Powell’s hand has been forced: The Fed can no longer ignore inflation after the latest inflation data shows the most significant price increases in four decades — the highest inflation since the Volcker days.

So, during their December 15 meeting, Powell finally announced their tapering plans: In an effort to gain control of inflation, the central bank will end its monthly purchase of $120 billion worth of bonds in March and raise its benchmark interest rate three times in 2022. Projections based on the median forecast by Fed officials sees the Fed raise rates to 0.9% by the end of 2022, to 1.6% by the end of 2023, and 2.1% by the end of 2024.

But the Fed’s attempt to tackle inflation could be a tripwire for the economy and the markets. This comes as Biden’s economic recovery is still struggling — GDP growth took a sharp decline to just 2% for the third quarter of the year, down from 6.7% the previous quarter. That’s despite the fact that the Fed kept up its generous accommodations of the markets with the government pumping stimulus money into the economy, even as lockdowns and restrictions were cancelled.

However, that’s not the only problem facing the US economy:

1. Will the US inflation rate keep rising?

Millions of Americans are already affected by rising prices on everything from food to gas. The official inflation rate reads 6.8% for the past year as of November, up from 6.2% in October. Wage increases haven’t kept pace with inflation, so Americans across the country are feeling the pain.

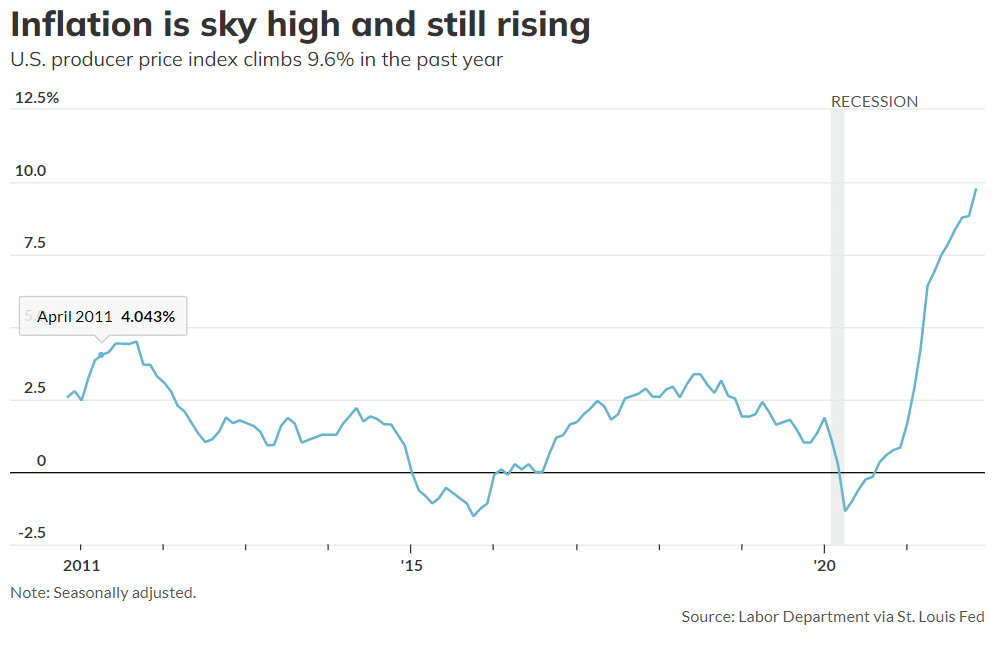

Analysts aren’t expecting inflationary pressures to ease up anytime soon, and there are signs that they are right. The producer price index, which measures wholesale prices, jumped 9.6% for the year ending in November.

Inflation is spreading across the economy, and businesses are likely to keep passing on their increased costs to their customers, so expect higher inflation.

2. Will omicron and other variants lead to renewed restrictions and lockdowns?

New variants of the COVID virus keep popping up in different corners of the world, rapidly spreading across borders. The latest scare, the omicron variant, is already causing renewed travel restrictions, and many countries have reinstated mask mandates and other measures.

What the case will be in the US is still uncertain, but we’d hardly be surprised if some states go into some level of lockdown after the holiday season. And, as we’ve seen over the past two years, that has a terrible impact on the economy and on Americans’ finances.

But even if lockdowns remain off-limits, our economy isn’t isolated from the impact of the virus. Our global trade partners are already affected — China reported its first omicron case Monday, causing many factories to halt production. Supply chain disruptions are likely to continue, if not worsen, as omicron sweeps across the globe.

3. Job growth is weaker than expected

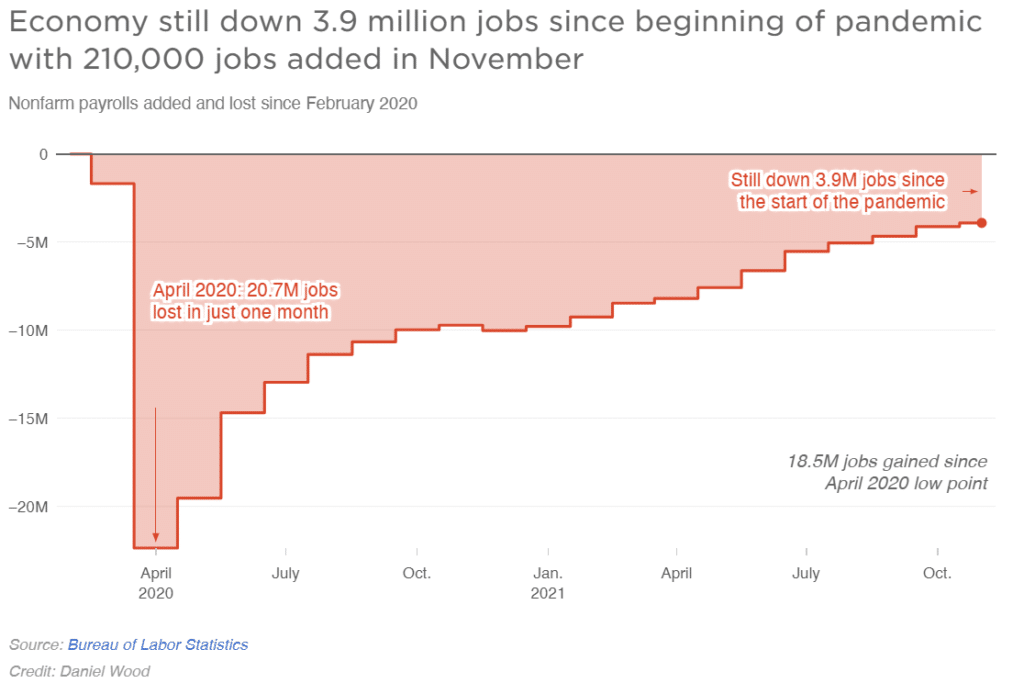

While the official unemployment rate is down to 4.2%, job growth is much slower than expected, and 3.9 million fewer Americans are employed today than before the pandemic.

Experts had forecast that the economy would add 550,000 new jobs in November, but the data from the Labor Department came in at a just 210,000. This is disappointing since you would expect strong numbers during a time when lockdowns and restrictions have been lifted.

And remember that this is the official unemployment numbers. As we discussed here, real unemployment far exceeds 4.2%.

Meanwhile, the labor force participation rate is at its lowest since the late 1970s — many people who would have been in the workforce are not going back to work, despite the Fed’s efforts to encourage higher employment. These people may decide to stay out of the workforce, even with the opportunities our government’s expansive stimulus plans — infrastructure and Build Back Better — may offer, which would effectively put a lid on further economic growth.

4. Productivity is declining

Labor costs are up, and employment may have maxed out. To add salt to the wound, productivity among those already employed is plummeting. Nonfarm business sector labor productivity decreased 5.2% in the third quarter of 2021, which is the largest decline since the second quarter of 1960, when the measure decreased 6.1%.

As companies are scrambling to find workers, they are hiring less-trained, less-productive workers, yet they have to pay them more. At the same time, skilled workers are retiring, while some of the people who could have taken their place won’t be returning to the work force after being paid more via stimulus checks to be unemployed than employed. Lower productivity means higher costs and lower growth.

How will the Fed tackle the economic challenges?

All of the above complicates the Fed’s actions. On one hand, the central bank needs to act by reducing liquidity to try to get inflation under control. On the other hand, decreasing bond buying and raising rates could hurt the economy and scare investors, igniting a market sell-off and another financial crisis once the historically large stock market bubble pops.

But even if they didn’t do anything, the economy is already stalling, and the issues it faces are daunting. This, in itself, could shake the markets and cause a correction or a crash.

We don’t know when the next crisis will happen, but history shows us there will always be another one. Whether it will be caused by the Fed’s previous mistakes, the pandemic, the markets’ reactions to the slowing economy, or a combination of them all, we already know the Fed’s response. Powell’s track record consists of low interest rates and money printing, and Biden has just renominated him. That means more of the same: more money printing and lower rates, kicking the can with our zombie economy down the road.

How long can we keep going with this inflated “business as usual” mode? In my opinion, months. Not years.

Fred Abadi

Senior Portfolio Manager

Gold Alliance

About Fred Abadi

Call us today or schedule a consultation to learn how to set up your Gold IRA

The post Here’s Why the Fed’s Tapering Could Shock the Economy and the Markets appeared first on Gold Alliance.