Learn how to protect your retirement savings.

Gold, the Dollar, and Where Our Faith Is Leading Us — Part 1

Financial analysis is not detached from the personal beliefs of the analyst, and while I try my best to avoid discussing anyone’s religious beliefs, including my own, in this case it’s difficult for me not to. Especially given the fact that, in the last 50 years, we have moved from using an eternal store of wealth that was always part of humanity’s journey to using a fallible man-made myth that has never stood the test of time. I am, of course, talking about gold versus the US dollar.

Any type of financial instrument wanting to be considered as money requires faith in its ability to be a reliable store of wealth. The historic move from gold to the unbacked paper dollar required a shift of faith, and it was made possible by the believers not truly understanding what they were switching to. In Part 1 of my analysis, I’ll discuss the different mechanisms of gold and the dollar as money. This alone should bring doubts to the path we chose and where we are headed.

Gold is “God’s money”

When I say that gold is God’s money, what I mean is that gold has historically been a form of money that was handed to us without us doing anything else other than bringing it out of the ground. Gold is a natural resource found in the earth. It’s impossible for man to create or replicate gold. We (the human race) work to extract gold from the ground via mining, and we are rewarded for our work with the value of gold that we extract. In addition, gold has very unique attributes that make it a perfect form of money, including its resilience against corrosion and weathering and the fact that it’s a finite resource.

While it may be too strong to state that if you believe in gold you believe in God, there are two facts about gold that will move people of faith to see it as God’s money:

- Gold has been with us since the dawn of time. Robert Kiyosaki, author of Rich Dad, Poor Dad, said, “… people are getting sick financially because they’re working for fake money […] Gold is God’s money because you can’t fake it […] It was here when the Earth was created, and it’ll be here long after we’re all dead and gone.”

- The supply of gold is tailored to the growth of humanity: Gold has been mined, produced, and supplied at a growth rate of 2% a year over the last 5,000 years, which is at the same pace as humanity’s population growth. So, for 5,000 years, there has never been a surplus of gold, meaning gold is not inflationary. Some may call this a coincidence. A fluke. To me, this is another surprising layer that makes gold a real, eternal, and trusted store of wealth.

Comparing gold to paper money is like comparing a pond in the desert to its mirage. Paper money is not the real thing. It represents something else, and there are various aspects, as I will show you here, that get lost in translation. Yet, for some reason, most people out there don’t put their financial faith in the infallible, historically proven gold. Instead, they put their faith in fallible man-made money, the printed dollar. In order to believe in paper money, we had to switch our faith from nature, history, and God to a man-made organization, the Federal Reserve.

In the Fed We Trust

When the Federal Reserve central-banking system was created in 1913, every (man-made) dollar printed had to be backed by (God-made) gold, so the “Federal Reserve Note” statement on the front of the dollar was interchangeable with the “In God We Trust” statement on the back of the dollar. You didn’t have to trust the Fed; you trusted gold and God as the backing to the sound money you were holding in your hand. “Backed by gold” meant that 40% of all dollars had to be backed by gold sitting in the vaults of our central bank. Not 100%, mind you. Just 40%.

But even 40% was too much of a limitation for our government.

The backing of the dollar by gold ended in the 1970s to allow the government to increase the money supply. This caused horrible stagflation. Since then, gold still cannot be printed or inflated, but the dollar sure can.

Over the last decade alone, the Fed has printed enormous amounts of dollars, increasing the paper money supply by about 10 times. Our population did not grow at that pace. So think for a moment about the value of the dollar under these conditions. There are 10 times the amount of dollars per person, but there are not 10 times the assets those dollars can buy. More dollars are chasing the same amount of goods, hence the rise of inflation that you see all around you.

But the current inflation is not as high as it was in the 1970s. What sustains the faith in the dollar to prevent it from crashing when the money supply has increased tenfold in the last decade? The answer is simple: We’ve been taught to believe the dollar is strong and will remain strong. We’re told by economists and the Fed that the dollar’s strength cannot falter. In short, we’re told by the same people inflating the dollar that the dollar is perfectly fine.

What does the Fed do with our trust?

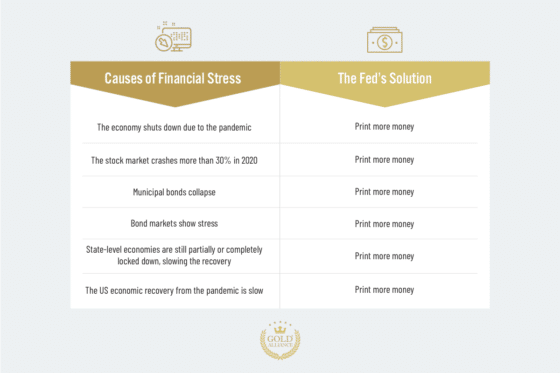

While some readers may have found it difficult to fathom a financial analysis that mentions faith in God, just see how many articles out there talk about faith in the Federal Reserve. Faith in Jerome Powell, faith in the dollar, etc. Faith in the Fed is both required and comforting since we gave the Federal Reserve a divine power: the power to dictate our money supply. And how has the Fed used this power? By acting as the knight in shining armor for the US government. The problem is that the Fed only has one solution for every problem: money printing.

There’s a pretty clear pattern here. The Fed — the same Fed we’re supposed to place all of our financial trust in — seems to only have one solution for every economic and financial problem.

As a matter of fact, over 40% of the money printed by the Fed ever (in the entire history of money printing in the United States) was printed in 2020. This was done to combat the economical impact of locking down the entire country during the pandemic, but it will impact us for many years.

Here’s the kicker: This money printing isn’t going to stop anytime soon. The Biden administration has implemented a stimulus plan worth $1.9 trillion dollars. Meanwhile, there is a $500 billion infrastructure bill in motion. And soon, a $1.7 trillion climate change program will be on the docket. So, it’s safe to expect this pace of money printing to go on for quite some time.

Think about it: Before the creation of the Fed, the supply rate of gold coming out of the ground was also the rate of our money supply. Now, the Fed prints as much money as they feel is right, and we have to have faith that their good intentions will yield good outcomes.

In a long process of going away from faith in God via our faith in gold when it relates to our money, we have changed our mantra of “In God we trust” to “In the Fed we trust.” The problem with this change of faith is the ignorance we have about how our money supply is increased with paper money. This is caused by the difference between the gold mining process and the money printing process. That ignorance will have dire consequences — and I’m not just talking about inflation.

How the Fed makes money

If, theoretically, a meteor made of gold crashed into Earth and the gold didn’t vaporize on impact, then the gold supply would increase sharply. This would affect the value of the existing gold on the planet.

The Fed’s massive (“meteoric”) money printing over the last decade was like a massive dollar meteor hitting the US. The added money supply is decreasing the value of the dollar (just look at home prices, stock prices, gas prices, and groceries right now). But we have a much greater problem. The Fed’s money printing brings a serious side effect: newly created debt.

Gold is money. Pure money without any debt attached to it. The dollar and all types of fiat currencies are instruments of debt. That is why a dollar bill is called a “note.”

The Fed’s fractional reserve system requires the creation of debt in order to create money. This is not intuitive or natural. So, paper money is not created on its own. It comes with baggage.

The process of making paper money has two steps: First, you create debt, and only then, as a side effect of this debt, you get money. In order to create this debt, the Fed has two options:

- It can lower interest rates and entice people to borrow. When the borrowers’ debt is created, they get newly made money. But in the last two decades, encouraging people and corporations to borrow was not enough to deal with the problems in our system, so the Fed moved to the second option.

- Outright print money. To do so, the Fed must create even more debt, which they place on their balance sheet. They then get the money, which they push out to the banking system.

Let’s look at this type of debt for a quick minute.

During the last decade, the exponential increase in the money supply was generated by creating a tidal wave of debt that never will or can be repaid. What happens when a borrower borrows money with the intent of never repaying it? He’s charged with fraud. Yet, when the Fed does it, everything is perfectly legal.

Psalm 37:21 states: “The wicked borrows but does not pay back.” The kicker is that every government now does this through their own central banking systems. And a pandemic of this wickedness is now on a global scale as we see historic, never-to-be-paid-down debt on one end and historic amounts of paper money on the other end.

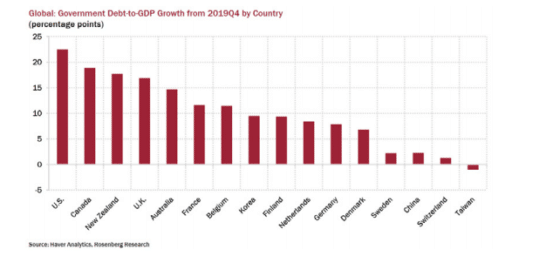

The Fed effectively has switched from backing money with gold to backing money with the good faith of a “broke” (debt-filled) government. Forget about winning US Olympic gold — we’re winning US debt gold. Our country currently leads the world in debt accumulation because of the Fed’s massive money printing.

In Part 2, we’ll explore how the mountain of newly created debt and newly created cash is leading us to LEGALLY redefine capitalism, and, together with our political system allowing the creation of corporate socialism, we are on a path to dismantling the very core processes that define our democracy.

Joseph Sherman

CEO, Gold Alliance

The post Gold, the Dollar, and Where Our Faith Is Leading Us — Part 1 appeared first on Gold Alliance.