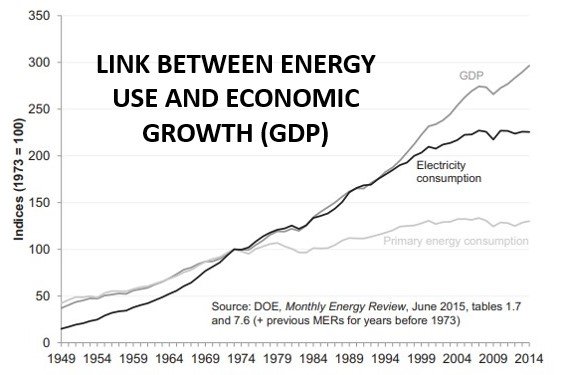

The link between energy usage and economic growth is real and long-established. For the past two centuries, the amounts of energy that economies consume directly affect the wealth (GDP) that they create.

Whenever energy supplies — coal, oil, natural gas, renewables, atomic, and biomass — are interrupted, economic growth slows and falls.

An IRA rollover means that you move all or a portion of your funds from one retirement account into another retirement account. People choose to transfer they savings into a different account to achieve certain benefits associated with the new account.

One of the most common types of rollovers is to move money from a 401(k) into a Roth, Traditional, or Self-Directed IRA, but there are several other options. In this article, we’ll guide you through them and discuss some of the benefits you could achieve.

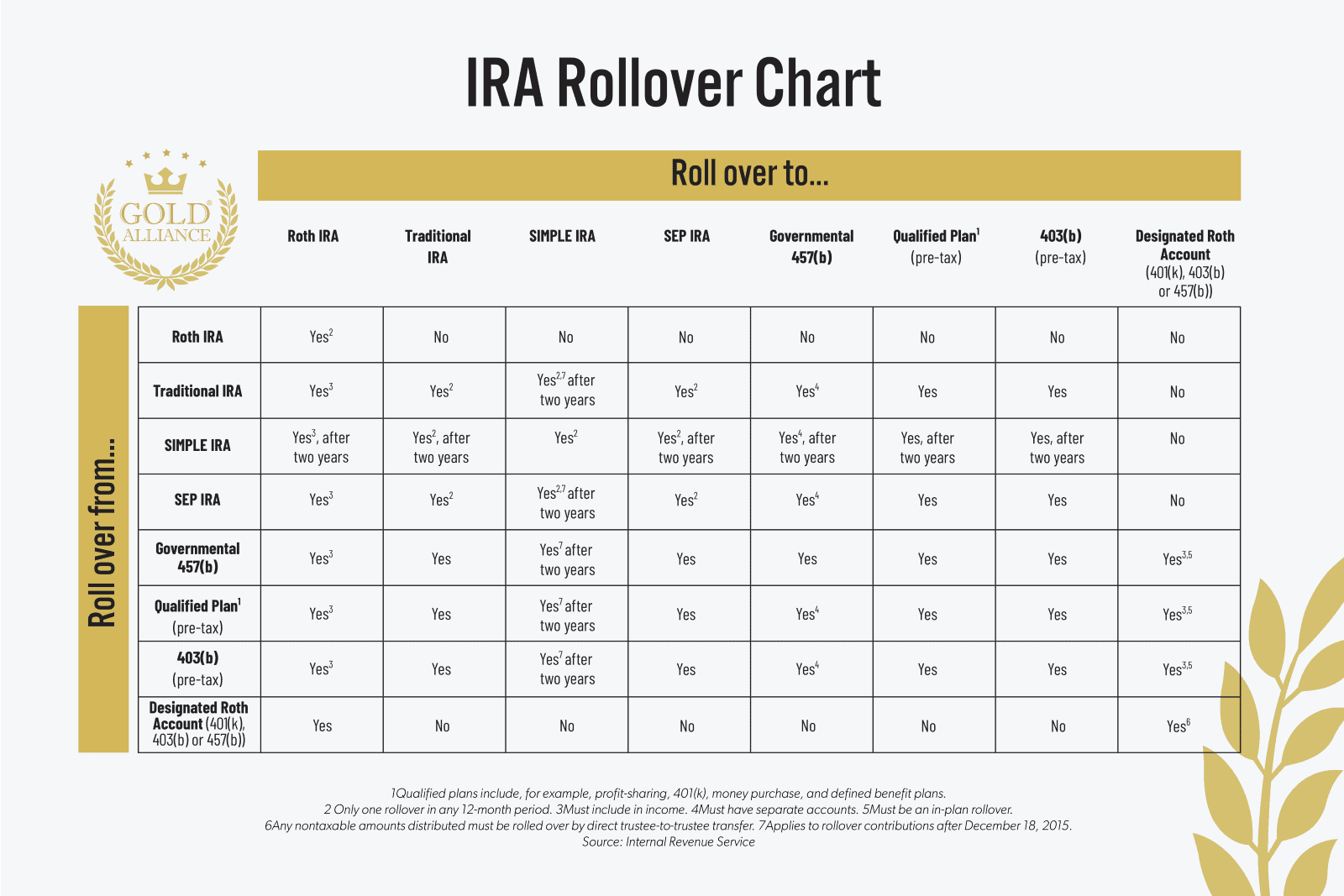

IRA rollover chart: Everything you need to know about where you can rollover your retirement account

The chart below is based on information from the IRS, which has strict rules in place for rollovers. So, before you decide to roll over your retirement savings, consider talking to your advisor to be sure about the options available to you and about the amounts you want to roll over that you are comfortable with.

This IRA rollover chart shows which retirement accounts you can roll over into other accounts

Which retirement accounts can I roll over?

For most accounts, you have several options, and your choice will depend on your individual situation and what you want to achieve. Below, we’ll go through the account types one by one.

Where can I roll over my Roth IRA?

If you have a Roth IRA, you can roll over your funds into another Roth IRA (only one rollover is allowed in any 12-month period) or into a Self-Directed Roth IRA.

Where can I roll over my Traditional IRA?

A Traditional IRA can be rolled over into a Roth IRA (a rollover that carries a tax consequence) or without penalty or tax consequence into another Traditional IRA (one rollover allowed in any 12-month period), a SIMPLE IRA (after two years; only one rollover in any 12-month period), a SEP IRA (one rollover allowed in any 12-month period), a Self-Directed Traditional IRA, a Governmental 457(b) (must have separate accounts), a qualified plan (includes profit-sharing, 401(k), and defined benefit plans), or a 403(b).

Where can I roll over my SIMPLE IRA?

You can roll over your Savings Incentive Match Plan for Employees (SIMPLE) IRA into a Roth IRA (after two years; must include in income), a Traditional IRA (after two years; only one rollover in any 12-month period), another SIMPLE IRA (one rollover in any 12-month period) a SEP IRA (after two years; one rollover in any 12-month period), a Self-Directed IRA, a Governmental 457(b) (after two years; must have separate accounts), a qualified plan (after two years; includes profit-sharing, 401(k) and defined benefit plans), or a 403(b) (after two years).

Where can I roll over my SEP IRA?

A Simplified Employee Pension (SEP) IRA can be roll into a Roth IRA (must include in income), a Traditional IRA (only one rollover in any 12-month period), a SIMPLE IRA (after two years; one rollover in any 12-month period), another SEP IRA (one rollover in any 12-month period), a Self-Directed IRA, a Governmental 457(b) (must have separate accounts), a qualified plan (includes profit-sharing, 401(k), and defined benefit plans), or a 403(b).

Where can I roll over my Governmental 457(b)?

You can roll over your Governmental 457(b) into a Roth IRA (a rollover that carries a tax consequence), a Traditional IRA, a SIMPLE IRA (after two years), a SEP IRA, a Self-Directed IRA, another Governmental 457(b), a qualified plan (includes profit-sharing, 401(k), and defined benefit plans), a 403(b), or a Designated Roth Account (401(k), 403(b) or 457(b); must include in income and must be an in-plan rollover).

Where can I roll over my qualified plan?

If you have funds in a qualified plan (includes profit-sharing, 401(k), and defined benefit plans), you can roll them into a Roth IRA (a rollover that carries a tax consequence), a Traditional IRA, a SIMPLE IRA (after two years), a SEP IRA, a Self-Directed IRA, a Governmental 457(b) (must have separate accounts), another qualified plan (includes profit-sharing, 401(k), and defined benefit plans), a 403(b), or a Designated Roth Account (401(k), 403(b) or 457(b); must include in income and must be an in-plan rollover).

Where can I roll over my 403(b)?

You can roll over your 403(b) into a Roth IRA (a rollover that carries a tax consequence), a Traditional IRA, a SIMPLE IRA (after two years), a SEP IRA, a Self-Directed IRA, a Governmental 457(b) (must have separate accounts), a qualified plan (includes profit-sharing, 401(k), and defined benefit plans), another 403(b), or a Designated Roth Account (401(k), 403(b) or 457(b); must include in income and must be an in-plan rollover).

Where can I roll over my Designated Roth Account, such as a 401(k)?

A Designated Roth Account ((401(k), 403(b), or 457(b)) can be rolled over into another Roth account, a Self-Directed Roth IRA, or another Designated Roth Account (any nontaxable amounts distributed must be rolled over by direct trustee-to-trustee transfer).

Here are the possible benefits of an IRA rollover

Why might it be a good idea to roll over funds from an existing retirement account to another account, such as a Roth IRA or a Self-Directed IRA? One of the most common reasons for this transfer of funds is that it could provide certain tax advantages or tax planning (consult with your tax advisor for those), or — through a Self-Directed IRA — it can provide you with assets that do not exist in the old account. Here are some of these benefits:

An IRA rollover could provide additional diversification

Some employer retirement plans offer only a handful of options, such as an S&P 500 fund or some bond fonds, which means you are limited in your diversification options. Other retirement accounts let you choose from a wider range of assets, but if you want more options, a Self-Directed IRA is a great choice. It lets you acquire real estate, cryptocurrency, and physical precious metals so you can diversify your savings even further than stocks and bonds.

Rolling over your retirement account could give you more control

Having more asset classes to choose from gives you more control over how your portfolio is structured. With a Self-Directed IRA, you get even more control because you can own assets such as physical gold and silver, which are out of reach of Wall Street and the banks.

Other retirement accounts only let you choose between mainstream assets, such as stocks, bonds, or other digital assets.

Rolling over a portion of your funds into a Self-Directed IRA to acquire physical precious metals also gives you more control over your portfolio risk: Physical gold and silver have no third-party risk. They have no debt or promise attached to them. They are real, tangible assets that no one can take from you.

An IRA rollover can lower your fees

Many retirement accounts, such as a 401(k), have high fees, including fund fees and administrative fees. An IRA rollover could result in lower fees. Owning physical metals in a Self-Directed IRA, for instance, means you only pay storage fees to the depository that holds your hold for you, and this low fee doesn’t go up if you increase your metal holdings, unlike typical fund fees that are calculated as a percentage of your holdings.

Diversification is key to success, so consider other options than putting all your eggs in any single basket.

———————–

Source

This chart was created with information from the IRS. Please visit the link here for more information and a directory of their resources.

The post IRA Rollover Chart: Where Can You Roll Over Your Retirement Account? appeared first on Gold Alliance.