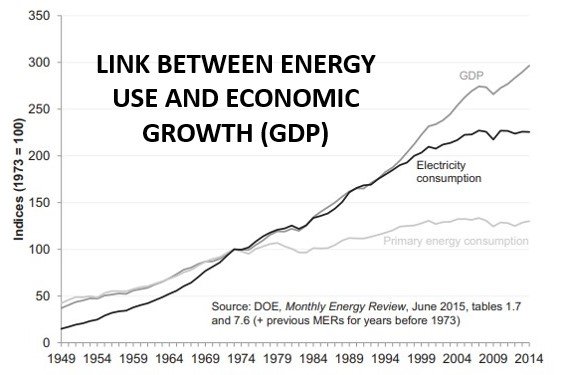

The link between energy usage and economic growth is real and long-established. For the past two centuries, the amounts of energy that economies consume directly affect the wealth (GDP) that they create.

Whenever energy supplies — coal, oil, natural gas, renewables, atomic, and biomass — are interrupted, economic growth slows and falls.

McKinsey & Company notes that when economies grow, energy demand increases. If energy supply is constrained, GDP growth pulls back in turn. “That’s been the case since the dawn of the Industrial Revolution, if not long before.”

History of energy supply interruptions

Since the mid-21st century, world economies have experienced numerous energy disruptions. In each case, they triggered economic recessions and significant stock market declines:

The OPEC price increase 1973–1974

For political reasons, the Organization of Petroleum Exporting Countries (OPEC) cut production, embargoed shipment to the US, and doubled oil prices. The GDP growth rate dropped from 7.2% to -2.1%, and the S&P 500 fell more than 50% during the period.

The Iran crisis 1978–1979

The Iranian Revolution in 1978 led to significant production cuts and a doubling of oil prices. GDP growth declined from 5.54% in 1978 to -0.26% in 1980, triggering a drop in the S&P 500 from 430.81 in July 1978 to 328.37 in August 1982 (a 23.7% decline).

The Libyan Civil War

Investors worried that the conflict would spread to other Arab countries, sparking a price increase from $8.54 per barrel to almost $120 with some concerns the price would rise to $220 per barrel. The S&P dropped nearly 18% from 1704 in April 2011 to 1401 in September 2011.

The S&P 500 did not recover its high in 1973 until March 1987. While other factors can cause GDP and market decline (e.g., Covid-19 in 2020), the negative impact of energy crises tends to linger for years.

European energy crisis

Increasing a country’s available energy supply requires sustained investment over time to build infrastructure and distribution systems. Equilibrium between supply and demand is difficult to sustain since demand is relatively consistent while supply levels vary significantly.

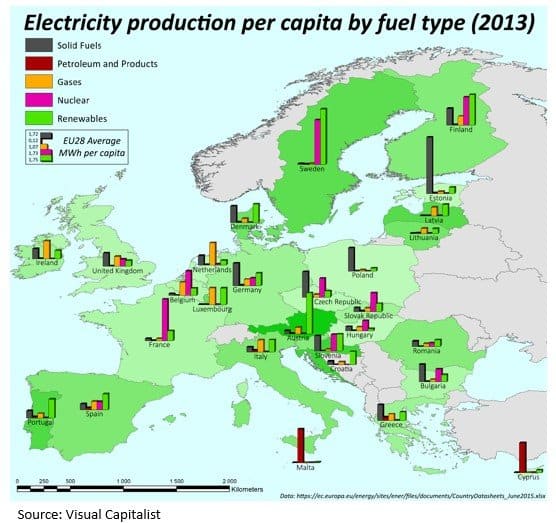

European countries and the UK are especially vulnerable to energy markets, lacking sufficient oil and natural gas production to support their economies.

Rising concerns over climate change have forced countries to turn from coal —the world’s most abundant carbon fuel —to oil, natural gas, renewables, and atomic energy. Realistically, a significant transition to non-carbon fuels will take decades.

The impact of Russia’s war against Ukraine

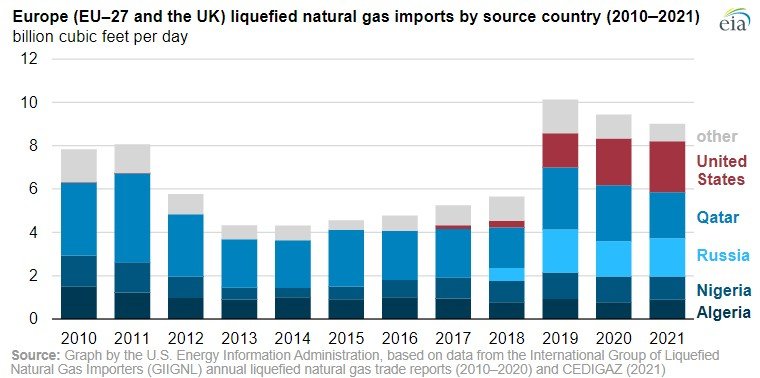

Russia currently provides the greatest proportion of the EU oil imports (27%) and 41% of natural gas imports. One-third of Russian gas flows through Ukraine’s gas pipelines to countries across the continent.

Russia’s invasion of Ukraine has ignited fears of reduced gas imports from Russia. The European Central Bank estimates that higher energy prices resulting from a 10% decrease in gas volume would cut eurozone economic growth by 0.2% or more.

How is the US reacting to Europe’s energy shortage?

If Russian gas deliveries are cut, the US intends to increase its liquefied natural gas (LNG) deliveries. Russia, Qatar, and the US are Europe’s largest suppliers.

Qatar has also indicated its intention to increase its LNG production. However, most of its output is contracted long-term to Asian suppliers and would not address the European shortage.<

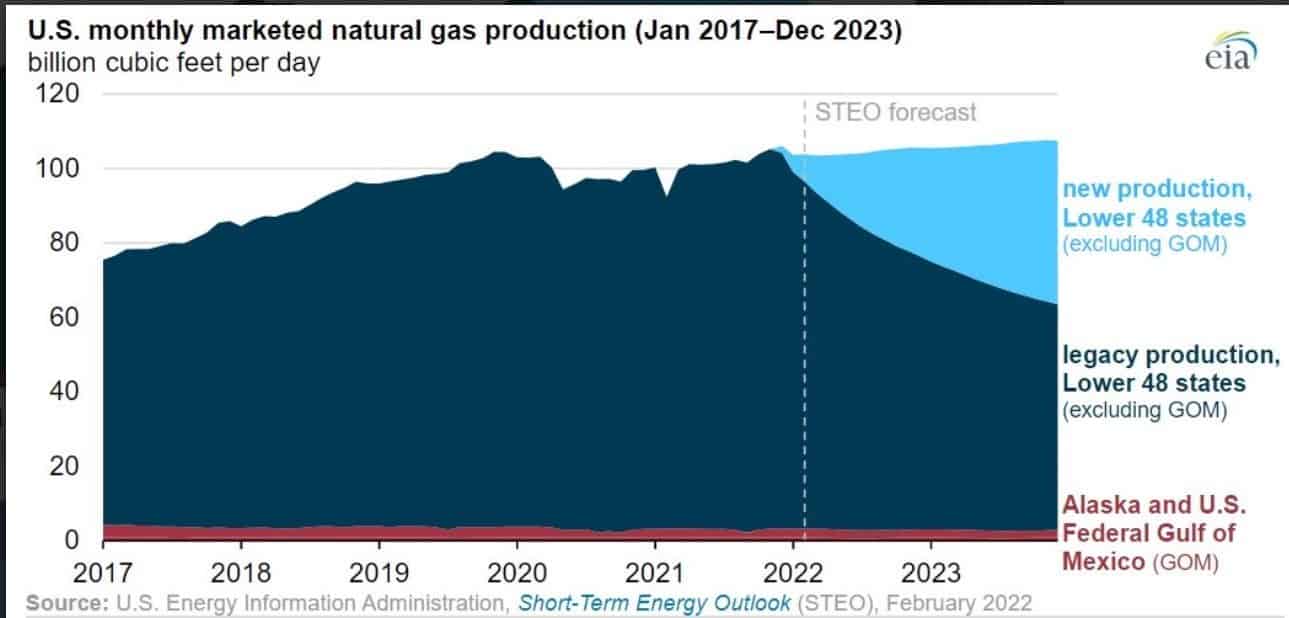

Can the US meet rising natural-gas demand?

Some question whether the US can increase LNG production sufficiently high to replace the supply deficit from the loss of Russian gas.

In 2019, the US exported slightly less than 15% of its domestic gas production. Due to the relatively low gas prices in the US, a sudden rise in global prices will likely increase US exports faster than new production increases. This means that energy prices will rise in the US, depressing economic growth.

International demand could raise US gas prices

As the Russian gas shortage is realized in Europe, the EUwill have to scramble to replace its natural gas supplies. Natural gas suppliers lack the cohesion of a central authority like OPEC to reconcile supply and demand pressures. Global gas prices reflect the supply and demand pressures within each economy, forcing countries and regions to compete for foreign supply. Natural gas, for instance, sells for $35 per MMBtu in Asia and $38 in Europe versus about $4 in the US.

This will cause foreign buyers to purchase all the LNG the US can produce until reaching price parity between the global and domestic prices. The possibility that producers will divert US production to higher-paying foreign customers is high, and therefore it’s expected that the price of gas will rise significantly in the US.

Energy shortages, inflation, and recession

Natural gas and crude oil prices do not directly affect the stock market. However, they impact the growth and profitability of businesses in direct proportion to their dependence on energy. When energy prices are stable, they have little effect. The impact of a change depends on its abruptness, scope, and duration.

Increasing prices typically produce inflation and higher prices of all goods, and inflation is a significant factor in the Fed’s interest rate decisions. Higher interest rates discourage new investment and increase costs, depressing the stock market.

Global effects of European energy crisis

In other words, the European energy crisis could have a domino effect worldwide, increasing energy costs and inflation, slowing investments, and further escalating international tensions. According to MarketWatch, this has led worried investors to liquidate securities (with losses in the DJIA, S&P 500, and Nasdaq Composite experiencing weekly losses greater than 1.5%) and turn to havens, including gold, to protect their assets.

The post Chaos in the Energy Market and Why It Matters to You appeared first on Gold Alliance.