Just over a year ago, the price of gold set a new record, pushing past the $2,000 threshold with ease. Since then, gold has stabilized and is trading today for $1,810. My personal belief is that for anyone who understands what gold is and does, the price of gold is irrelevant to the decision to own it, unlike risk assets like stocks and bonds. When you have a portion of gold in your portfolio, it serves as insurance against financial crises. The cost to do so is irrelevant to the risk you take if you don’t hold gold.

If you share my point of view, you are more concerned about the performance of your risk assets than the performance of your gold because you know that, in times of crisis, your gold will protect and cover losses from risk assets. However, you may have gold in higher percentages of your portfolio than what people typically hold for their hedging purposes, or you may just want to gauge the short-term upside rewards, so here’s my attempt at a forecast.

The internet is full of predictions about the gold price, but most forecasts about the future are as worthless as an ashtray on a motorcycle. The best anyone can do for you is look at the various factors that drive the price of gold, and depending on where these factors are, you may get an idea of where gold’s headed.

The three main drivers behind the price of gold are:

- Negative or low real yields

- A fear trade — gold is a proven safe-haven asset investors flock to during times of crisis.

- Momentum (continuous demand for gold)

When all three converge, the price of gold soars — and does not stop soaring until the drivers dissipate — and when one or more is missing, gold’s spot price will trade sideways or even lose steam. Let’s take a closer look at each of the drivers.

The correlation between real yields and the price of gold

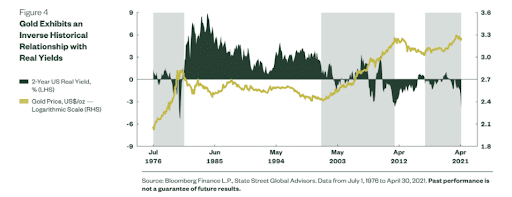

Historically, real yields and the price of gold are inversely correlated — the price of gold goes up when real yields (the interest rate minus inflation) goes down, as seen in the chart below.

Due to the Fed’s accommodating monetary policy, interest rates are now very low, and our money supply has seen explosive growth, causing inflation to rise. So, low interest rates minus high inflation rates lead to negative real yields. Negative real yields are driving investors away from yielding assets like Treasuries either to assets that are high-risk and might provide returns that overcome the higher inflation or to assets that are proven stores of wealth, such as physical gold. Investors find gold more enticing because they are getting all the protection without losing potential yield as that is not available.

As the chart shows, due to the Fed’s accommodating policies, yields have been mostly negative for the past five years, which explains why the price of gold has been on the rise since 2016. From a yield perspective, the price of gold should be going up, but then why has gold’s price gone down from its 2020 all-time high by about 11%?

How fear drives investors to physical gold

Gold is a proven safe-haven asset: It cannot be printed or inflated, it has no third-party risk, it cannot be hacked, and its performance doesn’t rely on the decisions of a corporate board. So when fear and uncertainty spread in the markets, investors turn to the tried-and-true low-risk asset that is gold. This happened right after the pandemic started when the low-yield environment converged with the fear caused by the pandemic hitting the economy and made the price of gold to rise to its all-time high of $2,029 in August 2020.

Today, however, fear has been mostly removed from the markets, again thanks to the Fed. By injecting trillions of dollars into the markets and keeping rates low, the central bank is providing easy access to capital. Combine that with the government’s multi-trillion-dollar stimulus schemes and we see why the markets are flooded with capital.

As a result, risk assets such as stocks, cryptocurrencies, junk bonds, and real estate are all soaring, pushing them into bubble territory. As an example, today, 40% of the stock market value (and the value of the stocks in your own portfolio) stems from company buybacks (when a corporation buys its own stock to boost its valuation), often leveraged via low-interest loans taken by the same companies. This is a clear sign of a bubble.

Fear is so far removed that investors are taking more and more risks in their pursuit of returns that can overcome the high inflation rate and negative real yields. We see this in the billions of dollars flowing into IPOs and SPACs.

As long as investors trust that the Fed will keep markets from crashing and as long as they have confidence in the economy, they’ll remain fearless. But as soon as fear returns, even if it’s just a faint smell of fear, investors will turn to safe-haven assets such as gold. And here are the signs that investors might want to do so sooner than later:

Biden’s economy is stalling

US economic growth slowed sharply in the third quarter of the year: The economy expanded at an annualised rate of just 2% from July to September, which is a significant drop from 6.7% in the previous quarter that happened as the economy was reopening. The drop is mainly caused by reduced consumer spending and by renewed restrictions due to the pandemic. It took financial analysts by surprise, and if the economic growth doesn’t pick up again, investors could start worrying about another recession — a worry that would lead them towards protecting their assets with gold.

Interest rates will remain low

The Fed has been hesitant to talk about hiking interest rates. When they have hinted at higher rates, it’s been in the context of “possibly next year.” Even if they do raise rates in 2022, they are unlikely to increase them significantly since our economy is fragile, which means real yields probably will remain negative, especially if inflation keeps rising or persists at the elevated level it’s been at for most of the year. Should inflation continue to rise, real yields will drop further, increasing the demand for gold and, thus, the price of gold.

The US inflation rate remains elevated

The latest inflation numbers came in at a 30-year high, and with the continued easy-money injections and significant supply chain issues, we could see even higher inflation or, at least, inflation persisting at the current levels. The fear of persistent and/or higher inflation and maybe even stagflation will drive investors towards traditional hedges — gold, in particular.

Momentum drives the price of gold higher

All asset classes are driven by momentum (demand). Gold is no exception. When its price goes up consistently, it pulls more people into gold — most investors are momentum investors and are driven by the fear of missing out, so they join the rally. This continuous demand drives the price of gold even higher.

For trading considerations of going in and out of an asset, momentum may be important, but for a portfolio hedge like gold, waiting for momentum to hit is like asking “When can I pay more for the same product?” But momentum can tell us a better story of when the price of gold will move up substantially.

If we’re right about the direction of the factors discussed above and fear starts spreading, gold will gain momentum, and all three drivers of gold will converge into a continuous price surge for the precious metal.

This happened in 2008. The Fed had lowered its funds rate to support the economy, causing negative real yields, after the stock market crashed, and both the incentive to invest in gold (negative real yield) and fear (stocks and real estate crashing) spread fast and created a strong demand for gold over three years (momentum). The price of gold rose from around $700 in 2008 to over $1,825 towards the end of 2011.

Where is the price of gold headed?

And now to my opinion with all this in mind. We have negative real yields, and the fragile state of our economy leads to a pretty safe assumption of continuous Fed monetary accommodation, which will keep yields in negative territory. This is the fertilizer the price of gold needs to rise. The seed for strong price appreciation is fear, which we currently don’t have.

I would argue that market conditions right now are an incubation of 2008-crisis proportions or worse. That is the trigger, and no one knows when it happens, but our level of debt, deficit spending, political gridlock, and competing superpowers (China) tell a story of major changes coming.

I believe we will see a major correction in today’s stock market during the next 12 months, which can raise the price of gold to $2,500, a price point that is in line with the forecast from Goldman Sachs. And if we do see a 2008-type stock market correction of 50% or more it may raise the price of gold to $4,000+ going by the 2008 ratios. If the stock market correction is going to be at a higher magnitude like in 1929 — taking into consideration that stock market valuations today are higher than back then — gold may soar further. Economist and best-selling author James Rickards predicts that, in case of a major financial reset, gold could even hit $5,000.

With that in mind, remember that if you use gold as a hedge, a hard and fast rise in the price of gold means that most of your portfolio is crashing. The only comfort you will have at that time is that, without your gold, your portfolio would have suffered terribly. Allowing you to sleep well at night during a financial crisis is what gold does best.

The post Where Is the Price of Gold Headed? Our Gold Forecast November 2021 appeared first on Gold Alliance.