“Should I wait for the price of gold to come down or buy silver now?” asked a friend recently after complaining that the price of gold was too high. Like many Americans, he worried that the stock market was dangerously over-priced and that a painful reckoning was coming, so he was looking for an asset that could help him reduce the risk of his savings.

He isn’t the only one worried about the economy — we hear these concerns every day when people call us to inquire about precious metals. And many of them share the same concern: that gold is too expensive.

However…

Here’s why GOLD may actually be cheap today

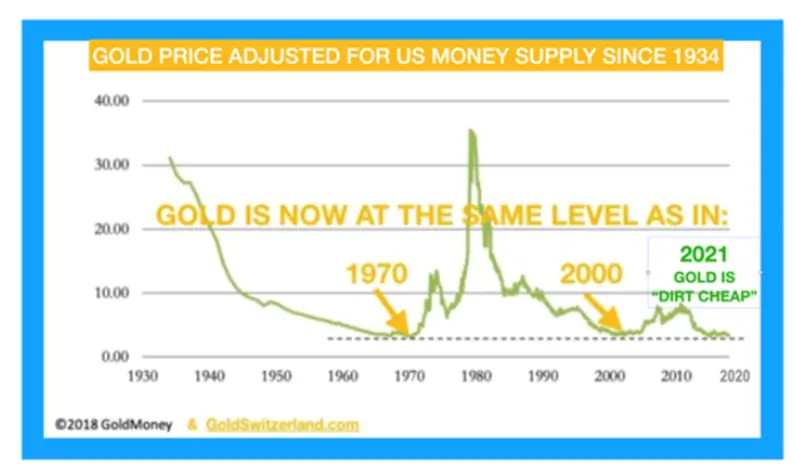

Looking at the spot price of gold ($1,856/oz at the time of writing this), it may seem “too expensive” when compared to its price at around $280/oz in 2000. But we can’t determine whether gold is expensive by just looking at its price alone. We need a measure of comparison, and one way to assess the price of gold is to compare it to the total US money supply.

The money supply has risen sharply over the past few years, most recently during the pandemic where it rose by trillions of dollars. When we calculate the price of gold in relation to the US money supply, gold today is as cheap as it was when we left the Gold Standard in the 1970s and again around the Dot Com crash era of 2000. In other words, despite its current price, when compared to the amount of dollars out there, gold is the cheapest it’s been in over 20 years.

With recession and stagflation warnings mounting, it’s reasonable to expect that the demand for gold will grow as people look towards defensive assets. And rising demand means rising prices. But not only that: If a recession hits the US, the Fed will most likely stop its rate hikes and instead go back to what it knows best – money printing — to get the wheels rolling again for the economy.

If you’re not convinced that gold is cheap today, then you can look at silver:

Here’s why SILVER may be cheap today

Today, silver can be considered undervalued, especially compared to gold. First, silver is trading at less than 50% of its all-time high from 2011. Out of all asset classes, silver is one of the most undervalued when you compare the prices of different asset classes to their all-time highs.

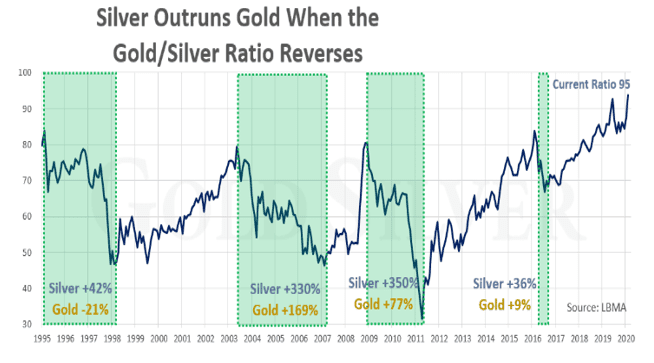

Another way to look at silver’s value is to compare it to gold. We can see this by looking at the gold/silver ratio, which is simply the spot price of gold divided by the spot price of silver and shows how many ounces of silver it would “cost” to purchase one ounce of gold.

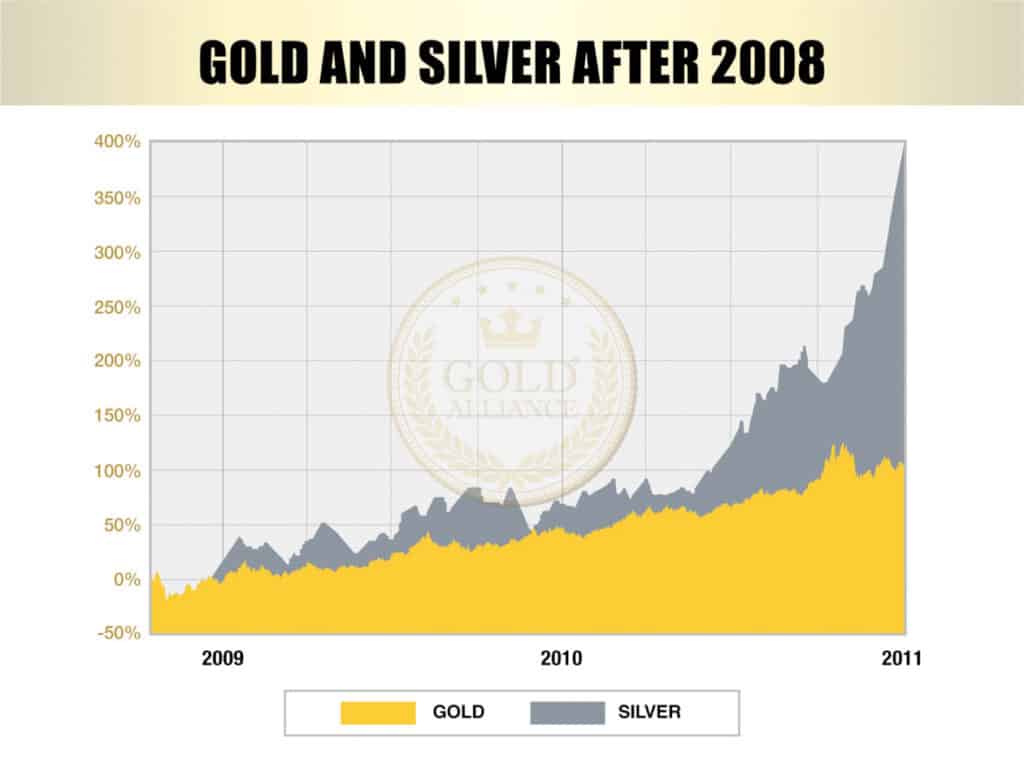

The ratio is above 80:1, just like it was before the 2008 Great Financial Crisis. In the aftermath of that crisis, silver spiked around 4x in less than two years.

In the modern era, the gold/silver ratio has averaged between 40:1 and 50:1. So, historically speaking, silver is very undervalued today compared to gold. In the past when the ratio reverses to its average, silver outperforms gold:

Precious metals tend to run in tandem during a short-term bull run. However, as the chart above reveals, silver has consistently outperformed gold when the gold/silver ratio reversed, which usually lasts 2–3 years..

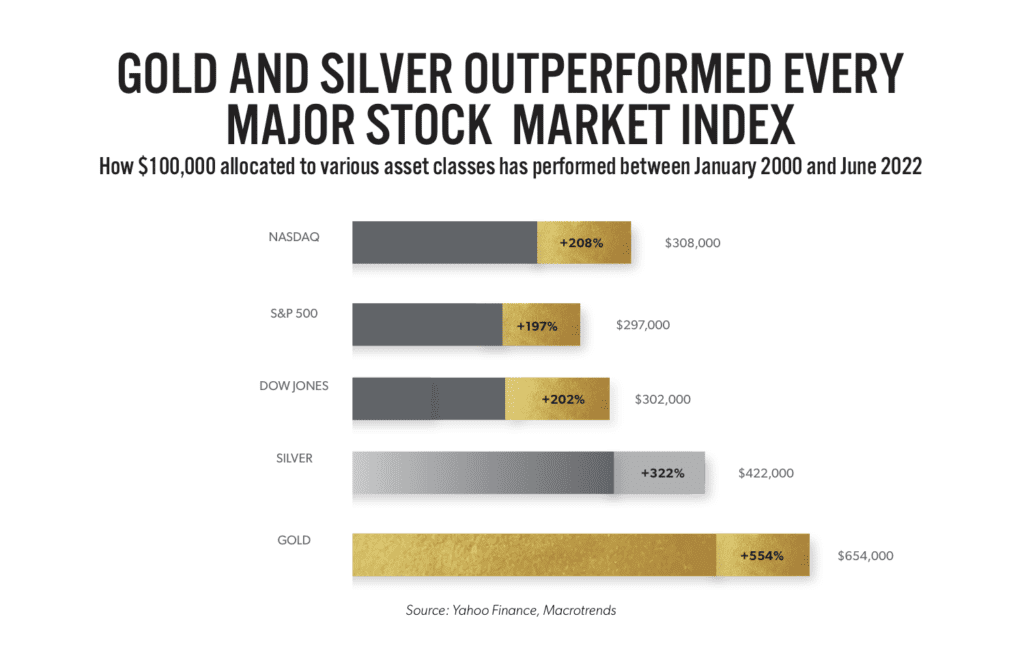

Viewed over a longer period, say since the start of the millennium, gold has outperformed silver. The graph below also reveals how both metals have outperformed all the major stock indexes, illustrating their growth in dollar terms and percentage.

Silver has, in my opinion, lots of potential. These days, many of our clients are adding both gold and silver to their savings to take advantage of their historically low prices and to benefit from silver’s potential short-term gains over 3–5 years.

The post Is Gold Too Expensive? appeared first on Gold Alliance.