Learn how to protect your retirement savings.

How to Find Financial Security in Uncertain Times

Rising inflation, an ever-increasing stock market bubble, the weakening dollar, the pandemic… We’re surrounded by uncertainty, so it’s no wonder that so many Americans are looking for certainty, financial security.

Right now, you are happy that the stock market is at record highs since a large portion of your investments probably is in stocks. But you are also nervous since experts are warning that the bull market is at its peak and is due for a correction or even a hard crash — one that could severely alter your plans or impact your ability to retire when and how you want.

But how do you protect your hard-earned money? How can you find financial security?

Financial security: The peace of mind you feel when your money, investments, and other financial aspects of your life are stable and look to remain stable in the future.

There is one asset that gives us that financial security, and since you’re reading this article on our website here at Gold Alliance, you won’t be surprised to hear that asset is gold.

But why does gold provide financial security? Let’s take a look.

Gold protects against stock market crashes

Historically, gold investments are a great hedge against stock market corrections and crashes. When the stock market tumbled, gold skyrocketed as investors sought the protection and security that gold offers. Take a look at this chart, which shows how the price of gold has performed during major stock market corrections.

As you can see, in some of the worst market crises in recent US history, gold has provided people with financial security, returning an average of 6.4% while stocks fell an average of 21.7%.

The current stock market trends are catching everyone’s eye because stocks are reaching record highs (we explain what’s fueling the bull market in stocks, why it’s unsustainable, and what that means for your portfolio in this article). The overvalued stock market could correct itself (or crash) at any moment.

When that happens, you have hopefully already protected your financial future by diversifying outside of the stock market with gold. Imagine having a portion of your portfolio in the stock market and a portion in a Gold IRA. This is true diversification — since gold historically goes up when the stock market goes down, you reduce the risk to your portfolio and may even see significant gains.

But the benefits of a Gold IRA don’t end there.

Gold protects against inflation

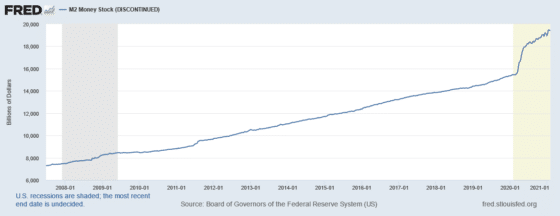

The Fed has the printing presses running seemingly nonstop as the government orders more and more money to be printed. This is causing inflation, and you can already feel the impact of increasing prices at the grocery store and gas pumps.

The chart below shows the money supply. Notice the huge bump when the pandemic hit — in just one year, the Fed has increased the money supply by 25%.

The Fed’s view on inflation is very nonchalant, and the central bank acted surprised to learn that the inflation numbers for April were the highest in 13 years. But there’s no doubt that inflation is already here, and the Fed keeps dismissing it, allowing it to rise. This places your financial security at risk as the dollar — and dollar-denominated assets like stocks — will suffer.

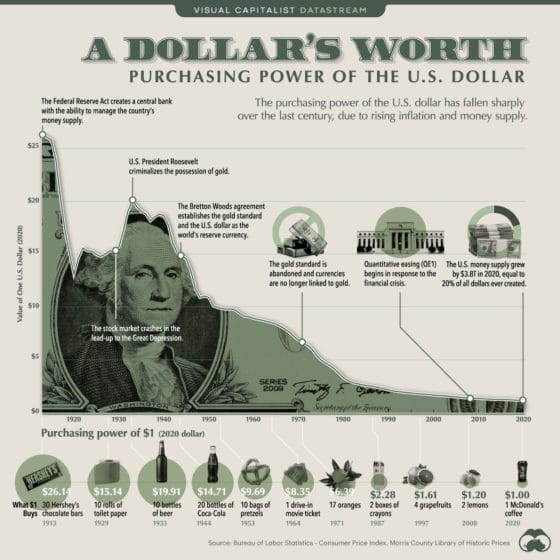

Just look at the purchasing power of the dollar over the past 100 years since the Fed was created.

Gold is immune to the negative impacts of inflation. Gold can’t be debased because it can’t be reproduced or printed. That’s why gold has long been the preferred hedge against inflation.

Gold is a tangible asset

Stocks and bonds are digital assets. They only exist electronically. The same goes for cryptocurrencies, like bitcoin. Accounts holding these assets are susceptible to hacking or can be compromised in other ways, and their existence relies on the internet and our infrastructure.

Gold, on the other hand, is a physical asset that you can hold. It cannot be hacked or compromised. Gold has value not just as an investment asset but also as an important material in many industries, not to mention in jewelry. Gold is an element — there is and will always be only one gold. With the knowledge that gold can always be quickly and safely exchanged for cash when needed, gold investors move with a sense of certainty, in addition to the financial security, that most other assets can’t give them,

Get peace of mind today

If you are one of the many Americans who have already invested in gold and other precious metals, you’re probably relaxing in your favorite chair with a cup of coffee by your side while reading this article — after all, you can relax because you know that you have already done the best you can to achieve financial security.

But if you’re even the least bit worried about the stock market, about inflation, and about your financial future, you now know how you can get peace of mind and financial security.

The post How to Find Financial Security in Uncertain Times appeared first on Gold Alliance.