“Red herring” – something that misleads or distracts from a relevant or important question.

It took Biden and the Fed over half a year to finally acknowledge inflation. It’s about time — the official US inflation rate has exploded to a 30-year high. The inflation rate is reported to us via the government-created Consumer Price Index (CPI), and the latest reading shows a year-over-year increase of 6.2%.

Of course, US consumers have been feeling the tightening grasp of inflation for months now. And the pain feels much worse than “6.2%.”

The official CPI is a red herring

Here’s how inflation is really impacting us:

- Gas prices are at a seven-year high of $3.40 nationally, flirting with $4 in Nevada, Washington State, and Oregon. Mono County, California, is leading the pack with an average price of $5.66 a gallon. And Bank of America warns it could get even more expensive to fill the tank of your car, predicting a 45% increase in crude oil prices by June 2022.

- Meat, poultry, fish, and eggs are up 11.9% since last year, and if you are a red-meat lover, prepare your wallet as the price of steaks rose a whopping 24.9%.

- Energy prices have jumped 30% in the past year.

- A used vehicle will cost you 26.4% more on average, while a new vehicle is up 9.8% — if you can even find the one you’re looking for because of the supply chain disruptions.

The main problem with the CPI is that it doesn’t capture all these real impacts of inflation. Take shelter, for example. The Bureau of Labor Statistics, who releases the monthly inflation data, reports that “shelter” is up 3.5% year-over-year. But according to the Wall Street Journal, real-world rents are up over 10% compared to a year ago, and the latest Case-Shiller Home Price Index shows home prices have increased almost 20% in the past year. The discrepancy between government data and real-world data is, to put it mildly, mind-blowing.

But no government red-herring index can mask the real costs we are experiencing, so it’s no surprise that a recent poll shows that 26% of Americans cite an economic concern as the nation’s top problem.

What is the actual inflation rate?

Today’s inflation is the highest since 1990, but that is using the government’s CPI as our yardstick. The real inflation we are experiencing is as high now as it was during the 1970s. Here’s why.

During the 1980s, our government changed the methodology used to create the CPI, making the red herring CPI index much fishier. When measuring today’s price increases with the methodology used during the 1970s, as inflation was running rampant, the index reflects the grim picture we are seeing at the grocery store and gas pump. Here’s what that looks like (red line = official current CPI; blue line = the CPI using pre-1980 method):

(The chart is courtesy of ShadowStats.)

Forget about 6.2% inflation. That’s just a distracting number. We’re now in double-digit territory with 15%.

Inflation is ravaging your fridge, your gas tank, and your home. But it has also found its way into your retirement savings.

How inflation swindles you

To show the impact of inflation on your retirement savings, we’ll take a round number to work with. Let’s assume you were able to save $100,000 for your retirement, which you are holding in dollar-denominated assets such as cash, stocks, and bonds. You are hoping and planning for your savings to gain value, right?

Well, If we follow the official CPI inflation rate of 6.2%, it means that your dollar-denominated savings have lost 6.2% of their value — the amount of real goods and services they can purchase — just in the past year. Every month, according to our government’s data, you’re “only” losing around $500 on average.

“The actual loss of purchasing power of the consumer dollar is far worse than even these very ugly inflation data. […] And this loss of purchasing power is permanent.”

– Wolf Richter, wolfstreet.com

But let’s look at the impact of actual inflation, which is much, much worse: Your $100,000 have lost 15% of their value in the past year. That’s $15,000 a year or $1,250 a month or $42 every day, including weekends.

And here’s the kicker: When we lose 15%, we need a 17.6% gain to get back to what we had. So, if your investments haven’t brought you a 17.6% net gain in the last year (after fees to your brokerage accounts) to offset the 15% drop in purchasing power, you were robbed.

Devaluing the dollar is theft. Why? You work all day for a corporation to pay you, right? This is payment for your time, dedication, and abilities. If it’s taken away from you by a hidden hand, it’s theft.

Now you can also see why investors are running to IPOs of obscure companies with unproven business models, to SPACs, to cryptocurrencies with no intrinsic value, and to the sixth-most valuable company in the world today — Tesla. Really?! We need enormous amounts of risk, hunting for growth to offset the loss of purchasing power.

Is there a secret agenda behind the official CPI?

One can speculate as to why our government is measuring CPI differently today than during the double-digit inflation in the 1970s. I propose the answer is “double-digit.” While 6.2% is significantly above the 2% target inflation rate the central bank will tolerate, letting everyone see that inflation is at 15% would simply be outrageous.

The government may claim that times have changed and that they have to alter the way they measure inflation to reflect those changes. They are right about one thing: Things have changed with inflation fleecing us for decades.

Fifty years ago, typically only one parent worked, and most Americans could afford their home and a comfortable standard of living on just one income, debt-free. Today, in most families, both parents have to work to pay for mortgages, student debt, auto loans, credit card debt, and so on just to live.

So — perhaps — the government changed its CPI “basket” to mask the fact that the average American’s standard of living has been in a steep decline for decades. Thank you, my elected officials, for coming up with a contrived CPI to make me feel much better. Like many government plans, it’s almost working.

Predicting inflation with food prices

The Federal Reserve heavily researched a wide range of inflation measures back in 2001 and found that “food inflation” is a much more accurate measure of inflation than CPI:

“We see that past inflation in food prices has been a better forecaster of future inflation than has the popular core measure [CPI and PCE]. […] Comparing the past year’s inflation in food prices to the prices of other components […], we find that the food component still ranks the best among them all.”

The Fed knows that the government’s CPI measure is inaccurate at best and that we should look at food prices instead. Let’s do that:

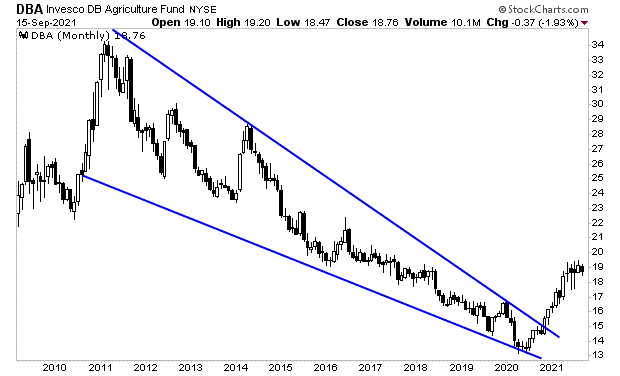

Agricultural commodities are the primary supplies for food. As the chart below shows, agricultural commodities were in a 12-year bear market, which is why no one talked much about inflation. It seems we are now in the beginning of a bull market. That means higher food-production costs that will trickle down to consumer prices.

Your inflation survival plan

Let’s sum it up: If we look at actual inflation — measured the way we measured it until the 1980s — we’re at 15% inflation. And if we look at food price inflation as the best indicator for inflation, food prices are soaring, and higher prices are on their way.

Biden recently called inflation “worrisome,” but I think Ronald Reagan hit the nail on the head when he described the 1970s’ inflation (which, according to the methodology used then, is as high as what we are currently experiencing):

“Inflation is as violent as a mugger, as frightening as an armed robber and as deadly as a hit man.”

The inflation threat is real, and surviving it is simple. I have written about how gold is a proven way to mitigate inflation’s theft of your retirement savings’ purchasing power, and I can’t think of a better time than now to take action.

Joseph Sherman

CEO, Gold Alliance

Call us today or schedule a consultation to learn how to set up your Gold IRA

The post Do You Have an Inflation Survival Plan? appeared first on Gold Alliance.