For several months, we have written about the risk a coming financial and economic meltdown due to uncontrolled inflation, the dollar facing increased competition, and the global impacts of the coronavirus pandemic and the Russia–Ukraine war.

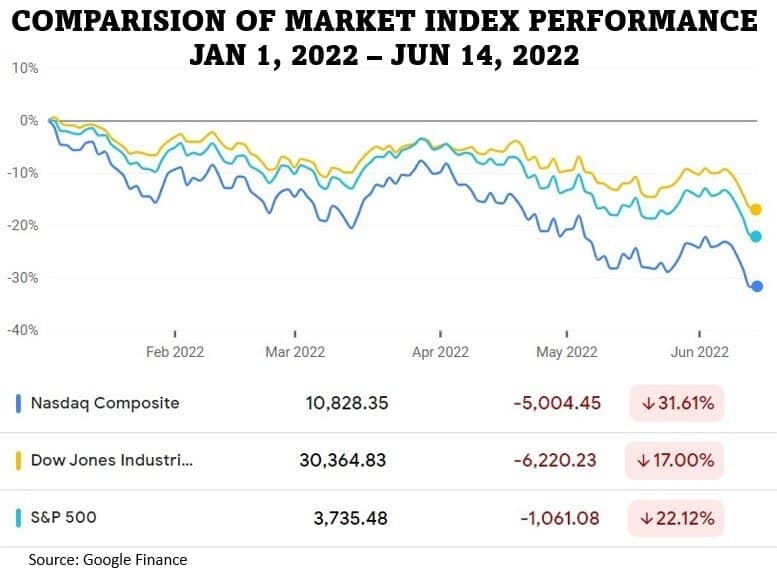

Towards the end of 2021, the financial markets seemed to ignore the multiple bad omens, and the S&P 500 reached a new high the day after Christmas. After a 12% decline over the first two months of 2022, the S&P recovered two-thirds of the loss in March, tempting investors that the good times would continue to roll.

However, since April the stock market has continued its downward spiral, and on June 13, senior index analyst Howard Silverblatt at S&P Global Dow Jones Indices announced that the S&P 500 is now officially in a bear market.

The stock market meltdown and the crypto winter

The S&P 500 isn’t the only stock market index that has suffered significant losses since the start of the year. The NASDAQ has taken the hardest blow so far.

Cryptocurrencies have lost even more value. A popular cryptocurrency, terraUSD, which is pegged to the dollar, collapsed in May. The crypto lender Celsius announced a halt in all withdrawals and transfers between accounts on June 12, which raised questions about its solvency. And Coinbase, a prominent crypto exchange, has laid off one-fifth of its employees and warned of a “crypto winter.”

Many cryptocurrency professionals predict that “thousands of cryptocurrencies will collapse” in the coming months. The most widely held and traded cryptocurrency – Bitcoin – has lost more than half of its value since January 2022.

What’s causing the stock market meltdown and crypto winter?

One would hope the worst is over, seeing how the value of savings accounts and portfolios heavy in stocks and crypto are declining with the markets. Unfortunately, the factors leading to the bear market remain in full force:

The US inflation rate remains high

Despite the Fed’s rate hikes, inflation in May soared to 8.6%. The impact of this week’s rate hike of 0.75 basis points will likely be diluted due to the rise in energy and food prices. They are two types of living expenses that Americans can’t easily reduce, and the World Bank is projecting that energy prices will jump 50% and food price 22.9% this year, keeping upward pressure on inflation.

The oil and gas markets are in turmoil

Sanctions against Russia have substantially reduced or ended supplies of natural gas to Europe, which is forcing countries around the world to reconfigure global supply relationships. Major energy companies in the US have cut refinery capacity in recent years in anticipation of a transition to electric cars, and this has become a significant obstacle to gasoline production.

The Fed is raising interest rates

After the May increase in interest rates failed to slow inflation, the Fed is banking on its June rate hike to slow inflation. Additional rate increases are expected for the rest of the year, which will likely slow economic growth and could push the US into a recession.

Supply chain problems continue

The disruptions in global supply chains caused by the pandemic remain. Increased coronavirus fears and tensions between the US and China, Russia’s main ally, complicate the supply chains of critical components in many US industries, such as automobile manufacturing and housing.

The dollar is strengthening

The Fed’s fiscal and monetary actions have strengthened the dollar over other global currencies. This is encouraging imports and weakening exports, and American companies with significant overseas markets lose sales as a result.

Investor pessimism is spreading

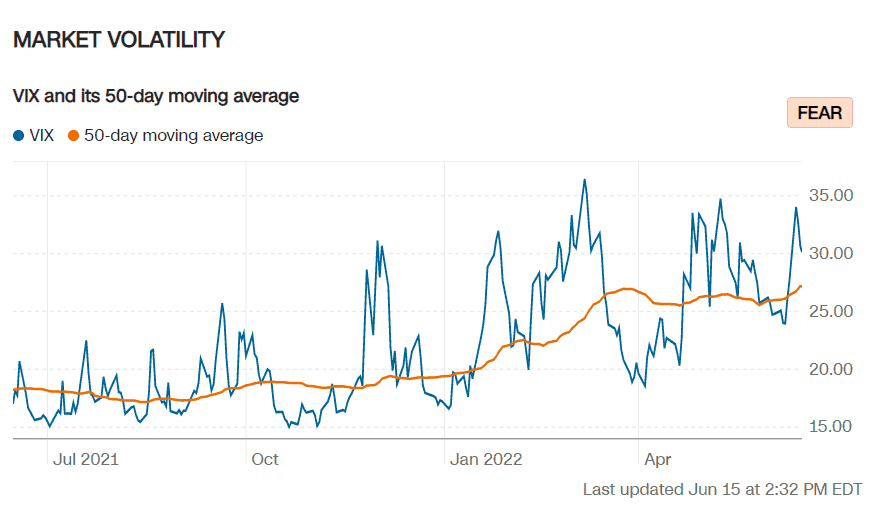

Multiple market indicators reflect investors’ growing fear of further declines in equity and fixed income investments. The VIX volatility index, for instance, is in “fear” territory and trending higher. Fear among investors will push them towards defensive assets at the expense of risk assets such as stocks and cryptocurrencies.

The risk of an economic recession is rising

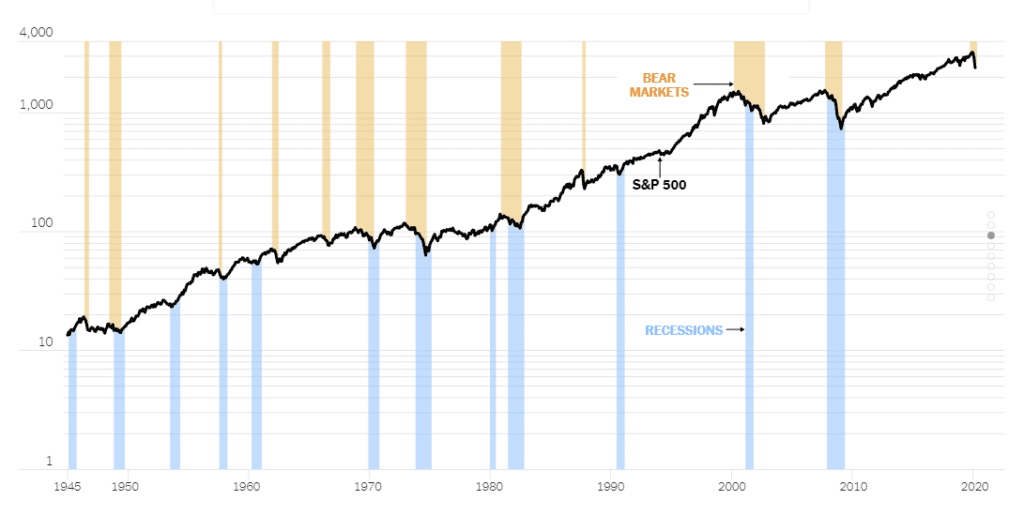

More than two-thirds of bear markets end in recession. (The chart below shows bear markets in orange and recessions in blue.)

The yield curve inverses

A yield curve inversion – a condition when short-term interest rates rise above long-term rates – frequently predicts a recession within the next 6–18 months, according to the Chicago Federal Reserve. The 2-year Treasury yield topped the 10-year rate on March 31, 2022.

One factor that could significantly increase the market decline is the plunge in cryptocurrency values. Hedge funds have invested billions of dollars in cryptocurrency in recent months, but as losses mount, fund managers will be subject to margin calls: They must either sell equity and fixed-income assets for cash or sell cryptocurrency at significant losses. Either response will add negative pressure to an already weak market.

Stay put and hope for the best or take action

The bear market in stocks and the meltdown in cryptocurrencies cause a dilemma: either stay put and hope the damage will be slight and recovery to previous values short, or act to protect what your can by liquidating now – ending the losses – and seeking out defensive assets to preserve and grow your savings.

The post Are the Market Wheels Coming Off? appeared first on Gold Alliance.