Stock market analysts agree that the equity markets seem to be entering a new phase of volatility.

Volatility is one of the least understood measurements of investment risk. In simple terms, volatility is the price swings. Or, in a more clinical language, it’s an asset’s degree of price movement within a set period compared to another asset or to its price history.

The bigger and more frequent the price swings, the more volatile the market or stock is said to be. For example, a stock trading between $20 and $40 is considered more volatile than one trading between $25 and $30 during the same period. Similarly, a stock that traded between $25 and $30 in 2020, then between $20 and $40 in 2021, has increased its volatility.

Volatility and retirement portfolios

Volatility may be a trader’s paradise, but it is an investor’s nightmare due to its uncertain impact on his or her retirement fund’s ending value. A useful analogy is to think of the retirement fund of an investor like an apple orchard of a farmer. The annual crop of apples is like the retirement income from the fund: more apples harvested means higher income from the retirement fund.

In this context, volatility is akin to violent windstorms and heavy weather during the growing season. Each time a strong wind blows, the apple trees shake, and apples fall to the ground, diminishing the size of the harvest.

Plus 10%, minus 10% = no change? Why this is wrong

People often underestimate the effects of volatility on a portfolio over time. They assume the same percentage swings up and down are equal and have no impact on a portfolio’s value. For example, a price decline of 10% followed by a price increase of 10% would appear to “even out,” i.e., the values before and after the changes would be the same.

Unfortunately, the math doesn’t work that way.

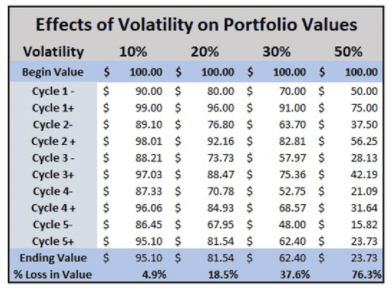

This table illustrates the effect of five cycles of price declines and price increases of 10%, 20%, 30%, and 50% from a beginning value of $100. Since the decreases and gains are the same percentage, it could seem that the ending portfolio value would equal the starting portfolio value ($100).

As shown in the table above, that is not the case.

In each example of volatility, the ending portfolio value is less than the beginning value. But as volatility increases, so does the decline in the portfolio’s ending value. If your stocks are seesawing in your portfolio, your investment apples are falling off your tree.

Volatility’s double whammy: inflation

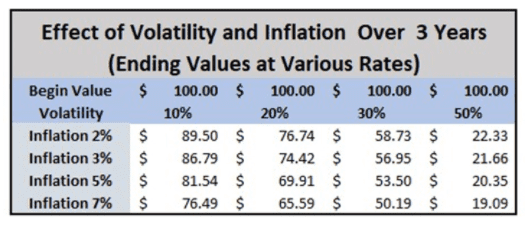

Focusing on the potential losses from volatility, investors often overlook the loss of purchasing power in a portfolio due to inflation. Inflation exaggerates the potential losses due to volatility. The following table illustrates the possible effects of multiple volatility rates and inflation rates over three years.

For example, an investment equal to the purchasing power of $100 experiencing 10% volatility and a 2% inflation rate would lose $11.50 in purchasing power over the period (11.5% loss in total value). Higher volatility and inflation rates compound the losses in purchasing power. Getting back to the purchasing power of three years prior with 30% volatility and 7% inflation requires a doubling of the portfolio value.

How to manage portfolio volatility

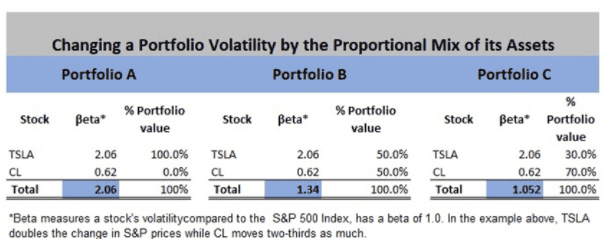

Portfolio managers can reduce portfolio volatility by increasing the proportion of assets with low volatility to the portfolio’s total assets. For example, replacing a stock such as Tesla, Inc. (TSLA), which has had about twice the volatility of the S&P 500 during the past five years, with a low-velocity stock like Colgate-Palmolive Company (CL), which has about two-thirds the velocity of the S&P 500, will lower the portfolio’s overall volatility.

Investors affect portfolio volatility by the types and proportions of assets held in a portfolio. For example, a portfolio of real estate investment trusts (REITs) is less volatile than a portfolio of cryptocurrencies, just as a portfolio of low-volatility stocks versus a portfolio of high-volatility stocks.

Diversifying with gold can reduce portfolio volatility

Gold ownership is a popular strategy to reduce volatility risk in a portfolio because it is considered a “safe-haven” asset especially sought out when financial markets are uncertain. There is economic research claiming that gold is an asset with no market risk. Gold prices typically rise when interest rates decrease, a national currency is considered unstable, or inflation worries grow.

Many portfolio managers purchase gold to lower equity portfolio volatility and hedge against stock markets declines. While gold can exhibit short-term price fluctuations due to unusual market conditions, gold historically moves counter to the stock market.

When stock prices fall, the price of gold tends to rise. In the rare times when the value of both assets declined, gold has generally retained a higher proportion of its value than securities. These characteristics suggest that adding gold to a portfolio of stocks notably reduces portfolio volatility without significantly lowering overall returns.

Understanding volatility is critical

Whether you’re just beginning to save or you’ve been at it for a long time, your goal is always to make the highest return with the least amount of risk. Identifying and managing risk within your risk profile is critical. Understanding the volatility of different investment classes, industries, and companies is essential to maintaining a balanced portfolio.

Preparing for your retirement should not be stressful or difficult. As the famous economist Paul Samuelson once said: “Investing should be like watching paint dry or grass grow. Manage your risks, and you’ll need a lawnmower.”

The post Volatility: The Thief in the Night appeared first on Gold Alliance.