Despite investor enthusiasm, the current bull market in stocks is running out of steam. Many companies, including Walmart and Microsoft, are cutting their profits forecasts for 2022. Many economists expect stagflation or a US recession because the Federal Reserve is hiking rates and reducing its balance sheet (“quantitative tightening”) in its fight against inflation. Meanwhile, a war is raging in Ukraine, and tensions are high worldwide.

So, it’s no surprise that many analysts project that the S&P 500 will suffer a severe further decline before the end of the year. Past markets have shrugged off bad news and been content to steam ahead. But history is unlikely to repeat itself in this case due to fundamental changes in the world’s economies and societies.

These events strike directly at the “pillars” that support the bull market, and they are starting to crack. Here’s what has supported the bull market so far and why that support is crumbling.

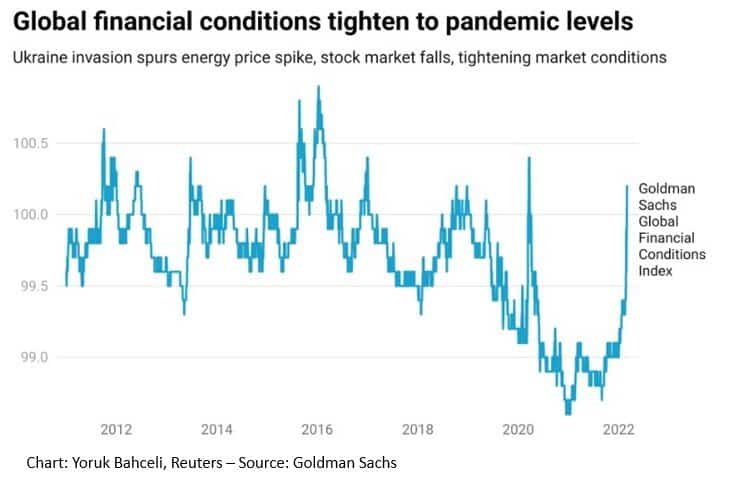

Global liquidity is shrinking and financial conditions tightening

On April 22, 2022, Reuters warned that the pumped-up dollar was compounding the global liquidity squeeze. According to liquidity specialist Michael Howell’s CrossBorder Capital, global central bank liquidity is contracting faster and faster, falling 10% (annualized) compared to 8% and 3% in the previous two weeks.

Goldman Sachs states that global financial conditions are at their tightest levels since the banking crash in 2008. The reasons include soaring energy prices and market turmoil stemming from Russia’s war against Ukraine. The Federal Reserve and the European Central Bank have raised interest rates and intend to reduce the money supply by buying government bonds.

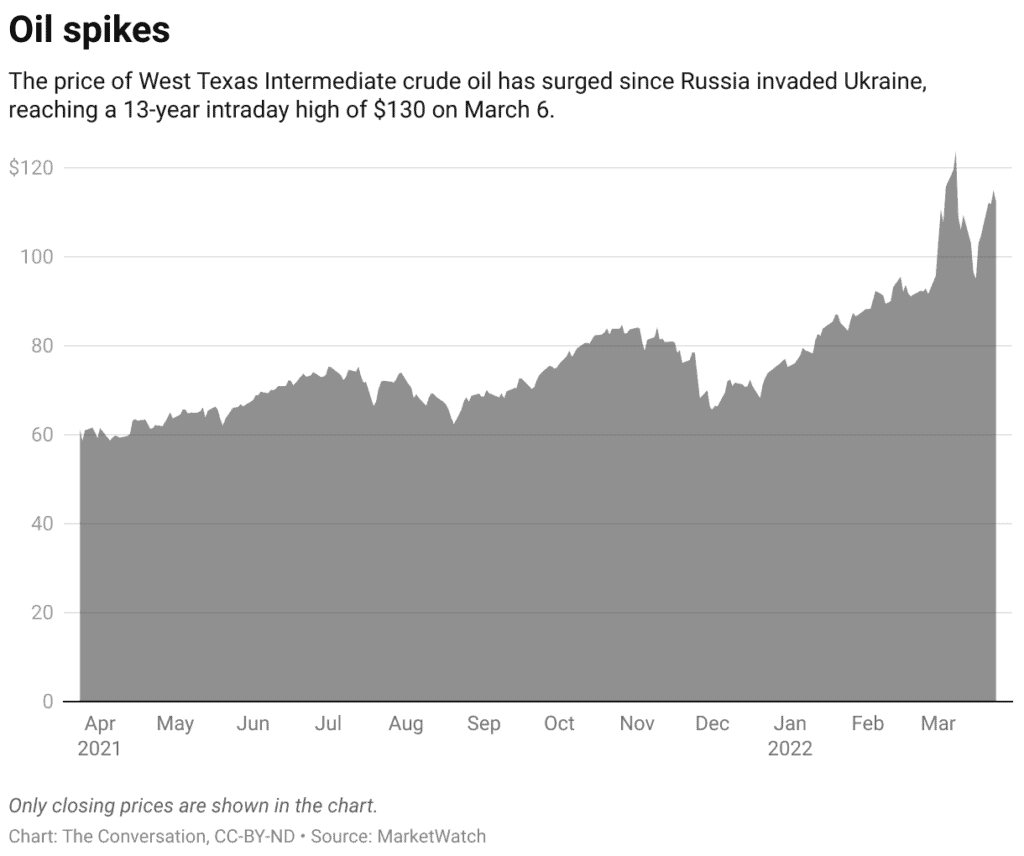

Energy costs are soaring

The US is the world’s largest producer of crude oil and natural gas, but despite that energy costs have escalated due to the disruption in international supply agreements. The sanctions related to the Russian invasion of Ukraine left European customers scrambling for new suppliers, and the lack of domestic restrictions on petroleum and gas exports requires the United States to compete with other countries for its energy needs. You feel it and see it when you go to fuel your car.

Carbon fuels, especially petroleum, are used in a long list of products and services, including gasoline, cosmetics and creams, and our children’s and grandchildren’s plastic toys. Americans consume almost seven billion barrels of crude each year. The price per barrel has doubled since April of 2021, and energy company CEOs warn that prices are likely to remain high for years.

International trade is crippled

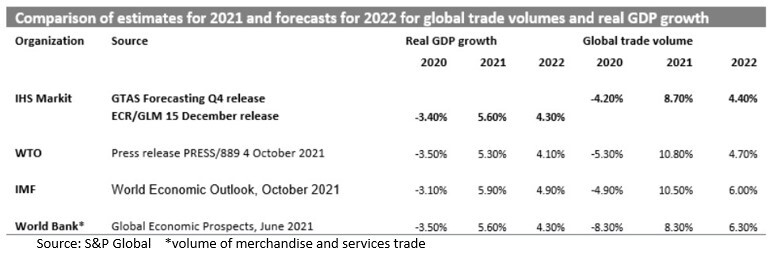

The coronavirus has disrupted global supply lines and continues to hinder their repair or replacement. International tensions over the Russian invasion and the Western allies’ sanctions have increased competition between China and the US, slowing trade between the two greatest economies in the world.

The Dow Jones Transportation Index, which is a good representative for international trade, is at its lowest level in seven months, and we might see it drop further as the financial systems underlying international trade – SWIFT, central banks, and national currencies – face competition from China and Russia.

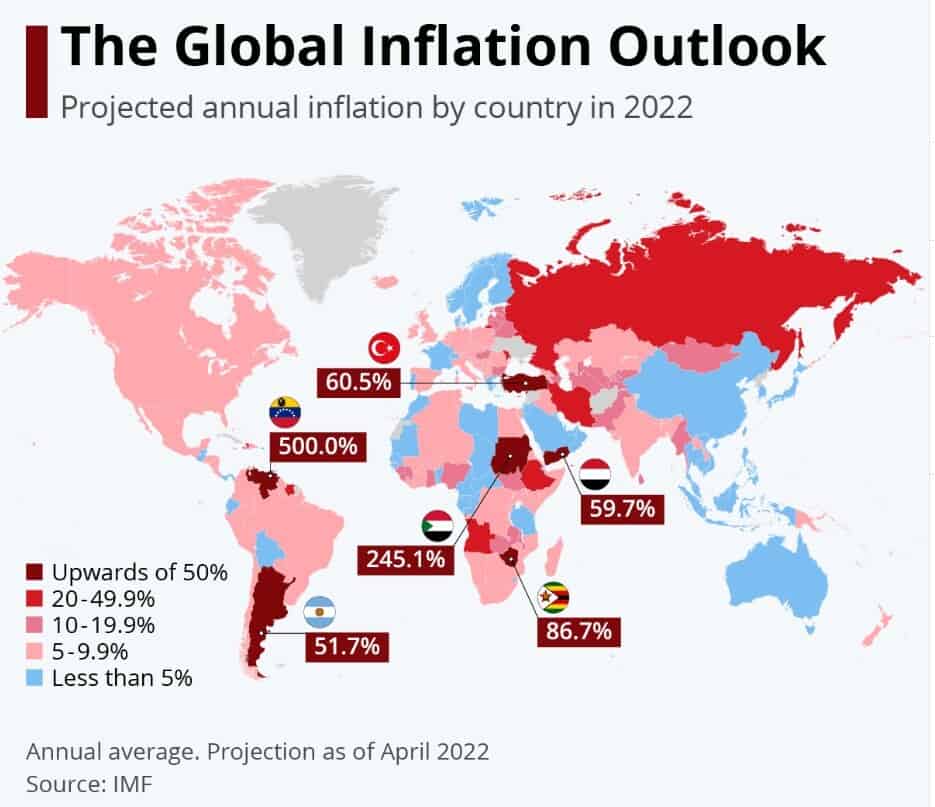

Inflation is rising globally

Inflation in the United States is at a forty-year high, and very few countries have escaped the debilitating effects of soaring prices. Globally, the inflation rate more than doubled between March 2021 and March 2022, and with higher prices for food and energy sky-high inflation could be with us for a long time, hollowing out the purchasing power of savings and perhaps even causing civil unrest.

Investor confidence is vanishing

Unlike the “Little Engine That Could” in children’s books, many investors no longer think the market will reach higher levels. According to a survey of investors by the American Association of Individual Investors, more investors believe the market will be lower in six months than those expecting it to be higher.

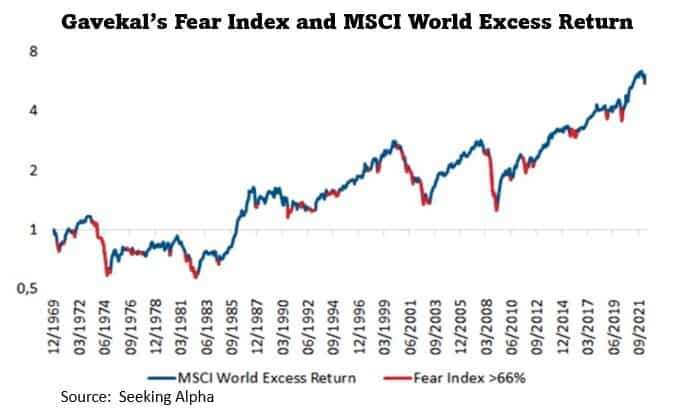

This belief is important because it amplifies bad news. It means that good news for the stock market will be discounted, while bad news will be strongly believed. Their sentiment aligns with the findings of Gavekal Research’s Fear Index and the MSCI World Excess Return:

The Fear Index, currently at 70%, is not forecasting bad news, but it indicates how the stock market is likely to amplify bad news once it occurs.

If all five pillars crumble…

The consensus among many analysts is that a significant stock market correction will occur in the intermediate term. As Jamie Dimon, CEO of JPMorgan Chase, said about the economy, “a hurricane is coming … That hurricane is right out there down the road coming our way. We just don’t know if it’s a minor one or Superstorm Sandy.”

Should all five pillars of the bull market crumble at the same time, my bet is on Superstorm Sandy. To borrow again from Dimon, “You better brace yourself,”

The post The Pillars of This Bull Market Are Crumbling appeared first on Gold Alliance.