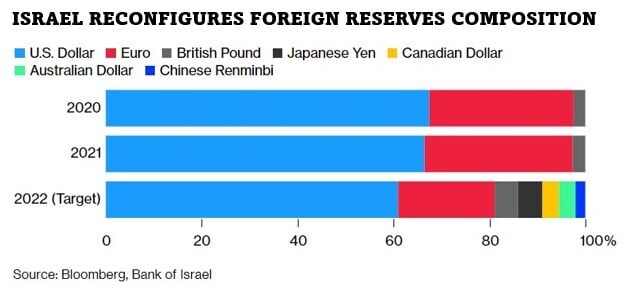

The dollar remains the world’s reserve currency, but Russia and China are signaling a significant shift away from the greenback. Now the Bank of Israel seems to show these efforts are somewhat successful as it’s reducing its exposure to the dollar (and the euro). In their place, Israel added the Japanese yen, Australian dollar, Canadian dollar, and Chinese yuan to its reserves.

Israel is lowering its dollar holdings from 66.5% in 2021 to 61% as of June 2022, down about 8.3%, and its euro holdings from 30.8% to 20%, down 35%. It’s the biggest change Israel has made to the allocation of its reserves in over a decade.

A significant move from a close ally

In 2021, Israel’s total reserves exceeded $200 billion for the first time ever, so the reduction equals over $10 billion. But what makes the change more noteworthy is that it’s a crack in the relationship between Israel and the US.

The ties between the two countries have been strong since WWII. Israel has been the largest beneficiary of US foreign assistance since WWII. The US has provided Israel with nearly $3 billion annually since 1985, occasionally exceeding that figure. Since the Second World War, the total figure is over $146 billion (not adjusted for inflation).

Israel is aware of this history and of its reliance on the US from a military perspective, which makes this move by the Bank of Israel stand out even more. This move is important not because it shows Israel is ungrateful.

The shift away from the dollar requires the Israeli bank to hold currencies it did not have to hold before to support import transactions where the exporters do not want to receive US dollars. By adding Chinese yuan to its reserves, Israel is telling us about the effects of the world reserve currency battle going on and that the dollar is losing ground to its competitors.

More and more countries are separating from the dollar

Israel is the latest in an expanding list of countries showing various degrees of moving away from the US dollar:

- China is increasing its gold reserves, possibly as part of a plan to launch a gold-backed yuan to rival the dollar. We wrote about China stockpiling gold here.

- China and Russia have both developed alternatives to the dollar-based SWIFT (a system used by banks around the world to communicate about cross-border transactions). China launched its Cross-Border Interbank Payment System in 2015, and Russia established its System for Transfer of Financial Messages in 2014 with the first transaction taking place in 2017.

- Russia and China are also establishing trade relations outside of Europe and the US through a “Future-Oriented Strategic Partnership.” China’s imports of Russian oil have soared 55% in one year. This sends a clear signal: China will trade with America’s adversary and ignore that the US has imposed sanctions on Russia.

- There are also cracks in the relations between the US and another important economy, India, who is refusing to join the Western sanctions against Russia. Moscow is now the second-largest exporter of oil to India, and India is joining an emerging Russia–Iran–India trade axis.

- China is strengthened its financial ties with India. India is a co-founder of the 2013 China-backed Asian Infrastructure and Investment Bank (AIIB) and its largest borrower. India has announced plans to link its domestic financial messaging system with Russia’s SPFS, which is connected to China’s CIPS.

- America’s biggest ally, Europe, is grumbling about the dollar’s dominance in international trade. In 2018, European Commission President Jean-Claude Juncker complained:

“It is absurd that Europe pays for 80% of its energy import bill – worth 300 billion euro a year – in US dollar [sic] when only roughly 2% of our energy imports come from the United States. It is absurd that European companies buy European planes in dollars instead of euro… The euro must become the face and the instrument of a new, more sovereign Europe. “

- Saudi Arabia’s talks with Beijing to price some oil sales in the yuan suggest the yuan will expand its global use in commodity trades.

- Latin American countries have invested nearly $30 billion in yuan assets over the last five years. According to Goldman Sachs, the yuan’s share of global foreign exchange reserves could grow from its current 2% to between 6% and 7% over the next five years as China progressively opens its financial markets. As a result, the bank says, the yuan could become the third-largest global reserve currency by 2030.

Are we heading towards the demise of the dollar?

Will there be a point where our allies put their own economic interests first over relations with their transatlantic partner?

According to Akhil Ramesh, a fellow with the Pacific Forum (a non-profit, foreign policy research institute), “It is a matter of when the US dollar loses its dominance among global currencies — not will.” [Emphasis is mine.]

The post Another Crack in the Dollar’s Dominance? appeared first on Gold Alliance.