Learn how to protect your retirement savings.

The Truth About Physical Gold as an Investment

“Expert” financial advisors seem to dismiss investing in physical gold left and right. But if physical gold is as bad an investment as they claim, why are investors seeing massive returns on their gold investments?

Because physical gold is a strong investment, but the “experts” don’t want you to know about it. Why not? They don’t benefit from you taking your money out of their firms, so why would they tell you it’s a good idea?

Here’s how it works.

When you tell your financial advisor you want gold

You’ve done your research, and now you want to tell your financial advisor that buying physical gold is the right thing for you. You know all about the benefits of physical gold investments, and you’re ready to roll a portion of your 401(k) or IRA over into physical gold.

But wait! If you tell your financial advisor that you want to move a portion of your retirement savings, the very first thing you’re going to hear is that physical gold is a bad investment. They’re going to try everything in their power to keep your money in the stock market and other assets their firm trades. It’s the only way they can continue to make money off of you.

This is exactly what you’ll hear from your financial advisor when you bring up investing in physical gold (most likely, you’ll hear it in this order too):

- Gold is a bad investment.

- Gold doesn’t yield.

- How much do you really want to put into gold?

- Instead of buying physical gold, let me get you into gold ETFs (Exchange-Traded Funds). They’re just as safe as physical gold, and you can keep your money in one spot.

- You trust us, right?

Let’s break this down. Gold is not a bad investment. As a matter of fact, gold is an excellent hedge against inflation and market crises. If all of your money is in the stock market (even if you choose to invest in gold ETFs), your financial advisor probably doesn’t have your best interests in mind.

Next, your financial advisor is right about one thing: Gold doesn’t yield or pay dividends. It’s a finite commodity, so it’s not going to yield. But yields are not the purpose of investing in physical gold. In addition to offering the benefits mentioned above, gold is a proven store of wealth that grows in value over the long term — that’s why it should be part of any portfolio.

When your financial advisor realizes you’re determined to invest in gold, he’ll ask you how much you want to invest. Don’t be afraid to tell him the real number you’re looking for. For instance, we typically recommend an allocation of 25%–30% to physical gold and other precious metals. Most likely, your advisor will then recommend you invest just a small portion of your savings in gold, perhaps a few percent, and he is going to try everything he can to keep your money under his umbrella.

That’s why he’ll offer you ETFs or other paper assets traded on the stock market in place of physical gold — your money will still be in the market; he will still have control over it; and he can continue to make money off of your investments.

It’s just the business.

But let’s face it. No matter how much you trust your financial advisor, you need to diversify outside of the stock and bond markets in order to fully protect your financial future. Buying ETFs still keeps your money in the stock market.

When the markets crash

If you listen to your financial advisor and keep all of your money in the stock market, you may feel a little sense of comfort knowing that you own gold ETFs. However, those ETFs aren’t real gold. You don’t own the gold those companies hold. You have a stake in a company that owns gold.

So, what happens when the stock market crashes and you own gold ETFs? Well, whatever happens to the company you’re investing in happens to your money. If they go down, so does your retirement portfolio.

And who do you run to? Are you going to give your financial advisor more money? No! You’re going to yell at him because, as the market and your gold ETFs slide, physical gold will be on the rise.

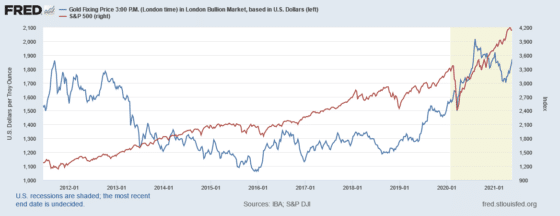

Why should you believe us? Well, just take a look at this chart that shows the performance of gold (blue line) versus the S&P 500 stock market index (red line).

Image Alt Text: Gold tends to perform in opposition to the stock market. This is because, in times of financial crisis, people turn to assets that have intrinsic value and protect their retirement savings, like precious metals.

We aren’t telling you this because we’re a Gold IRA company. We’re telling you this because your financial future matters. No one should be left in the cold when the markets crash . We know that it’s important to diversify among asset classes, and it’s important that you know that too.

So, when your financial advisor wants you to keep all of your money in the stock and bond markets, you should see a huge red flag.

What do we really know about gold investments?

Ultimately, investing in physical gold is rarely talked about in the financial world. The “secrets” of investing in gold are often kept among those who know the value of gold. All the while, others will tell you that gold doesn’t yield — when you buy an ounce of gold, five years later, you still only have an ounce of gold.

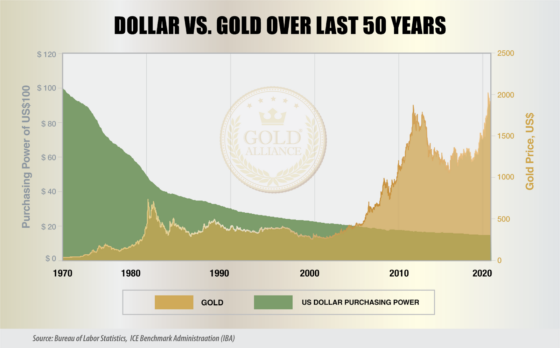

While gold doesn’t yield, it does store wealth and grow in value, especially over the long term. Compare that to the value of the US dollar, and you’ll see exactly how much gold has grown.

Take a look at this chart that shows the price of gold versus the purchasing power of the US dollar over the last 50 years.

As you can see, dumping the gold standard led to the demise of the dollar. Since we left the gold standard, gold has grown: over 5,300%!

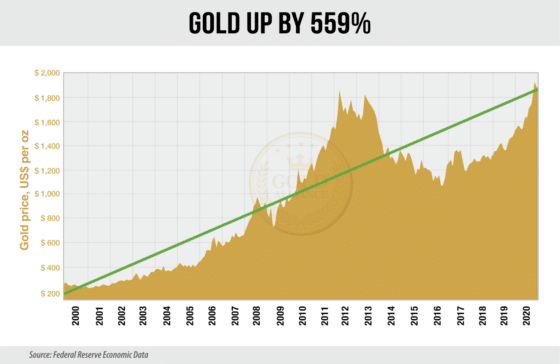

If you “do your own research,” as they say, and see the history of gold prices, you’ll notice one thing: even though gold has its ups and downs, on average it’s on a steady increase.

Image Alt Text: Gold has its ups and downs, but the long-term trend is showing great increases in the gold price.

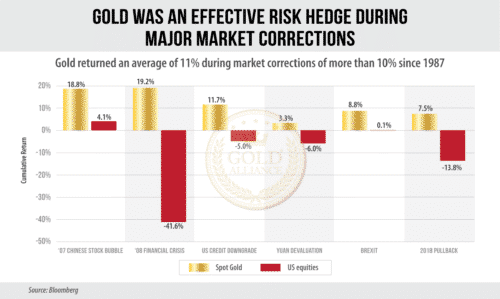

Not to mention, when you look at how gold reacts to market crises, corrections, and recessions, gold functions as a hedge. Take a look at this chart, which shows how gold reacts when the market faces major market corrections.

Image Alt Text: What goes up must come down, and when the stock market crashes, gold tends to perform better. While gold has its ups and downs, it’s rarely as volatile as the stock market.

It’s no wonder that more and more Americans are looking at gold as an insurance policy that protects their investments in every other market.

But if no financial advisors will discuss gold, how do you know the best ways to succeed when investing in gold?

We have those answers for you.

How to succeed when investing in gold

Gold functions a lot like other asset classes: its price and value move up and down. However, gold has a tendency to work in opposition to other asset classes, such as stocks.

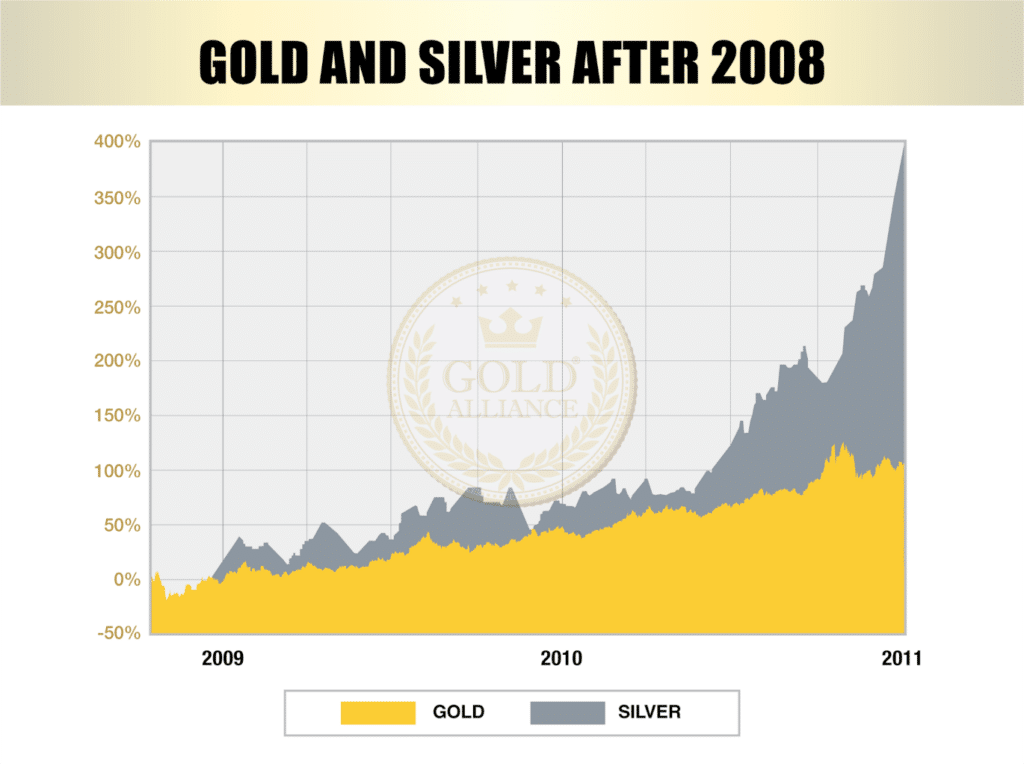

For this reason, the first way to succeed when investing in gold is to give gold enough time. While gold can make huge jumps in price (like it did after the housing bubble burst, see the chart below), gold typically shows such growth over longer periods.

Remember that when the stock market is down, gold tends to move upwards, and when the stock market is up, gold tends to maintain or fall slightly. That means that the best time to buy gold is when the stock market is doing well.

The final way to succeed when investing in gold is to be sure you have the right ratio of gold within your portfolio. How much gold is enough? We recommend rolling 20%–30% of your portfolio over into a physical Gold IRA. This will give you enough of a hedge against the next stock market crash.

You already know how your financial advisor will respond to that, but now that you’ve done your research on investing in physical gold, you know how to respond to him.

The post The Truth About Physical Gold as an Investment appeared first on Gold Alliance.