How Yields Show the Price of Gold Will Rise

Most investors we talk with intend to grow their nest egg and, when the time comes, live out their retirement dreams. To do so, they are choosing assets and investments they want to put their hard-earned money into. Some focus on asset classes, companies, or verticals they believe in. Others may focus on assets like stocks and bonds that provide a yield (such as stock dividends) or some kind of cash flow.

Since yield, which means passive income, is attractive, and most likely every portfolio has some yield-generating assets, here are some key insights into how yield should be viewed.

When looking at yield the investor should not just look at the yield rate or how many percentage points this asset is guaranteed to grow. Yield should be viewed relative to inflation and how inflation erodes the value of the dollar. This means investors need to make sure the asset price together with the yield it generates go up in “real” terms or grow compared to inflation. If inflation is up 8% and my account or asset value only grew by 6%, then, in real terms of purchasing power, I lost 2%. On paper, I see the dollar value of my investment is up by 6%, yet I can afford fewer goods and services with it.

Assets that don’t provide any yield, such as gold or tech stocks, need to provide that growth over inflation without yielding. Tech stocks are a risk asset, so if you placed the right bet, you may see great growth. Gold, as we discussed in this article, is special in the sense that it maintains and grows in purchasing power without yielding. The physical amount of gold doesn’t grow on its own, but its purchasing power does over time. This is a feature of gold not many investors know — and Wall Street doesn’t want you to know it. However, the most sophisticated investors do.

Yield is tied to interest rates

The yield of assets like Treasuries or bonds is tied to the interest rates. When interest rates are low, the yield will be low, and when that happens, gold becomes way more attractive to sophisticated or institutional investors, and the alternative yielding assets become less attractive.

This creates an interesting correlation between yield and the price of gold. Because gold, like any investment asset, is viewed against its alternatives, gold is sensitive to the global yield cycle. A sophisticated investor knows that when interest rates are high, yields are high, and that makes gold look “less attractive.” After all, they’re making more yield by investing in yield-generating assets. On the other hand, when interest rates are low — or if real rates accounting inflation are negative — the appeal of gold increases compared to cash deposits, Treasury bonds, dividend-yielding stocks, bonds, etc.

The price history of gold during low-yield environments

When looking at the environment we’ve been in pretty much since the financial crisis in 2008, we see central banks across the world lowering interest rates in an attempt to trigger an economic recovery. As a result, real bond yields (the bond’s yield minus the rate of inflation) dropped far below zero, and the trend has continued throughout the last decade.

Those who saw low yields from their bonds, also noticed an interesting thing happening to the price of gold: It rose fast.

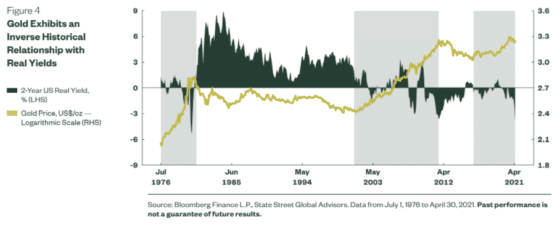

When we overlay the price of gold over real yields during the last 50+ years, the price of gold shows an inverse relationship, historically speaking, to real yields, as seen in the chart below. The price of gold (the light green line) has a strong performance record when real yields are low or negative (the gray shaded areas in the chart). Real yields of US bonds were dismal in the negative for nearly one-third of the last 45 years (in the late 1970s and for most of 2000–today, and the price of gold rose steadily during those times.

Even when real yields were in the positive (between 0% and 2%), gold performed well. And as the chart shows, the slight dips in the price of gold when bond yields were high were minimal compared to the spikes when bond yields were low or negative.

Understanding all this should lead any investor looking at gold to ask where our yield is headed. As yield is tied to interest rates, the question is where are our interest rates heading.

The Federal Reserve and other central banks’ accommodating monetary policies are likely to persist for the long term. Fed Chair Powell yesterday announced that tapering the Fed’s $120 billion monthly bond purchases will start next year. Nobody is talking about raising interest rates. Not only have global markets become accustomed to our low-interest-rate environment, we are also facing economic uncertainties, such as the ongoing pandemic and a questionable economic recovery. Therefore, interest rates are unlikely to rise significantly, which means real yields will remain low or negative.

The correlation between gold and yields is known to professional investors, and it is one of the reasons billionaires are turning to gold in 2021. Common sense and 45 years of consistent economic history tell us the gold price will continue to rise. This shows that gold can help investors not only protect but also grow their wealth since the precious metal typically maintains its value when the economy is doing well and increases in value when the economy is doing poorly.

Joseph Sherman

CEO, Gold Alliance

The post How Yields Show the Price of Gold Will Rise appeared first on Gold Alliance.