The US economy has suffered one blow after another over the past couple of years, and recession warnings are mounting — from Deutsche Bank, the World Bank, and Morgan Stanley to Elon Musk and Jamie Dimon. And, according to a CNBC survey, 80 percent of small-business owners expect a recession to occur this year.

However, some analysts are pushing back against the thought that a recession is coming, banking on the willingness of US consumers to continue to spend despite soaring prices.

The optimists believe that we will deplete our savings and go further into debt to sustain our lifestyles and that this spending will keep the US economy afloat. But is this realistic?

Why is consumer credit important to our economy?

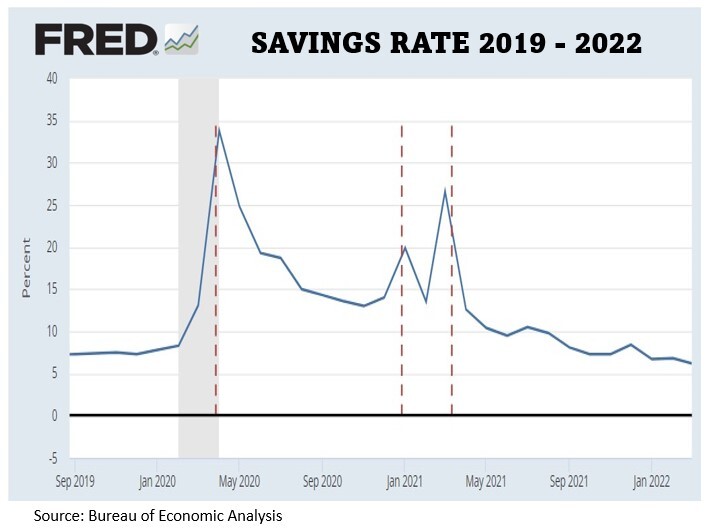

During 2020 and 2021, personal savings increased to a high of 33.7%, more than five times the level in December 2019. The surge in savings is likely due to the three rounds of stimulus payments people received and, due to the lockdowns, their limited abilities to spend it. However, the savings rate plummeted from its short-lived high, as seen in the chart below.

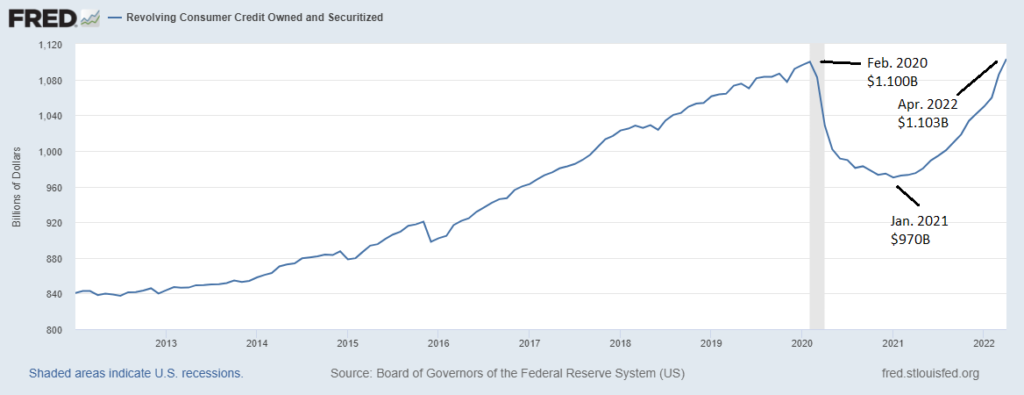

It appears that consumers used a significant portion of their savings to reduce revolving credit (credit cards, credit lines). Total revolving consumer credit fell by more than $100 billion between February 2020 and January 2021.

But many people love debt in good times and bad, and they are now maxing out our credit cards at a record pace. We just passed pre-pandemic levels:

And just like our national debt, US consumer debt is expected to keep rising:

“There’s a good chance that Americans’ total credit card balances will soon reach a new record high, marking a sharp reversal from the precipitous drop that occurred in 2020 and early 2021,” Ted Rossman, a senior industry analyst at CreditCards.com, told CNBC.

With rising debt and a falling savings rate, the likelihood that consumers will have excess savings available to spend is shrinking each day as inflation drives up food and energy costs. It does not seem like there is a hidden reserve of money to grow or maintain demand in order to rescue the economy. The economy may soon be in dire need of a major rescue operation…

Which statement best describes how the Fed responds to recessions?

Let’s assume a recession will come — we’ve had recessions throughout history, and this is unlikely to change. When the next recession hits the US, the Fed will most likely respond the way it always does: by returning to quantitative easing — money printing. How that turns out, we’ll have to wait and see. But the past could give us some hints:

When the pandemic-induced recession shook our country, the Fed cranked the money printers up to full speed. And those trillions of dollars flooded the markets, driving up inflation. To fight rising prices, Powell and Co are trying to engineer a “soft landing” by hiking interest rates. Their historical success rate? 3 in 14. Most of the time, the Fed’s rate hikes trigger a recession… and this could very well happen this time around as well unless the Fed finds a way to avoid it. Relying on consumer spending does not seem like the solution.

The post Is a Recession Coming? appeared first on Gold Alliance.