You might not be old enough to remember this, but…

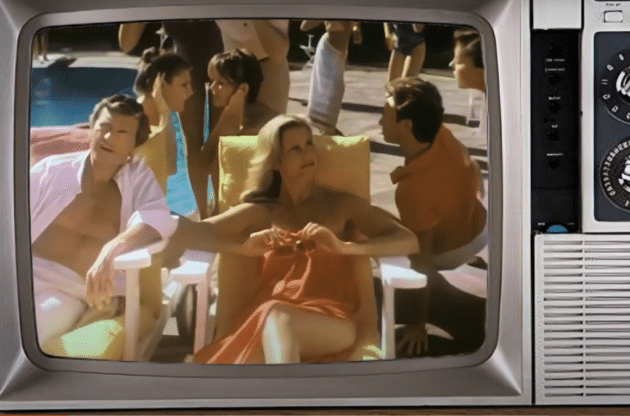

Back in the late 1970s and early 1980s, an investment firm called “EF Hutton” ran non-stop commercials where one person shares his broker’s advice with a friend and asks, “What’s your broker say?”

The friend replies, “Well, my broker is E.F. Hutton. And E.F. Hutton says…”

With that line, the crowd of busy people milling around in the background abruptly stops to near E.F. Hutton’s investing wisdom.

A narrator then ends the commercial with the now iconic line:

“When EF Hutton talks, people listen!”

Back then, solid financial advice from experts wasn’t easy to come by.

Today, the world is filled with many “E.F. Huttons” from the business, investing and economic world. And for anyone looking for valuable financial insights from the economic front lines, it may be time to stop and listen to what they’re saying about the Fed, interest rates, inflation and the possibility of a recession.

In the banking sector, one of the most vocal experts is JPMorgan CEO Jamie Dimon.

According to Business Insider, Dimon says the long-term consequences of the Fed’s rapid tightening campaign are unknown and “This may be the most dangerous time the world has seen in decades.”

During JPMorgan’s third-quarter earnings call last Friday, Dimon also expressed his concerns over further interest rate hikes, soaring US debt, and the risk of higher inflation fueled by massive fiscal deficits.

And right now, Dimon says, “I think you have to be very cautious.”

One of the business world’s most outspoken “E.F. Huttons,” Elon Musk, agrees with Dimon and says caution is in order.

As the captain of several billion-dollar companies, Musk sees the effects of growing debt, rapid rate hikes and more affecting his bottom line every day.

During his third-quarter earnings call, Musk echoed Dimon’s concerns but hedged, “I’m not saying things will be bad, I’m just saying they might be.”

Musk also listed several macroeconomic challenges coming down the pike and commented on the effect on Tesla and other US businesses, saying, “If the macroeconomic conditions are stormy, even the best ship is still going to have tough times.”

And he may be right…

With so many challenges building on the horizon at once, the macroeconomic conditions we’re all facing right now are “stormy” indeed.

Some experts believe a recession is still a high probability, but the storm may be delayed…

In a recent interview, elite investor Jeremy Grantham says we will experience a recession, and “it will probably go deep into next year.”

Like Musk, Grantham noted the sheer number of financial challenges brewing in the US and explained, “You increase the pressure on a very complicated system until a few things snap. That is the pattern — something breaks, and nobody seems to know what it is. It’s always a surprise, but you always have a surprise, so the idea of a surprise is totally unsurprising.”

And this concept, coming from Grantham, is worth considering.

Because, as Yahoo Finance says, Grantham “correctly predicted the 2008 financial crisis, along with other market meltdowns over the course of his career.”

Whether Grantham’s forecast is correct remains to be seen.

But billionaire investor Leon Cooperman says the Fed’s rapid rate hikes have definitely destabilized the financial system.

And when Cooperman speaks, he hopes Washington is listening because “We’ve got to get our house in order, or we’re headed for a crisis.”

Goldman Sachs CEO David Solomon was a bit more reserved with his forecast and said his investment firm is “cautiously positioned” and hinted “Overall levels of risk are more elevated than we’ve seen in quite some time.”

And the famous CEO of the nation’s largest hedge fund, Ray Dalio, echoes Solomon’s sentiments, saying he’s “pessimistic” about where the economy is headed.

In a recent interview with Business Insider, Dalio also said we “should understand how to achieve balance and diversification” to achieve an “all-weather portfolio.”

This, for many people, is solid advice worth listening to.

Especially in the face of so much economic uncertainty.

The question is: If time is of the essence, how can we quickly achieve that “balance and diversification”?

Perhaps, if commercials like E.F. Hutton’s aired today… with Ray Dalio as the star… he’d stop the room with his iconic quote:

“If you don’t own Gold, you know neither history nor economics.”

Or call 888-529-0399 to schedule a free consultation with an experienced Gold Specialist. There’s no obligation.

October 24, 2023

America’s Biggest Banks Shutter Thousands of Regional Branches

October 10, 2023