Russian tanks crossed the border of neighboring Ukraine on February 24, 2022. The “special military operation” quickly bogged down in the face of furious Ukrainian military and guerilla opposition. Allies of the besieged country, led by the United States and the European Union, isolated Russia by imposing extensive financial sanctions on its access to foreign markets, while supplying military and medical aid to Ukraine.

Despite the pain to the Russian economy and its citizens, the sanctions have yet to secure an armistice or a withdrawal of troops.

The immediate consequences of the invasion include a significant loss of life on both sides, massive damage to Ukraine’s infrastructure, and an unprecedented flow of Ukrainian refugees across Europe. The impact of the conflict in the industrialized nations is likely to be severe and long-term, potentially triggering an era of nationalism, recession, and elevated East–West competition. Americans, long accustomed to the benefits of its status as the world’s largest economy, are not immune from the fallout.

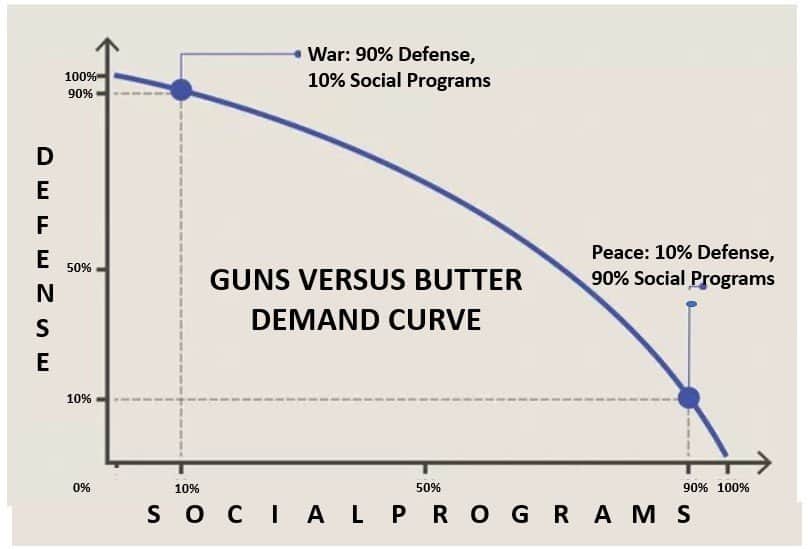

Guns or butter — how wars affect resource allocation

The term “guns or butter” refers to allocating a country’s expenditure between defense and social benefits for its citizens. For example, a factory has a finite productive capacity based on its labor, capital, energy, materials, and purchased services. Before WWII, General Motors produced automobiles and trucks for consumers (social benefit). Between 1942 to 1945, the company devoted 100% of its productive capacity to war materials (defense).

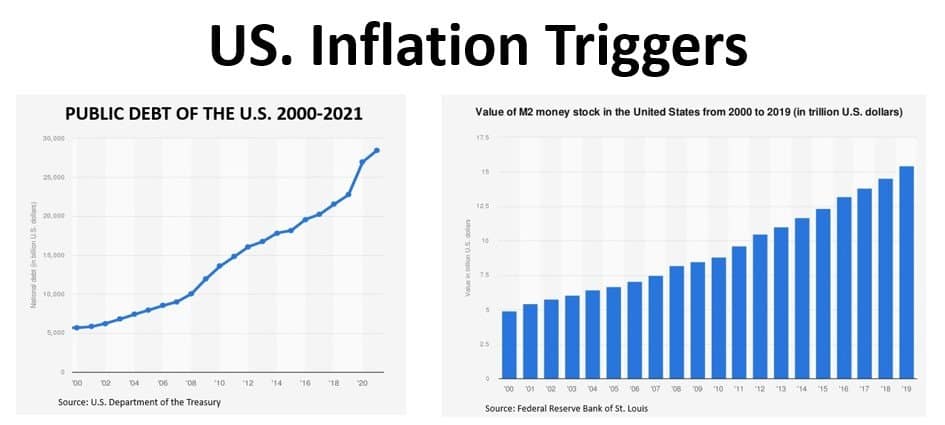

In wars since Vietnam, politicians have attempted to insulate the American public from the drastic sacrifices typically associated with military conflict. Rather than raise taxes to pay the costs of wars in Iraq, Afghanistan, and Iran, our government operated its printing presses to issue massive amounts of US dollars and increased our national debt significantly. The US debt has risen to more than $30 trillion today.

The link between war and inflation

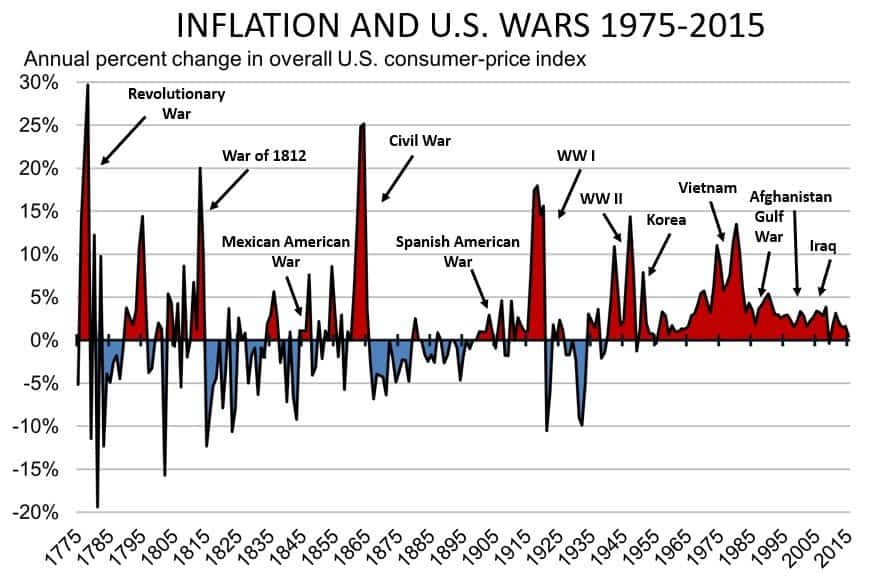

War is inflationary. It is always wasteful no matter how just the cause. It is cost without income, destruction financed (more often than not) by credit creation. It is the essence of inflation.”

– Grant Interest Rate Letter, September 14, 2001

War always increases the demand for the output of a country’s limited productive capacity. To pay for the war products, a government can do the following:

- Cut existing services. Cutting government services is political death in a democracy in most circumstances, and elected officials rarely go this route.

- Raise government taxes and fees. While tax cuts are always popular, tax hikes are as unpopular as cutting services. Both hurt the electability of politicians.

- Borrow funds via the sale of government debt. Unsurprisingly, issuing debt in the form of government bonds or increased levels of currency is the most typical source of funds to pay war and reconstruction-related expenditures. Since 2000, the US national debt has increased 520% and its money supply (M2) by more than 330%.

The link between high inflation in the United States and its wars is hard to deny, beginning with the Revolutionary War through Afghanistan. While America is not a direct combatant in the Ukraine–Russia conflict, history suggests that the war will likely cause US inflation rates to rise. Congress and the President seek to substantially raise defense spending after passing a $1.2 trillion infrastructure legislation, and it’s possible the coming years will see a return to the higher inflation rates of the past.

How the war could cause product shortages and price increases

The long-term impact of the invasion and subsequent sanctions is not yet fully known. In a PBS interview on March 28, 2022, a Kremlin spokesperson asserted that the sanctions imposed by the US and the EU are the equivalent of “total war.”

The repercussions of the sanctions are likely to last for years, including Russia strengthening its ties with China. The financial consequences of the alliance are unknown, but we’re unlikely return to a pre-sanction state of “business as usual.” China is already the “lender of last resort” to certain countries, and the resulting bipolar world of East vs. West could bring a reversal of globalization.

Get ready for food shortages and higher prices

Ukraine, known as the “Breadbasket of Europe,” is a major exporter of grains (corn, barley, and wheat) and seed oils (sunflower, safflower, and cottonseed). Russia and Ukraine are major global suppliers of fertilizers. Lost production due to the invasion sends buyers to other markets and to substitute products, driving up worldwide agricultural prices and increasing hunger rates, especially in emerging economies. The rise in basic food prices will domino through the food chain, raising the costs of animal feeds and meat processing.

Can we expect gas prices to rise even higher?

Energy prices have spiked worldwide as Europe seeks to reduce and eliminate its dependence on Russian fossil fuels. America, one of the world’s largest oil and gas producers and exporters, will divert increasing production to foreign markets and higher prices. The increases will remain in place for an extended period due to the time required to expand drilling and build infrastructure.

American consumers are likely to see sustained gasoline prices of $5 per gallon or more. Downstream energy users will raise the prices of their products and services to cover the increased energy costs. Hence, American consumers, separated from the conflict by half the world and two oceans, are expected to see significant price increases in most, if not all, essential commodities and services. Expect high inflation to persist.

Trouble ahead for the steel and semiconductor industries

The conflict is likely to significantly increase global steel demand from the rebuilding of Ukraine, replacement of defense assets expended during the war, and a general increase in defense budgets globally. Ukraine is the world’s third-largest producer of nickel (used in EV batteries and stainless steel) and aluminum. The country produces 70% of the world’s neon gas used in semiconductors. Since the invasion, the price of neon has increased 900%. Due to the conflict and political tensions between the East and West, the supplies may not be available to American manufacturers for years.

Why your purchasing power might suffer

Estimates of the projected loss in purchasing power for the average American in 2022 are as high as 8.5%, slightly above the CPI inflation rate of 7.9% in February 2022. At this rate, a dollar in today’s paycheck will be worth 91.5₵ at the end of the year in terms of purchasing power. According to the OECD, real wages in advanced economies are falling 2%–5%. As more consumers expect prices to rise from inflation, they tend to spend their funds quickly to avoid the loss, accelerating demand and fueling higher inflation rates — taking a page from what Argentinians have been doing for more than a year.

How the war could impact financial markets and precious metals

Equity markets worldwide are increasingly volatile, reflecting the uncertainties of the war on future supply and demand, fractured supply lines, and the specter of persistent inflation. Morgan Stanley, in a March 2022 investment report, noted that “we therefore expect volatility to persist in the short term, so remain cautious in our positioning, in fact, we felt it prudent to further reduce exposure to risk assets.”

Dubravko Lakos-Brujas, JPMorgan Chase’s global head of equity research, told Kiplinger magazine that “an energy price shock amid an aggressive central bank pivot [Federal Reserve raising interest rates] focused on inflation could further dampen investor sentiment and growth outlook.” Weakness in financial markets will likely persist until we have clarity on sanctions, at the very least.

Steven Dover, Chief Market Strategist at fund manager Franklin Templeton, notes that the impact of the war on top of the pandemic could encourage a transition away from global trade, resulting in a greater variability, i.e., increased risks, in economic outcomes.

We are deep in uncertain times, and during similar times, investors have turned to precious metals to preserve their purchasing power. Prices of the noble metals — gold, silver, platinum, and palladium — have risen sharply since the end of 2021. The rise reflects their long-term status as a “safe haven” when the skies seem to be falling.

The post The Effect of the Russia-Ukraine War on Americans appeared first on Gold Alliance.