Is Powell Planning a “Volcker Shock”?

Listen to this article

For a few months, the Fed’s been publicly claiming that the rising inflation is transitory, but Fed meeting notes show that, behind the scenes, there are significant dissenting opinions and chatter about eliminating the central bank’s accommodations of the financial markets — especially its $120 billion in monthly bond purchases.

Then, on August 26, the Fed’s favorite measure of inflation, the personal consumption expenditure or PCE price index, climbed for the fifth consecutive month and hit a 30-year high at 4.2%. Was that enough to change the Fed’s public tune? All eyes were set to watch Fed Chair Powell at August 27’s annual Jackson Hole forum. And in true Fed form, throughout the day, four Fed board members were marched out in front of the media with eyes blinking at the lights to make hawkish fire-and-brimstone comments about interest hikes and cutting back on monetary quantitative easing.

But when Powell took the stage, a hawk was nowhere to be seen. Instead, we saw the usual dovish Powell refraining from announcing any major policy moves to tackle inflation or winding down bond purchases, and — voila! — the stock market rose to a new all-time high and bond prices climbed higher as well. Party on!

However, inflation isn’t paying attention to the Fed’s delay tactics and continues to rise, and we still have no clear indication of when and how the Fed will taper its monetary interventions. But even if the Fed gradually reduces its support of the economy and markets by buying market assets like bonds with printed money, the central bank knows it won’t be enough. There is enough fuel now in the form of paper money in the banking system to continuously heat up the economy and further raise our inflation, so it’s inevitable that the Fed will act, and when they do, it will be in more ways than just stopping to pour more paper money on the fire.

So what can we expect once the central bank takes action against inflation? We received a clue in a recent Town Hall meeting where Powell was asked what book he recommends reading. He went into a long and admiring talk about former Fed Chair Paul Volcker, recommending Volcker’s book Keeping At It and calling him “the most distinguished public servant in economics” in his lifetime.

Why is Powell not talking about the Fed chairs that came after Volcker, like Greenspan or Bernanke, and dealt with tough financial decisions? Why go back to Volcker? It’s the inflation context. In the late 1970s, we faced destructive double-digit inflation, which climbed as high as 14%. Volcker got into office, and his strategy was to aggressively hike interest rates and dry up the money supply causing inflation. His tactics ended up raising short-term rates to as high as 19%, which stopped inflation over the span of three years. Volcker conquered inflation, and that allowed our economy to rebuild. The only issue is the tremendous, unprecedented historic pain that was unleashed on our economy and markets for a period of about three years.

Things got so bad that this period was nicknamed “The Volcker Shock.” As you may expect, Volcker became highly unpopular, but according to Powell at the Town Hall, Volcker “did what was best for the country” over the long-term: Volcker beat inflation and set the stage for “a long and very good period for the development of the US economy.” Is Powell’s public admiration of Volcker giving us a hint about his future monetary plans?

What to expect if Powell “goes Volcker”

Today, 40 years after Volcker’s term, inflation is rising again along with inflation expectations, so if Powell is going to respond to inflation like Volcker, his idol, what is in store for us? When Volcker became Fed chair in 1979, he immediately announced that he would start limiting the growth of our money supply to combat inflation. This is the exact opposite of what Powell has done so far. Volcker did it by limiting the growth of bank reserves, which the Fed can manipulate. As money in the banks became more scarce and demand for money outstripped supply, the banks raised interest rates, limiting the amount of liquidity available in the economy. So in very simple terms, the “Volcker Shock” is really a “no-money shock.” Most of us have experienced at least once in our lifetime the effects of having no money, and if you went through it, you know what financial hell feels like. This is what happened under Volcker.

Goodbye, employment

Businesses and employers during that time experienced a double whammy. The high interest rates were giving savers over 10% return on a savings account, causing people that had money to save it, which cut down on consumer spending. Couple that with the higher cost of borrowing required to keep a business going and you’ll get tens of thousands of businesses and employers going out of business at the same time. This decimated employment — the unemployment rate almost doubled. The hardest-hit areas were in the industrial belt, where residents competed for spots in homeless shelters in some cities.

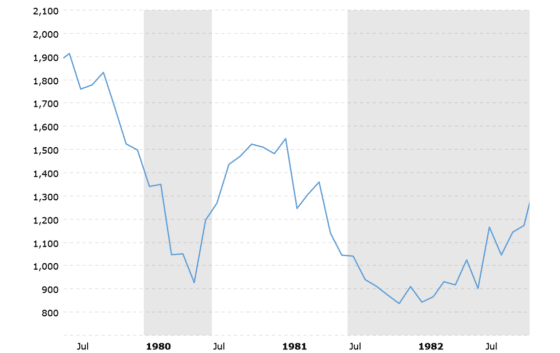

So long, stock values

Following Nixon’s abandonment of the Gold Standard in 1971, the Dow Jones (adjusted for inflation) dropped 50% during the same decade. Enter Volcker’s interest rate hikes in October 1979, and during the implementation of Volcker’s solution over three years, the market went down an additional 30%, rounding off one of the most disastrous 12 years of all time for stock market portfolios via a complete destruction of stock market values. This crisis created a retirement crisis as retirees relying on their stock market portfolios had to go back to work, which was, as mentioned, generally not available.

Dow Jones Industrial Average (inflation-adjusted)

See you later, home values

The Volcker shock created a “perfect storm” in the housing market too. Double-digit interest rates meant mortgage rates rose into the double digits, turning the housing market into a nightmare for homeowners who had adjustable rates or anyone that required a refi. The 30-year mortgage rate spiked into the high teens in late 1981 and continued at double digits until 1990. Remember the millions of bankrupt employers and the unemployed as well as retirees trying in vain to find ways to support themselves? They were trying to sell their homes to get money to pay the bills at the same time, which created a supply shock that decimated home values. All this cut housing starts (new residential construction projects) in half, which led to even higher unemployment in a vicious cycle that seemed like it would never end.

Housing starts, annual rate in thousands

Hello recession, my old friend

Volcker’s tactics and their outcomes were so harsh that they plunged the US economy into two recessions almost back to back in January to July 1980 and July 1981 to October 1982. Imagine the feeling of going out of one recession to be dunked into a second one within a year.

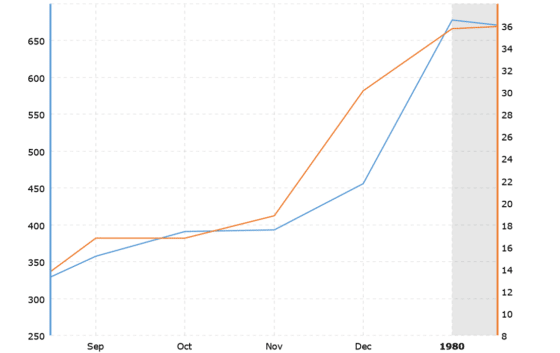

And welcome higher gold and silver values

However, Volcker’s strategy was good news for two assets: gold and silver. Within just four months of Volcker’s rate hike, the price of gold and silver doubled.

Gold price (blue line) and silver price (orange line)

Overall, Powell is right for calling Volcker brave — he took very aggressive measures to fight inflation, which was destroying the US economy, but when the disease is harsh, the cure is equally harsh. “The Volcker Shock” treatment of inflation plunged employment, the real estate market, and the stock market and took the US into back-to-back recessions before the tides turned. That takes guts.

With inflation climbing month after month and Powell admiring Volcker “the inflation slayer,” circumstances today are a bit different. For example, does the Fed need to raise interest rates dramatically like Volcker to stop inflation today? At this point, most likely not as dramatically. But today, much lower interest rates will wreak havoc on our economy since our level of debt is much higher than it was in 1979. Now, even a historically average interest rate of 5–6% would be very hard for our government to handle with the interest payments on our debt. In fact, our economy now is so fragile that even with our rising inflation, the Fed is not stopping its money printing, let alone talking seriously about raising interest rates.

So this is where we stand. The Fed, with its money printing and zero interest rate scheme for more than a decade, has infected our economy with malignant inflation cancer that if not stopped will lead us to hyperinflation and loss of reserve currency status for the dollar. The only way to “save us” is to take a superharsh “Chemo” treatment in the form of high interest rates, which will make us all extremely ill and weak financially for several years so we can rebuild.

The history of economics tells us that the choice Powell’s Fed faces today is this: “Be very ill now or suffer even worse down the road.” Ray Dalio, the founder of the world’s largest hedge fund, said a few years ago: “If you don’t acquire gold, you know neither history nor economics.” Well, now you know.

Joseph Sherman

CEO, Gold Alliance

The post Is Powell Planning a “Volcker Shock”? appeared first on Gold Alliance.