Congratulations to us all. Our government has reached a gloomy milestone:

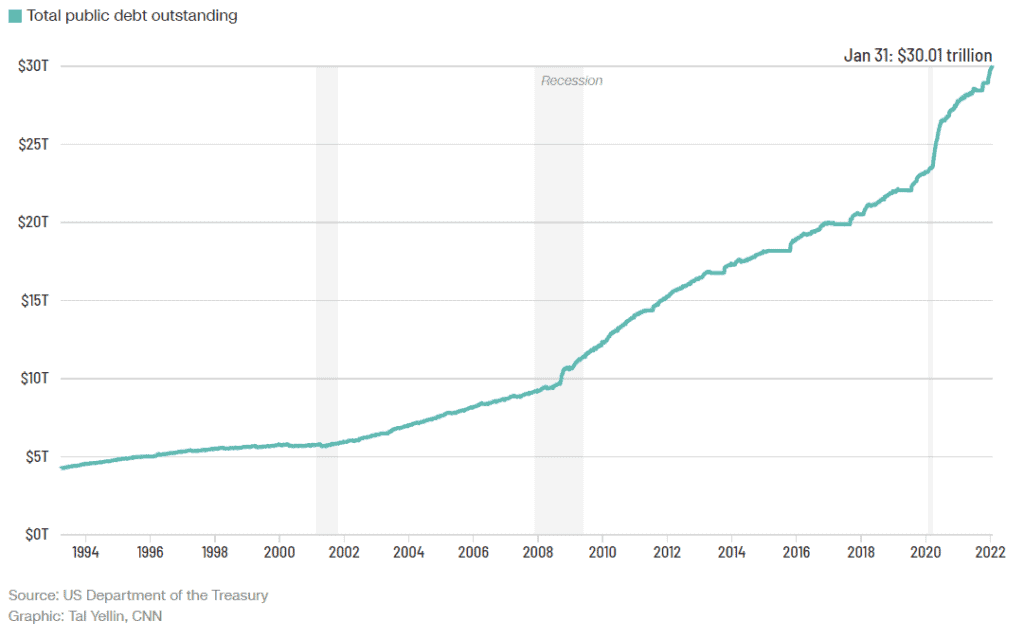

For the first time in US history, our total national debt has surpassed $30 trillion. The almost exponential growth of the national debt is astonishing.

As seen in the chart below, our government owed “just” $10 trillion about a decade ago.

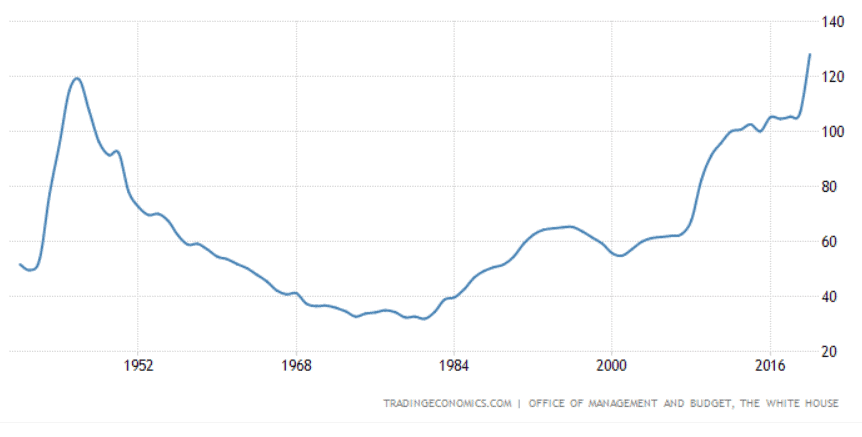

Another way to illustrate the size of the debt is to compare it to our gross domestic product using a debt-to-GDP ratio. As seen in the chart below, we’ve returned to a debt-to-GDP ratio last seen in the aftermath of World War II.

The debt-to-GDP ratio currently stands at over 125%. In other words, our government would have to spend 25% more than the entire annual US economic output (which is impossible) in order to pay off its debt.

Whether or not our government needed to triple its debt in little more than a decade is a different discussion. My focus here is on why our debt is likely to keep soaring and on discussing how the record debt poses several risks to our economy that will only worsen as the debt continues to rise.

The state of the US debt today

The Fed hasn’t yet released concrete plans to hike interest rates, but Wall Street predicts that the central bank will raise rates at least three times this year, with Bank of America forecasting seven rate hikes.

We’ll have to see how aggressively Fed Chairman Powell moves, and while we probably will not see rates go up to the levels of the Volcker Shock like 40 years ago, raising rates even a few percentage points affects the government’s debt obligations tremendously: With $30 trillion in debt, every 1% rate hike means it will cost an extra $300 billion a year to service the debt.

Some experts think the Fed will increase rates to at least 2%, and if that fails to curb inflation, Powell will need to move more aggressively… 3%? 5% perhaps? Think about what that’ll mean for the costs of servicing the national debt…

Other experts don’t think the Fed will do much to fight inflation as inflation is a terrific way to eliminate the cost of our debt: Since inflation erodes the value of the dollar, it also erodes debt

The Fed will talk about inflation, and they will raise rates, but when inflation is soaring at its current pace of 7.5%, a 2% interest rate is just not enough to make a dent. Over a few years, this will help our government reduce their obligations to Social Security and to our overall debt. If the Fed raises the rates aggressively, however, the central bank will make servicing the debt extremely difficult as the debt-servicing costs will leave no money for any other expenses.

But the Fed has other factors to consider too. .

How an aging population will add to the challenge

Currently, 54 million Americans are over the age of 65, according to the latest census. By 2030, that number will reach 74 million. The number of people over age 85, who generally need the most care, is growing even faster.

Commerce Secretary Gina Raimondo put it this way: America’s aging demographics is going to hit the country “like a ton of bricks” without increased federal aid, referring to the need for increased healthcare spending and caregivers.

The need for further healthcare spending is just one part of the challenge. As more and more people retire, the workforce declines, which means lower tax revenue. More people will also qualify for Social Security payments, which will add further stress to our government’s finances: The Social Security fund is expected to be exhausted by early 2034, and it’s facing a long-term funding shortfall with unfunded obligations totalling $19.8 trillion.

To balance the budget, our government will need to either raise taxes, increase its debt, or find the money somewhere else in the budget through cuts. Of the three options, raising taxes is likely to be the least popular option, in which case they will be forced to either go into even more debt or massively cut spending elsewhere.

The current deficit will only get worse

Speaking of government spending: It’s been 20 years since our federal government ran a surplus:

Michael Peterson, CEO of the Peterson Foundation, which promotes deficit reduction, has this to say about deficit spending:

“COVID exacerbated the problem. We had an emergency situation that required trillions in spending, but the structural problems we face fiscally existed long before the pandemic. Our current fiscal posture is a result of many years of fiscal irresponsibility from both parties.”

The problem he mentions is that we have a tax system that doesn’t bring in enough revenue to cover spending. The structural problems are exactly that: structural. They are unlikely to be resolved anytime soon, especially with the gridlock and polarization we’re seeing in Congress today. Deficit spending is here to stay. And with that, higher debt.

What are the implications of the record debt?

The historic national debt affects both the government, the economy, and individuals, and if it keeps rising, these problems will only intensify.

High debt is a roadblock to economic growth

Extensive research has documented that elevated levels of government debt suppress GDP growth. Countries with a debt-to-GDP ratio above 90% for at least five years saw their economic growth rate reduced by 33% compared to countries with a ratio below 90%.

This is highly consistent with what we’re seeing in the US, where the growth rate since 2000 has fallen 50% below the trend rate from 1870 to 2000. In other words, if our public debt was below 90% of our GDP, we’d likely see significantly higher economic growth. Unfortunately, we are moving in the opposite direction of this benchmark.

Debt lowers the ability to respond to problems

As we’ve seen during the pandemic, our government increased its debt by trillions to respond to the crisis. This is not surprising — governments often borrow to tackle unexpected events, such as financial crises, natural disasters, and wars. When its debt is already historically high, it makes this option riskier to lean on in case of unexpected crisis.

The Congressional Budget Office warns: “If the federal debt stayed at its current percentage of GDP or increased further, the government would find it more difficult to undertake similar policies [another stimulus] under similar conditions in the future. As a result, future recessions and financial crises could have larger negative effects on the economy and on people’s well-being. Moreover, the reduced financial flexibility and increased dependence on foreign investors that accompany high and rising debt could weaken U.S. leadership in the international arena.”

Rising debt Increases the risk of a crisis

If the debt keeps climbing, both US and international investors will lose confidence in our government’s ability to repay its debt with dollars that actually contain purchasing power. Borrowing will become more expensive as lenders till demand higher interest rates to balance the higher risk. At some point, rates could rise suddenly and sharply with broad economic consequences.

Confidence in the dollar would also waver, and our greenback’s status as the world’s reserve currency could be threatened. That would, ultimately, result in a lower standard of living.

How much debt is too much?

Conversation about austerity measures and balanced budgets belong to the past. Instead, our politicians are discussing how many trillions to spend. As long as interest rates remain low and our government can continue to borrow cheaply, our nation might be able to handle its current debt or even higher debt.

But once conditions change adversely, we could be looking at a debt crisis that’s unprecedented in American history.

May you be well and safe in these uncertain times.

Joseph Sherman, CEO

Gold Alliance

The post Why the National Debt Matters to the Economy and You appeared first on Gold Alliance.