Learn how to protect your retirement savings.

What Is China’s Secret Agenda?

China is making blatant economic power plays, and for a relatively short time we are paying attention. While US politicians argue about how to best work toward economic recovery after the Covid crisis, China is making bold moves to elevate its position globally — moves that could crush the dollar in the global economy.

The China play is not difficult to spot, and what is interesting about it is that it revolves around gold. Here’s China’s play for world domination in 5 easy steps:

Step 1: China is increasing its gold reserves

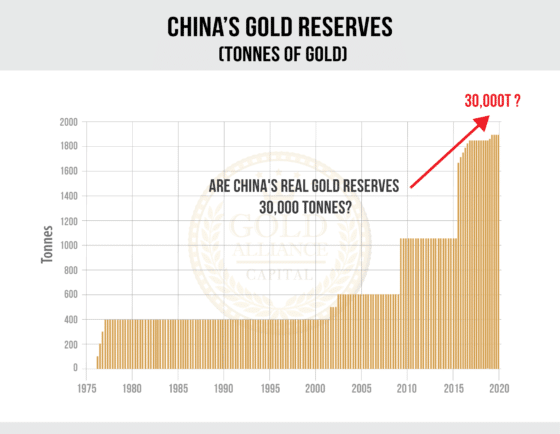

There’s no doubt China is after gold. The chart below shows China’s official gold reserves.

China has increased its gold holdings significantly, especially in the last five years.

But the chart above only shows the officially reported gold reserves. So, how much gold does China really have?

The Chinese official records state that they are holding 1,948 tonnes of gold right now, which equals 3% of its $3.2 trillion in foreign exchange holdings. Compared to America’s stated 8,133 tonnes of gold, which equals 77% of its official foreign exchange reserves, China’s official gold reserves don’t seem like much.

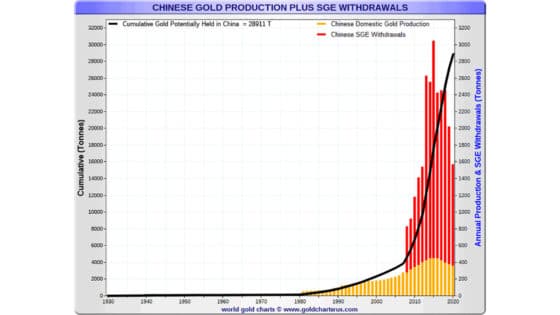

But this number is suspect. Since 2007, China has been producing more gold than any other country. China produced 380 tonnes of gold in the last year alone, and in the last 10 years, they have mined around 15% of the total gold mined throughout the world.

Records state that since 2000, China claims to have mined around 6,500 tonnes of gold, and over half of China’s mining operations are owned by the Chinese government. And what’s really interesting is that China does not sell the gold it mines. Exporting domestically mined gold is not allowed in China.

Now, let’s add the gold that China is importing. China has been bringing in gold from Chinese-owned mining operations in Asia, Africa, and South America. China is at the forefront of gold production in the world, and they’re the world’s leading importer of gold. Although it’s difficult to get exact numbers, it’s estimated that China has imported more than 6,000 tonnes of gold since 2000.

Add those 6,000 tonnes to the 6,500 tonnes mined, and you have a number that dwarfs American gold reserves by over 4,000 tonnes. More importantly: These numbers dwarf China’s official gold holdings.

Now you may ask, why is China not revealing how much gold it has? For the same reason the US is not revealing how much gold it has. Gold is the only true form of money for central bankers, and a country that has more gold has more financial firepower in times of crisis. China is hoarding gold but not letting the US know about the gold arsenal it is building so the US will not compete with it in gold purchases.

And if you want to look at total estimated numbers for Chinese gold, whether it’s imported, mined, or recycled, most of the gold that enters China goes through the Shanghai Gold Exchange (SGE). So, we can use withdrawals from the SGE to estimate Chinese gold demand. The SGE reports that China has withdrawn around 20,000 tonnes of gold since 2008.

We can then add privately held gold, which the World Gold Council estimates at 2,500 tonnes.

Adding all the numbers, we arrive at estimated gold holdings close to 30,000 tonnes (the black lines in the chart below).

These numbers don’t even include undeclared gold exchanges like the privately owned gold by Chinese citizens, the gold that China’s central bank, the People’s Bank of China (PBOC), purchases outside the SGE, and the gold owned by the Chinese military.

What’s the big deal? While it is true that several other countries are building up their gold reserves, China is swinging for the fences here.

To us it seems that Step 1 of the Chinese plan is complete. China’s gold hoarding will be a key element when its next steps are revealed.

Step 2 and 3: Create massive trade deals contracted in yuan and back the yuan with gold

While the yuan became a world reserve currency in 2016, as of right now, it only makes up 2.25% of foreign exchange reserves.

However, China has a few cards up its sleeve to push the yuan forward.

For example, the oil futures contract that China launched in 2018 is priced in yuan. As an added incentive to oil producers, China offers to immediately convert the yuan into gold. Oil producers can now get paid in yuan and immediately convert it to gold, which is highly desirable to them. Now you see why having huge gold reserves is so important to China. China is practically backing these contracts with gold, effectively boosting the credibility of the yuan on the world stage.

A crucial part in strengthening the yuan is Step 4..

Step 4: The introduction of the digital yuan and the fall of cryptocurrencies

While many central banks are focusing on digital currencies, China has been working on theirs since 2014 and has already made a soft launch within their country. They’re miles ahead of most other countries, and it seems their goal is to have the e-yuan fully ready for launch by the 2022 Beijing Olympics.

China knows digital currency is the future, but they also know that digital currencies still lack broad appeal and credibility. That is most likely the reason why they are hoarding gold. Their gold reserves give them the confidence to move to a power position with the digital yuan.

They’re even taking action to ensure that the digital yuan is the most powerful digital currency in China. They’ve gone so far as to shut down power to bitcoin mining operations in Sichuan, the second most intensive mining region in China, justifying the move with concerns about the impact of crypto mining on the climate. According to a 2020 study, 80% of bitcoin mining operations take place in China, and the Chinese crackdown led to bitcoin falling 9%. Other major cryptocurrencies, which often mirror bitcoin’s movements, fell as well: Ether, cardano, and dogecoin all lost 5–6%.

Cutting the legs off of cryptocurrencies is a strong power move that can help strengthen the digital yuan in terms of both value and credibility. If China can chop off bitcoin’s legs by turning off the power, it can clearly keep its own digital currency as a stable, reliable store of wealth.

Will China surpass the US in the world economy?

Beijing insists that China isn’t moving in on the dollar and that they aren’t working to create a digital yuan as the world’s reserve currency. What they are saying is that world economies go through a natural cycle, and if the digital yuan happens to become the world’s leading currency, so be it.

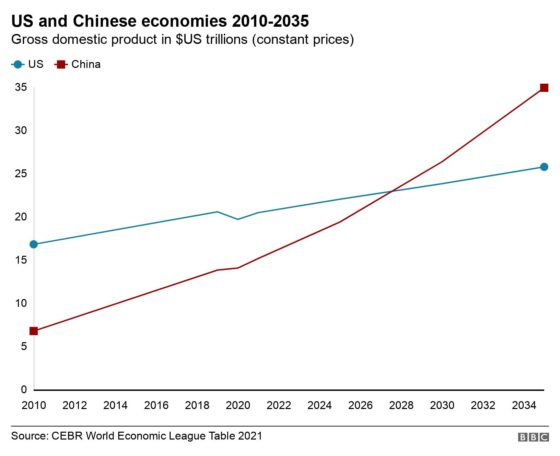

China is already the second-largest economy in the world, and it’s projected that China will surpass the US and become the largest economy by 2028 — and, perhaps soon, the leading world power.

Step 5: China is on a buying spree

To increase its power globally, China is buying up not only companies but also key infrastructure across the globe — enough so that NATO is warning countries about China buying influence.

China has been buying Greek ports, and the China Overseas Shipping company owns 90% of the only terminal operator in Belgium, 51% of the stake in two key port terminals in Spain, and minor stakes in other terminals in Europe. China is also moving into southeast Asia. And, of course, US companies aren’t immune to Chinese acquisition either.

All that is to say that China is increasing its influence across the world by buying up strategic infrastructure and companies. And even if the US and Europe should start putting up roadblocks, China still has all of Asia, Africa, Eastern Europe, and Latin America to expand to.

Here’s what appears to be China’s agenda:

- Hoard gold to build their reserves and back the yuan

- Create massive trade deals that are contracted in yuan

- Passively back yuan with gold (as with the oil contracts)

- Create a digital currency ahead of other countries

- Buy up infrastructure and foreign trade

China has been working on the plan above for the last couple of decades, and they are succeeding in every one of them.

What can you do about China’s plan?

The best advice we could give both you and our government is to do what made our country the world’s foremost superpower: get more gold. At times of crisis, the golden rule is “he who has the gold, makes the rules,” and if China has beaten us in gold ownership, they will have a stronger hand at the negotiation table when that major global crisis hits.

When that happens, each and every one of us will feel great pain when it comes to our paper assets — our dollars and dollar-denominated assets like stocks and bonds will lose a significant portion of their value. And what will determine our wealth will be our hard assets: land and gold.

While you won’t be able to get your hands on over 30,000 tonnes of gold to beat China, you can start building your own “gold reserves” in order to curb the effects of the US dollar losing its status as the world reserve currency.

Joseph Sherman

CEO, Gold Alliance

The post What Is China’s Secret Agenda? appeared first on Gold Alliance.