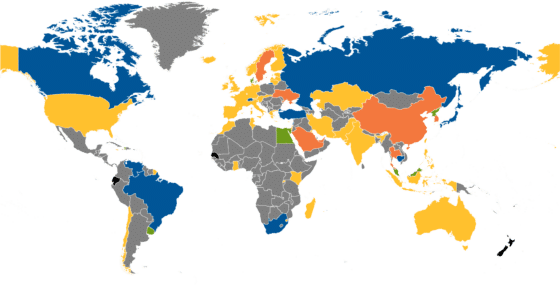

A central bank digital currency is, simply, a digital version of the current fiat currency created by a central bank, such as the dollar. Several countries, including Brazil, Sweden, and Russia, are currently developing their own CBDC.

(You can see an interactive version of the map that’s tracking the world’s progress on CBDC here.)

Most prominently, however, is China, who is already testing its digital yuan. Undoubtedly, this is one of the reasons the Fed is intensifying its pursuit of their own CBDC. Currently, the Fed has been examining various digital currency options, including stablecoins, which (unlike bitcoin) are digital currencies pegged to some external reference, such as the dollar or perhaps even gold.

How far will digital currencies go?

For our government and the Fed, the ultimate goal would be to eventually transition from our current monetary system to a digital-only system that requires digital currencies to be used in all transactions, fading out the use of physical currency altogether.

And the reason is simple: More control.

With CBDC, the government will be able to monitor and flag every cent you earn, save, or spend. You will have no privacy left when it comes to your finances. Not a single cent will escape the government’s watchful eye, and they’ll be able to tax everything they want. In fact, they could, in theory, just withdraw the taxes you owe them directly since they’d practically be in control of your money.

This will allow the government to do something they can’t effectively do today: setting negative interest rates. With a negative interest rate, they will be able to tax you on every dollar that you don’t spend. If you don’t use it, you will lose it. This is not possible when you can hold physical cash, so get ready to lose one of your last great benefits.

Eventually, the only private asset you will have left will be the physical gold you’ve acquired.

The benefits of gold in the digital age

What protects gold from the watchful eye of the government?

1. Gold cannot be tracked electronically

Unlike the dollars in your bank account or your investments in stocks, physical gold cannot be tracked or accessed electronically, keeping your precious metals investment out of reach of the government, the banking system, and Wall Street.

2. Gold cannot be hacked

Both the government and the banks have been hacked on more than one occasion, and cybercriminals have been able to access personal information such as bank account and credit card information. Gold, on the other hand, is as likely to be hacked as the salad in your fridge.

3. Gold is a physical asset

Unlike the stocks and bonds in your portfolio, investing in gold comes with the added bonus of owning something physical that you can hold in your hand.

Ultimately, if you’re looking for privacy in your investments, gold may just be your last resort.

The post How Central Bank Digital Currency Will Affect Your Privacy appeared first on Gold Alliance.