Powell’s “Baby, It’s Inflation Outside”

For most of the year, the Fed has sounded like a broken record stuck in “Inflation is transitory.” And Fed chair Jerome Powell never missed an opportunity to blast the song at full volume during Fed meetings and interviews with the media.

While the contrast has grown between how the Fed is interpreting inflation and how Americans are feeling rising prices every day, nothing has been able to nudge the Fed to change its tune. Not even when inflation recently reached a 30-year high as per the Fed’s preferred measure, the core personal consumption expenditures price index (core PCE). Surely, that should have shifted the central bank’s stance, but it didn’t seem to matter, at least publicly.

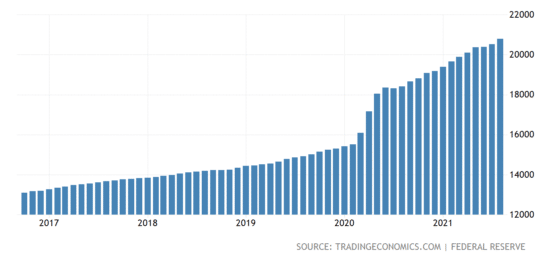

Meanwhile, the Fed is continuing to fuel inflation. Since the beginning of the pandemic, they have increased the money supply by $5 trillion — that’s a stunning 30% increase of the Fed’s balance sheet in just 18 months.

Add to that the $10 trillion in fiscal stimulus spending that has already been disbursed, are in the process of being disbursed, or are awaiting Congressional approval. This is an obscene amount of money to inject into the economy, and it is responsible for the inflation we are seeing:

- A gallon of gas was $1.96 in May last year. Today, you’re looking at $3.72 — almost twice the price.

- Meat, poultry, fish, and eggs are up 5.9% over last year and up 15.7% from prices in August 2019, before the pandemic.

- Used car prices are up 24.9% in September 2021 compared to September 2020.

- US house prices grew 16.5% from June 2020 to June 2021.

And according to Salesforce.com Inc., we can expect price increases to persist. The software and analytics company is forecasting that consumers will face 20% increases in prices for the holiday shopping season and beyond.

This so-called transitory inflation has already artificially pushed wages higher because companies have to offer higher pay to attract workers struggling with higher costs for groceries, rent, education, and gas. And wages are a key driver of inflation, as we discussed here.

Powell changes his tune

Last week, Fed chair Powell suddenly, albeit in a tempered tone, acknowledged his frustration with inflation and said that it would stay with us for “longer than we [the Fed] thought.” A statement he echoed in front of the Senate Banking Committee: “Inflation is elevated and will likely remain so in coming months.” The sudden realization that inflation may not be as transitory as he thought is spreading through the central bank — the Federal Open Market Committee (FOMC) raised its projection for 2021 core inflation to 3.7% from its 3% forecast in June.

These speeches were the signal that a change is coming to the Fed’s ultra-accommodating policies. The central bank will be tapering its support of the markets (by gradually pulling back its monthly $120 billion in bond purchases, starting this November), and some Fed officials have begun talking about rate hikes.

The Fed’s stance on inflation being transitory may have been an attempt to manipulate inflation expectations lower — as we discussed here, inflation expectations can trigger actual inflation, and if the Fed would have acknowledged from the beginning that inflation was concerning, that sentiment would have spread to consumers. So, now that the central bank is acknowledging inflation data, it has also opened the door wider to rising inflation expectations. Reality is catching up to Powell and to investors who were lulled into complacency by the Fed’s tune, and it will be a rude awakening once the realization sets in that high inflation will persist and once the Fed actively starts tightening its monetary policies.

With trillions of dollars yet to enter the economy, with continuing money printing, and with rising inflation expectations and wages, we could be facing double-digit inflation, and the Fed might find itself having to chase inflation with aggressive rate hikes like it had to do during the early 1980s.

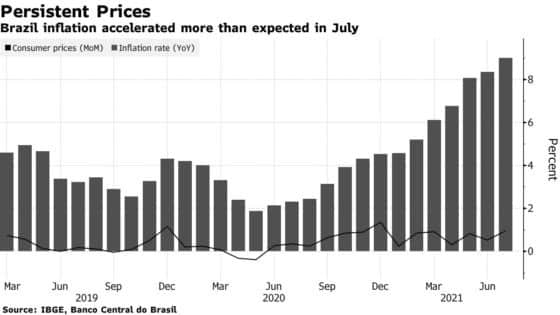

In other words, we could see ourselves in a situation similar to what’s happening in Brazil, where the Central Bank of Brazil has hiked interest rates by 4.25% since March to fight an inflation rate that is steadily creeping towards double digits.

Powell gave us a clue about the timing of the Fed’s response in typical dovish fashion:

“Of course, if we were to see sustained higher inflation and that were to become a serious concern, I would tell you the FOMC [we] would certainly respond and we would use our tools to ensure that inflation runs at levels that are consistent with our goal,”

How long inflation has to stay with us for Powell to consider it “sustained” and when the Fed chair becomes “seriously concerned” both remain open questions. Whether the most important decision in finance, which is the cost of money determined by the open market interest rate, should be left in the hands of a committee of unelected officials is another open question. And the last question for your consideration: If during the days of the old gold standard we had no Fed, no inflation, the longest sustained period of prosperity for Americans, and the least amount of income inequality, should we call what we have now “progress”?

Joseph Sherman

CEO, Gold Alliance

The post Powell’s “Baby, It’s Inflation Outside” appeared first on Gold Alliance.