Learn how to protect your retirement savings.

The Wage-Price Inflation Spiral

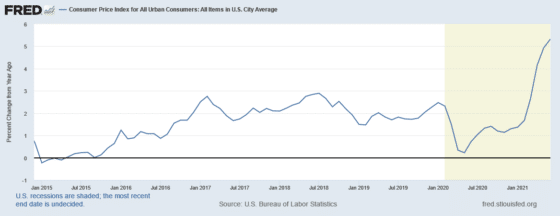

There shouldn’t be any doubt that Inflation is here — outside of the Fed, of course, but more about that below. The latest inflation numbers were released last week, and the consumer price index rose yet again, continuing the trend we’ve seen since the start of 2021. Inflation is now at 5.4% for the year ending in June, up from 5% for the year ending in May.

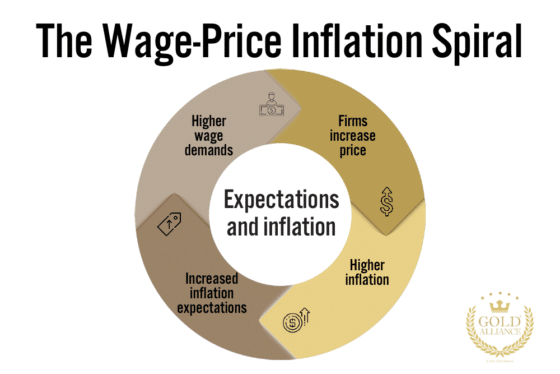

What is more concerning is the fact that the rate at which consumers and businesses are expecting prices to rise in the future — simply referred to as “inflation expectations” — is up as well. This is important because actual inflation depends, in part, on our inflation expectations: When making financial decisions, businesses and consumers take into account the expected rate of inflation, and all of these decisions feed into wage negotiations, companies’ pricing decisions, consumers’ purchasing decisions, etc.

We saw an example of this in the 1970s and 1980s.

The wage-price spiral

In the 1970s and 1980s, both inflation and inflation expectations rose, a phenomenon termed the wage-price spiral at the time. Here’s how it plays out: High inflation increases inflation expectations, which causes workers to demand higher wages to cover the expected loss of purchasing power. To pay for higher wages, businesses raise their prices, which increases inflation, and so on.

The wage-price spiral means that once inflation expectations rise, it becomes difficult to drive inflation lower, and, as we saw back then, inflation stayed with us for a long time and severely impacted businesses, consumers, and investors alike, including Americans saving for their retirement. It stopped and reversed course when the Fed raised the interest rates to as high as 21%, crushing inflation but also the markets and the economy. We did not have our current debt load at that time, which probably takes out of the realm of possibilities a similar move by the Fed today: Our country will not be able to pay the interest on its debt at such a high rate.

US consumers worry about rising inflation

According to the University of Michigan’s consumer sentiment index, US consumers are increasingly worried about inflation. “Rather than job creation, halting and reversing an accelerating inflation rate has now become a top concern,” says Richard Curtin, the chief economist behind the survey.

“Inflation has put added pressure on living standards, especially on lower- and middle-income households, and caused postponement of large discretionary purchases, especially among upper-income households,” Curtin adds.

Survey respondents to the New York Fed’s Survey of Consumer Expectations show the same expectations, stating that inflation will be 4.8% for the year ahead. That’s the survey’s highest outlook since 2008 and up from 4.2% last month. This survey shows that consumers disagree with the Fed’s stance that inflation is “transitory.”

US companies see inflation clouds on the horizon

Inflation has also become a hot topic in corporate boardrooms. Inflation was mentioned on 87% of earnings calls among S&P 500 companies, compared to just 33% a year ago.

Earlier this month, Conagra Brands Inc. and PepsiCo Inc. both stated that they don’t expect higher input costs (raw materials, labor, etc.) to be just temporary. Costs, they say, will remain substantially more expensive in the coming months.

“I’m not going to assume it’s going to be transitory,” said PepsiCo’s Chief Financial Officer Hugh Johnston in an interview on Bloomberg TV on July 13. “It’s going to be with us through the better part of next year.”

And companies are already accounting for inflationary pressures. Conagra — the maker of Vlasic pickles and Slim Jim snacks — cut its profit forecast for the current fiscal year because it expects margins to suffer from higher input costs (as a side note, “inflation” was mentioned 49 (!) times on their earnings call). As a result of their revised profit forecast, Conagra’s shares dropped 3.5%.

If the forecasts about higher input costs and lower profit margins are accurate, equity investors will have to reconcile with a sustained inflationary environment. So far, tech stocks and other sectors with higher valuations that do well when Treasury yields fall have rallied. But if inflation — and inflation expectations — remain heightened and yields climb, that could change fast. Just look at the stock market during the high inflationary period in the 1970s: During 10 years, the market went up by only 1%. Inflation erodes the purchasing power of the dollar and the economy that is powered by it.

“We see risk building in these sectors, which would be vulnerable to a reversal in real rates or a rise in inflation expectations,” wrote Michael Darda, chief economist and market strategist at MKM in Stamford, Connecticut, in a research note on July 14. We’re not seeing rate hikes yet, but inflation expectations are rising, putting pressure on the markets.

And then there’s the Fed…

Despite inflation sitting well above the Fed’s 2% target and rising for several months in a row, the central bank is sticking to calling inflation “transitory.” They are distancing themselves further and further from the reality that consumers and businesses live in. Perhaps the central bank should take a cue from businesses, who have a clearer vantage point — they are seeing costs rising and margins tightening, which will inevitably lead to further price increases.

But the Fed keeps printing money and fueling inflation, with no talks about tapering its quantitative easing. In fact, it’s likely the central bank will need to extend its interventions as the delta variant of the coronavirus is spreading rapidly. The pandemic and its impact on the economy are still very much with us, and the very last thing Fed Chairman Powell wants to do is announce plans to tighten their monetary policy when the economy could suffer another major wave of infections and shutdowns.

For investors — and particularly if you’re saving for your retirement— it’s key to watch inflation closely and make sure you’re accounting for the effects of inflation on your investments. 5% inflation means your investments have to go up by at least 5% just to keep up their purchasing power.

If you aren’t one of the many Americans who have already hedged their IRA, 401(k), or other retirement account against inflation, it’s worth considering doing so before inflation spirals out of control.

Fred Abadi

Sr. Portfolio Manager, Gold Alliance

About Fred Abadi

The post The Wage-Price Inflation Spiral appeared first on Gold Alliance.