What would you do if you had access to unlimited credit? Ask our government because it effectively has no credit limit. Well, it does, officially, but every time its deficit spending pushes it close to the debt ceiling, Congress extends its credit limit…. to no limit.

We did come close a few times — politicians on both sides of the aisle like to threaten they’ll let the US default — but after some fierce back-and-forth between Democrats and Republicans, Congress ultimately allows our government to keep spending beyond its means. The show must go on, and no party wants to formally add the takedown of the US economy to its record.

What is the debt ceiling?

The debt ceiling is the maximum amount of money that the United States can borrow by issuing bonds. It was created during World War I to hold the federal government fiscally responsible together with the Gold Standard that required the government to hold at least 25% of its printed money in physical gold. The debt ceiling is a practical solution that allows the US Treasury to issue debt without needing approval from Congress every time, as long as it doesn’t break the ceiling.

When our government bumps into the debt ceiling, the Treasury Department needs to find other ways to pay our federal government’s expenses. Otherwise, the US risks defaulting on its debt, with dire consequences for the entire economy.

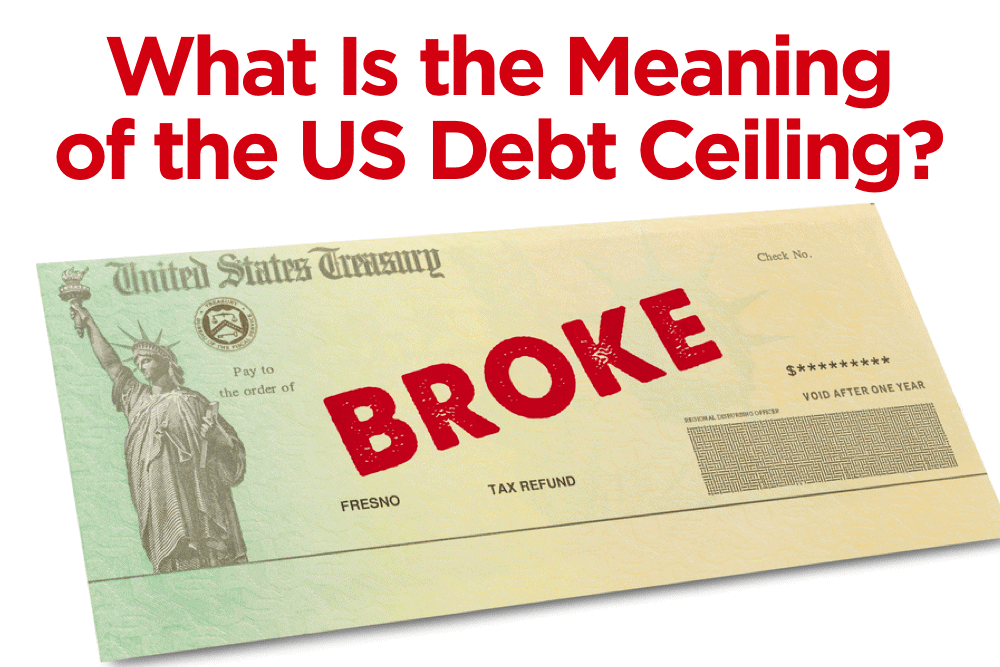

Not surprisingly, some people are questioning the effectiveness of the debt ceiling since it’s been raised many times to allow for further spending. In total, the debt ceiling has been raised, extended, or revised 78 times since 1960.

Is the debt ceiling spectacle more than a political game?

There have been several showdowns over the debt ceiling, which sometimes have led to government shutdowns, and it’s been used as a bargaining chip both under President Obama, President Trump, and now President Biden. Neither political party ultimately wants the US to default, but it’s not keeping them from threatening to let it happen. It’s all part of the political game.

The US Treasury expected that they’d reach the current debt limit (which sits at $28.4 trillion) on October 18, but just days before that deadline Congress agreed to kick the can down the road until early December.

Many analysts consider it unlikely that the Democrats and the Republicans, making rational moves, won’t agree on increasing the debt ceiling, but we do have to keep in mind that the political climate today is fiercer than ever before — shooting wars have started with less tension than what we’re seeing between our current political parties. In fact, the situation is so serious that JP Morgan has begun scenario-planning for how a possible default would affect financial markets and America’s credit ratings.

What happens if the US defaults on its debt?

Let’s hear it from Treasury Secretary Janet Yellen herself, speaking to the Senate Banking Committee:

“It is imperative that Congress swiftly addresses the debt limit. If it does not, America would default for the first time in history. The full faith and credit of the United States would be impaired, and our country would likely face a financial crisis and economic recession.”

The US economy would enter a recession

According to Moody’s Analytics, a prolonged default scenario would kick the US into a recession:

- GDP would fall by close to 4%.

- Around 6 million Americans would lose their jobs.

- The unemployment rate would jump to 9%.

- The stock market sell-off could cancel $15 trillion in household wealth.

Interest rates would rise

In her statement, Yellen added that we could expect to see interest rates spike, which would not only disrupt the Fed’s plans to keep rates near zero but also increase the interest payments on government debt. Rising interest rates, even the fear of rising rates, could severely rattle the highly leveraged stock market and trigger a collapse.

The credit rating of the US would be destroyed

Like you and me, our government has a credit score. We’re currently rated AA+ with S&P Global Ratings, which downgraded the US from AAA+ (the highest rating possible) in 2011 amid political battles over debt, deficits, and the debt ceiling. The agency says that if the government defaults on its debt, the credit rating of the world’s biggest economy would plummet to D (the lowest rating possible).

In a bulletin, S&P said that “it would be unprecedented in modern times for an advanced G-7 country, like the U.S., to default on its sovereign debt,” and warned of “severe and extraordinary” consequences for financial markets if the United States defaults.

Investor confidence would shatter

Investor confidence has been riding high on the Fed’s low rates and historic money printing, but a default would surely shatter that confidence, leaving investors scrambling to sell their overvalued stocks and crashing the markets.

A US default would be felt globally

The important role of the US in the global economy and the fact that the dollar is the world’s reserve currency cannot be ignored. A US default would have global repercussions:

“The U.S. Treasury market is the world’s anchor asset. If it turns out that that asset is not actually risk-free, but that it can actually default, that would basically detonate a bomb in the middle of the global financial system. And that will be extremely messy,” said Jacob Kirkegaard, a senior fellow with the Peterson Institute for International Economics.

The most reasonable scenario is that Congress will increase the debt ceiling, which would mean more spending and more debt that we’ll be paying off for generations to come. Either way, as an investor you want to make smart investment decisions that let you ignore the political cacophony and their (hopefully) empty threats so you can focus on your life.

Sleep well at night with a well-diversified portfolio

The way to start your worry-free financial life is to take control of your finances.

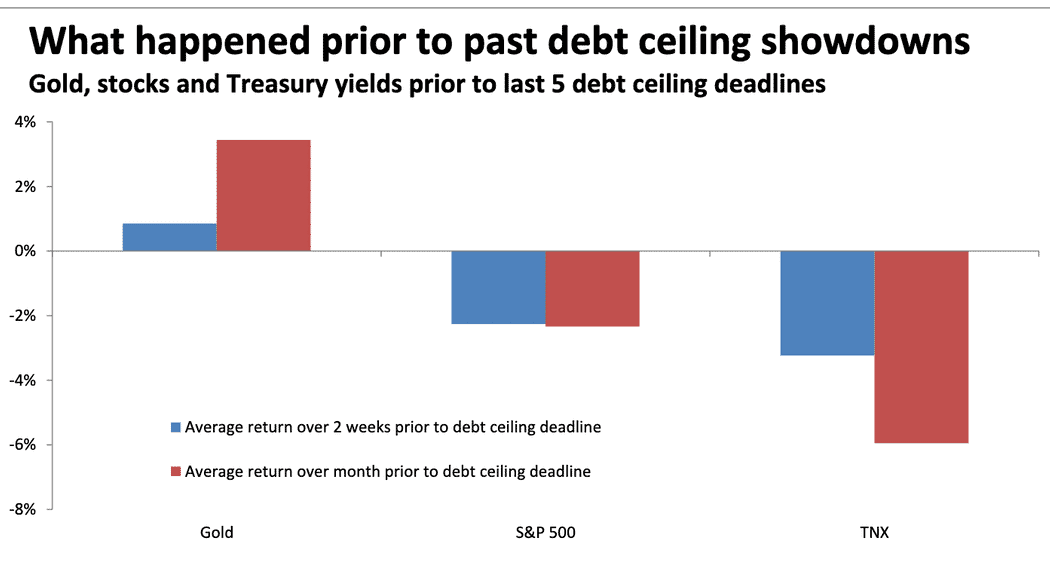

“Look for gold to rally over the next couple of weeks in anticipation of the showdown in Congress over the U.S. federal debt ceiling. Similarly, don’t be surprised if stocks and Treasury yields fall.”

These are the conclusions that financial analyst Mark Hulbert draws from his analysis of the returns of gold, stocks, and bonds over the weeks leading up to the five prior occasions in the past decade where political showdowns over the debt ceiling brought the federal government to the brink of financial default.

As the chart below shows, the S&P 500 fell an average of 2.3% over the month prior, while the 10-year Treasury yield fell 6%. Gold rose an average of 3.4%.

It makes sense that gold would rally during Congressional battles over the debt ceiling. After all, one of the drivers behind the price of gold is uncertainty. So, if you have diversified with gold, you need not worry about the politicians’ infighting.

What if we do see a US default and a financial crash? Here, gold is your safe haven as well — historically, gold performs tremendously during financial crises.

Should Congress increase the debt ceiling, most of your portfolio that is not in gold — your stocks and bonds — are likely to rally because investors will draw a deep sigh of relief that certainty has been restored. So, in that scenario, your portfolio will be safe as well.

The above is a great example of how a well-diversified portfolio can protect and grow your savings regardless of the state of the economy and its recent crisis fad. With a truly diversified portfolio, you don’t need to try to predict what will happen to the debt ceiling, to the stock market, to the economy… You will have peace of mind because you’ll know you’re prepared for any scenario.

About Kevin Troy

The post What Is the Meaning of the US Debt Ceiling? appeared first on Gold Alliance.