When people are talking about acquiring precious metals, the conversation often centers on gold. But no one should ignore silver. In fact, it might be worth paying special attention to silver these days as it can be considered heavily undervalued with a great growth potential.

What is the gold-to-silver ratio?

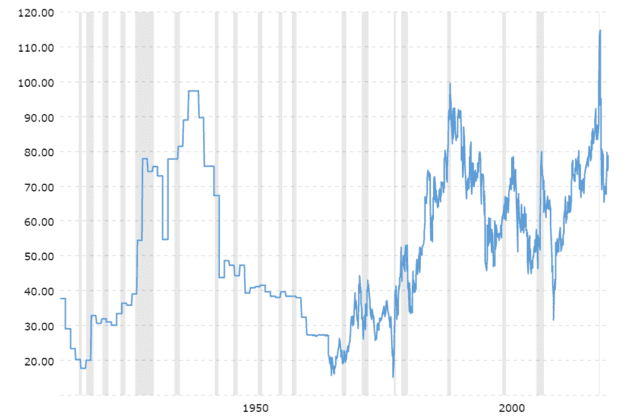

The gold-to-silver ratio compares the value of gold and silver, and it’s a great way to get an indication of silver’s potential. The ratio compares the spot price per ounce of gold and silver by dividing the price of gold by the price of silver. As of January 4, it stands at 78.6:1 ($1,815.33/$23.11 = 78.6), which means 1 ounce of gold costs 78.6 times more than 1 ounce of silver. In other words, it would “cost” 78.6 ounces of silver to purchase 1 ounce of gold.

Here’s a chart the plots the gold-to-silver ratio over the last 100 years:

In the modern era, the gold-silver ratio has averaged between 40:1 and 50:1. So, historically speaking, silver is extremely undervalued today compared to gold. Here’s why we expect silver to rise and tighten the gap:

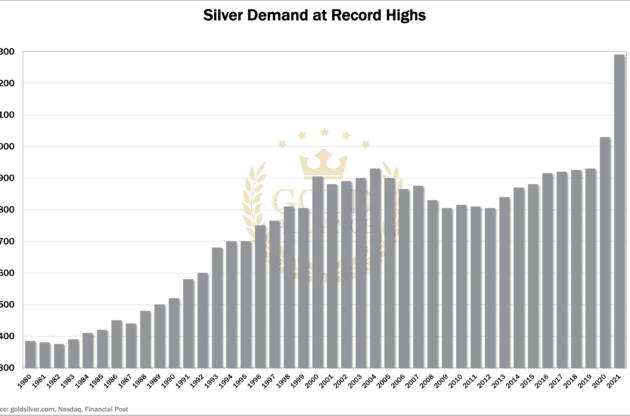

The demand for silver is rising

Silver is nowadays more of an industrial metal than a monetary metal like gold. Silver is an essential material in many industries, such as electronics, which are in greater demand than ever. The number of mobile devices, for instance, is expected to increase by 22% to over 18 billion in 2025.

But it’s silver’s role in green energy products that should catch any investor’s eye. As efforts to address climate change are becoming a high priority across the globe, green energy is facing a prominent future, and silver is a major component in solar panels. We can therefore expect the industrial demand for silver to keep rising.

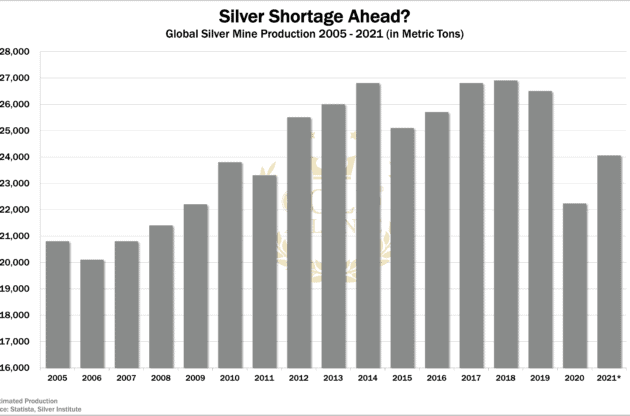

Silver mining production is flattening

While the demand for silver is skyrocketing, the supply of silver was plateauing in the years before the pandemic. The virus caused many mines to shut down, and the production of silver dropped significantly. Production is slowly increasing, but it’s far from its pre-pandemic levels.

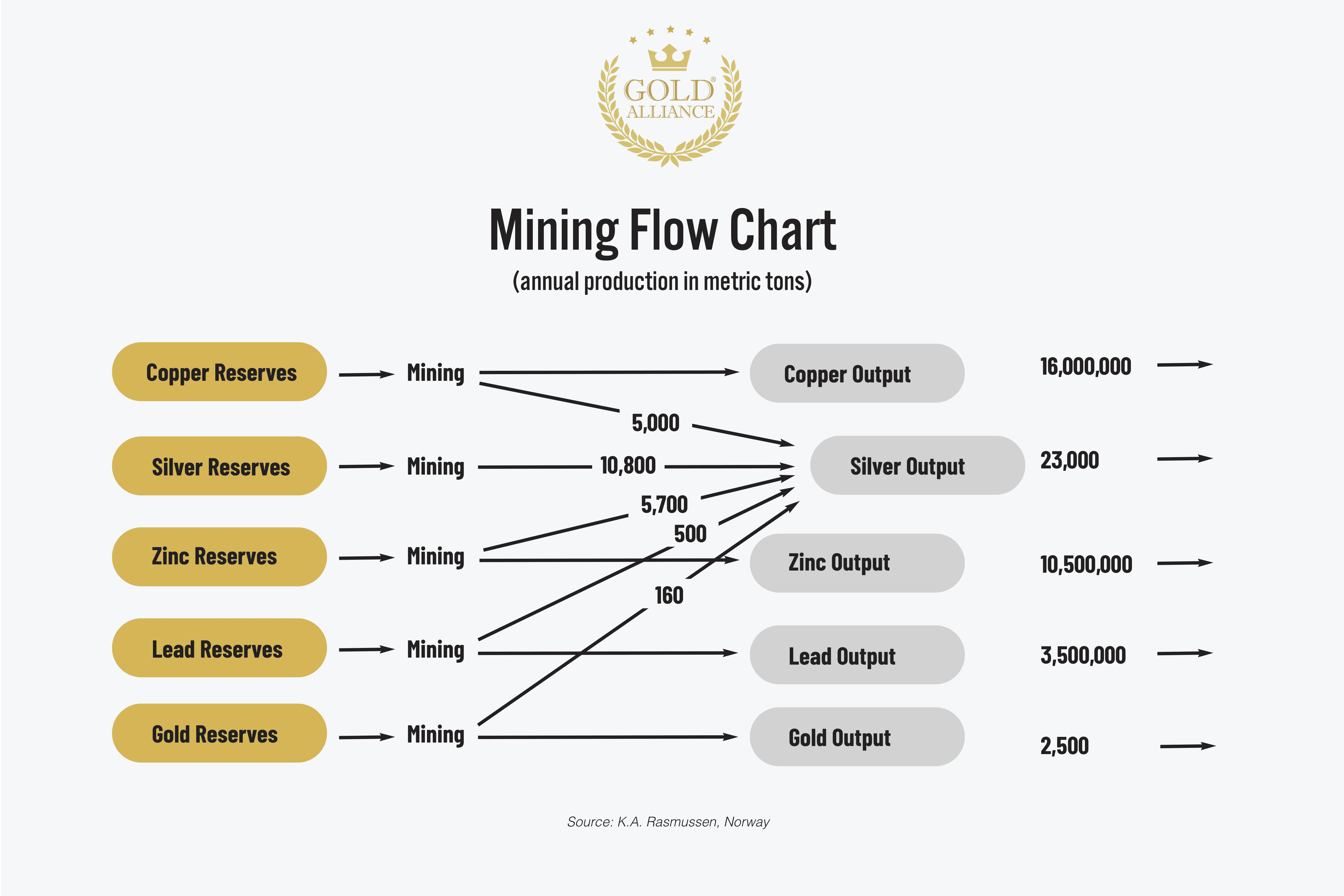

Further, the majority of the silver production occurs as a byproduct of mining other metals such as copper, lead, tin, and gold. In fact, only about 28% of silver is actually mined from silver deposits. To significantly increase the main supply of silver, companies would have to increase their production of the primary metals, and they are unlikely to do so without significant price increases in those metals — a higher silver price alone would not entice them to mine more of the primary metals.

Since the industrial demand for silver is rising and silver supply is struggling, the scene is set for a silver shortage, which means higher prices.

Global government silver reserves are dropping

Since silver is no longer commonly used for coinage, very few governments are maintaining silver reserves. Many countries used to hold extensive silver inventories, but only the US, India, and Mexico do so today.

If global industrial demand or investor demand were to suddenly spike, these stockpiles of silver would likely be insufficient, leaving the current relatively small silver market deal with significant and overwhelming demand. This would push up prices even higher in a silver market that’s already struggling to meet the current demand.

Money printing and the gold-to-silver ratio

There seems to be some correlation between the gold-silver ratio and the Fed’s money printing. The ratio appears to drop when the central bank eases its monetary policies. When the Fed put its money printing on high speed after the 2008 financial crash, the gold-to-silver ratio dropped.

Fed Chair Jerome Powell recently announced the central bank’s plans to rapidly tighten its monetary policies to fight inflation. This decision was expected, so markets had already priced it in, which is why the gold-to-silver ratio has widened.

The big question is whether the Fed can master the balancing act of raising interest rates to stop inflation without causing an economic collapse or trigger a debt crisis. The last time we faced rapidly rising inflation was in the 1970s.

Back then, under Fed Chair Volcker, the Fed raised interest rates. Then, it raised them again. And again. They achieved their goal of stopping inflation, but the economy crashed, and the recession lasted years.

Will that happen again? No one can tell for sure. But the financial markets have been relying on easy money for two decades now (since the dot-com bubble burst), and the result is a stock market bubble that dwarfs any previous bubble.

All it takes to pop that bubble is a little bit of fear among investors — fear that can spread quickly and cause a panic and a sell-off. If the markets start thinking the Fed is moving too aggressively, or if the Fed fails to contain inflation, markets would start to get scared, paving the way for a recession.

And what’s the Fed’s preferred tool when faced with a recession? Lower interest rates and more money printing. Gold and silver both typically thrive in that environment, and we’d expect silver to grow the most as it’s the furthest from its historical highs, which would again narrow the gap between gold and silver prices.

Silver is an opportunity asset

Silver is a safe-haven asset like gold but with a more industrial angle, which is great for diversification within precious metals. As such, it offers many benefits that can help give you peace of mind about your financial future. To learn more about silver, you can reach out for our free “Silver Rising” guide, which goes into further detail about the precious metal.

When people ask me if now is the right time to buy silver, I don’t say “Yes” because we help people acquire silver. We don’t “have a horse in the race” on the particular metals our clients choose. I say “Yes” because silver is historically cheap today and one of only a handful of greatly undervalued assets of any kind. In my opinion, buying low and selling high is a key investment principal, so now is a great opportunity for anyone who wants to reap the benefits of owning physical silver.

The post Silver, the Opportunity Asset appeared first on Gold Alliance.