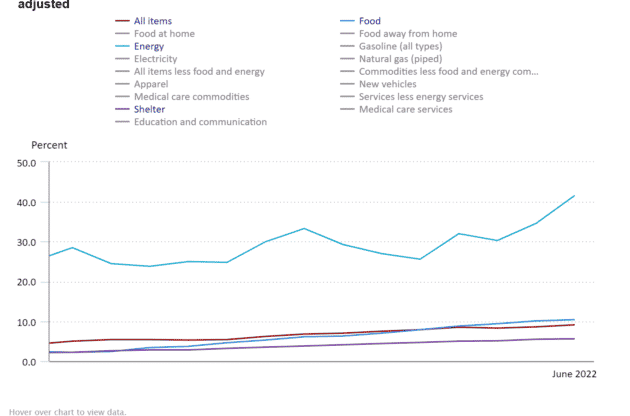

On July 13, the Bureau of Labor Statistics released the latest inflation data, which shows that the Fed remains unable to reign in spiking prices. For the year ending in June, the consumer price index rose 9.1%, the highest since 1981.

Three categories are the main contributors to the worse-than-expected inflation rate: energy, food, and shelter.

Are we already in an energy crisis?

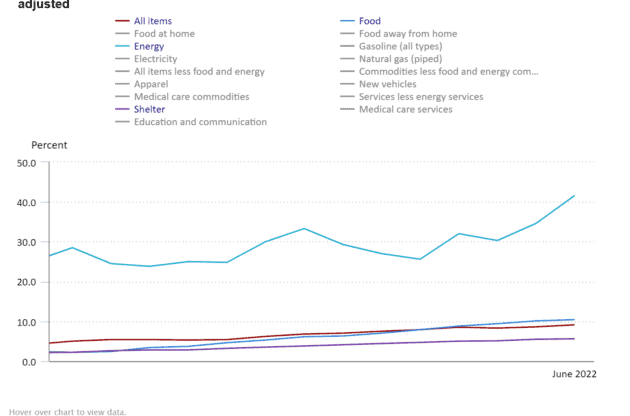

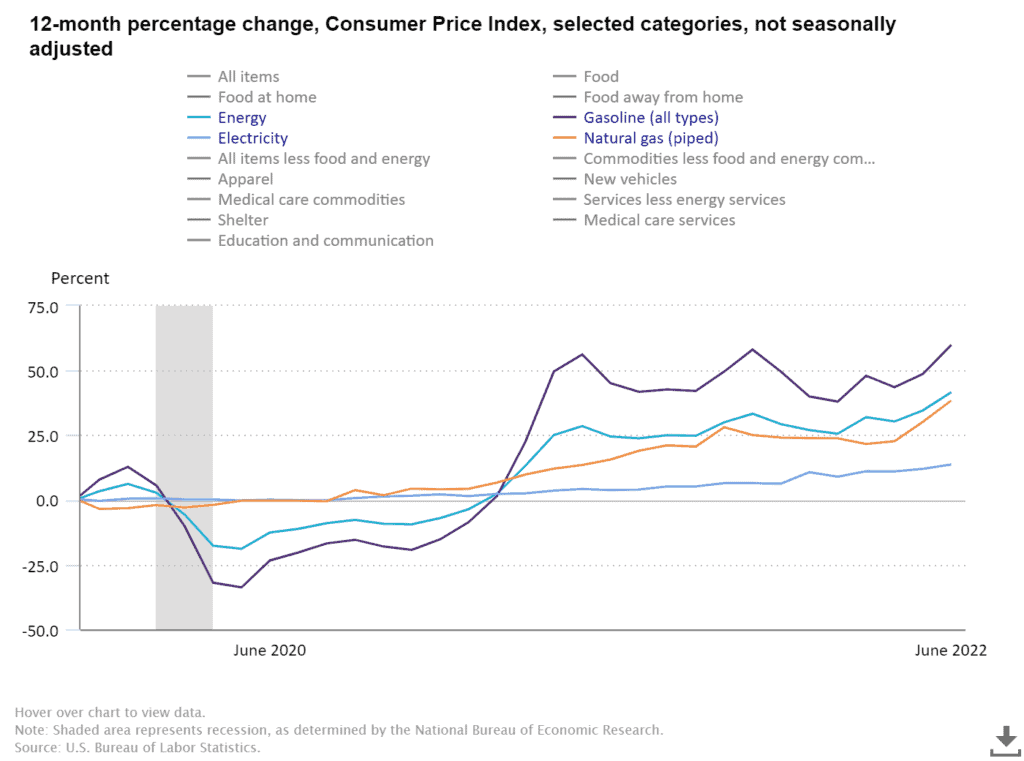

Blame it on supply chain issues or the sanctions against importing Russian oil and gas, but the fact remains that energy prices are soaring. The overall energy index rose 7.5% month-over-month and contributed to almost half of the overall increase in the CPI inflation rate. The energy index is up 41.6% over the past year, while one of its components, the gasoline index, increased 59.9% — the largest 12-month increase in that index since March 1980.

The price of gasoline isn’t the only thing that is straining consumers’ budgets across our country. As seen in the chart above, natural gas prices and electricity keep rising as well.

Oil prices have dipped over the past week, but some experts say this is only temporary: “I would think [oil] prices stay elevated relative to prior periods — and not so much that we’re going to get a collapse in prices just because things normalize a little bit,” Wells Fargo senior equity research analyst Roger Read told Yahoo Finance Live.

In other words, the energy index may remain high, and according to Fatih Birol, the executive director of the International Energy Agency, we are “in the middle of the first global energy crisis.”

But fueling your car is one thing, filling your stomach is another.

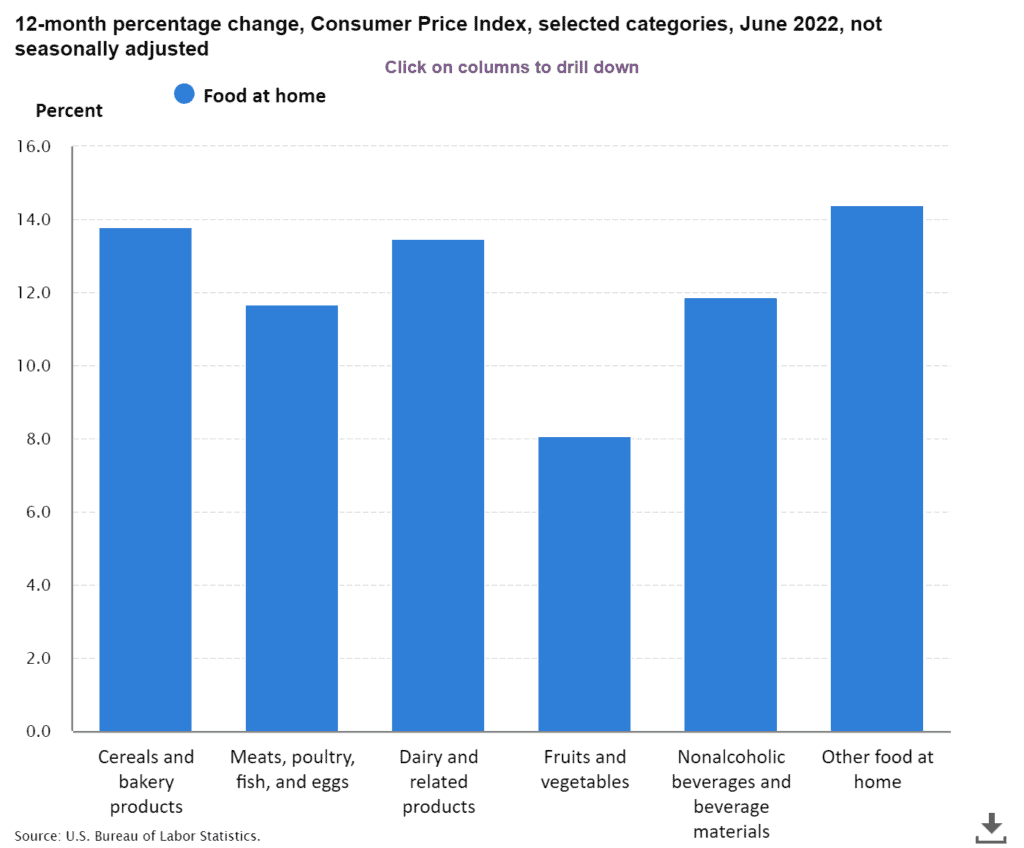

Food prices are rising

While some people are able to use other means of transportation than their cars and thereby stay clear of soaring gas prices, it’s more difficult to cut down on meals. Overall, food rose 10.4% over the past 12 months. The chart below shows the food index broken down by main categories.

One example of rising food prices is Campbell’s soup, which has risen in price for the third time this year:

Campbell’s Soup putting through their THIRD price hike this year. Announced June 17th – that’s anecdata not in CPI yet. Food inflation still has momentum. pic.twitter.com/g66mTO7ECy

— Andrew Sinclair, CFA (@CT_Osprey) July 13, 2022

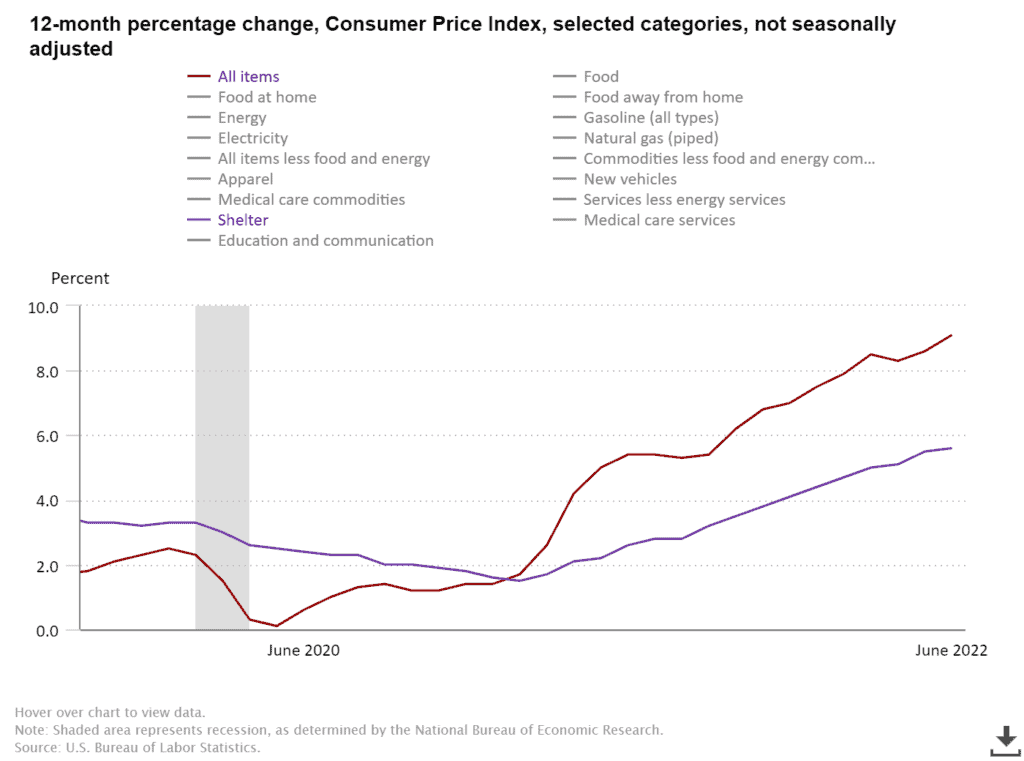

Rent keeps rising

Not only are our lives being impacted by prices at the pump and in grocery stores, but we’re also facing rising shelter costs. The Bureau of Labor Statistics shelter index rose 5.6% over the past year, less than overall CPI. But it has an upwards trend:

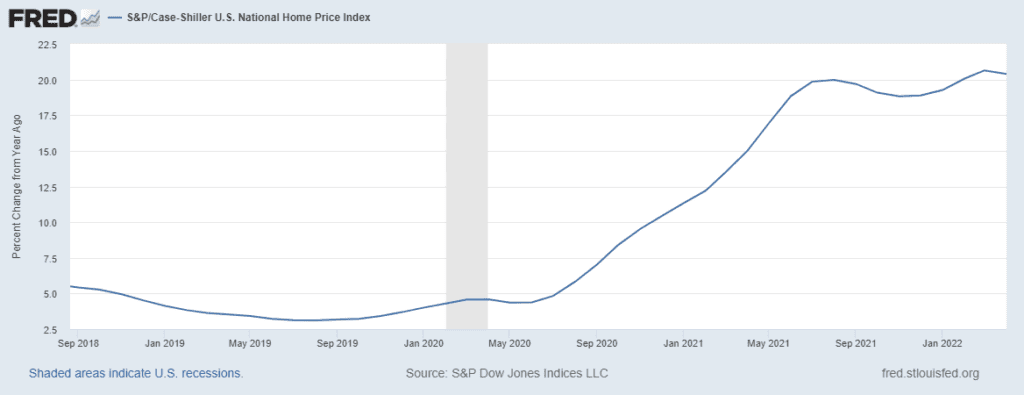

It’s questionable, however, if the CPI’s shelter index reflects reality. If we look at the Case Schiller home price index, we see that the average home price is up over 20% since a year ago.

The Fed can’t perform miracles

The essential costs of living are all rising, and despite the Fed’s best efforts, Powell & Co have little to no control. Monetary policy can affect the money supply but not create goods: The Fed can’t produce oil, grow food, or build homes.

And the outlook is gloomy. In a recent note to its clients, Goldman Sachs economists said they expect the CPI to grow even faster this summer as transportation and health insurance costs continue to surge.

According to Forbes, some experts believe we might as well get used to high inflation, citing LPL Financial chief economist Jeffrey Roach: “Consumers may have to live in a world where inflation consistently runs hotter than the previous decade.”

This is echoed by President of the European Central Bank, Christine Lagarde, who’s warned there are “growing signs”— including the ongoing war in Ukraine— that “supply shocks hitting the economy could linger” beyond 2024.

No matter what’s in your basket, prices have kept rising, and it seems they will stay high or rise even further.

The post Inflation shock— what can the Fed do? appeared first on Gold Alliance.