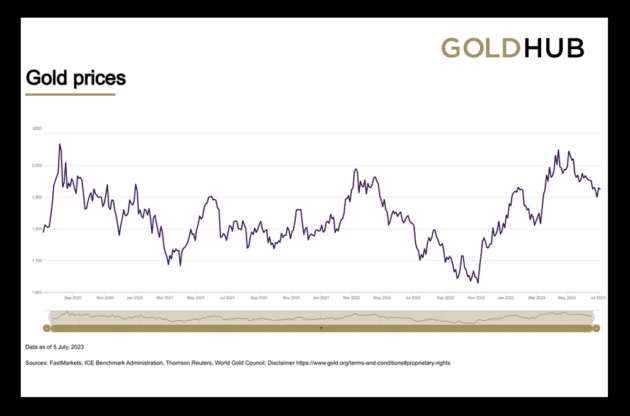

A few weeks ago, the price of gold came within pennies of its all-time high.

And if recent forecasts from experts and analysts are correct, gold could soar to a new high in the coming months.

Here are 5 reasons why we believe their forecasts may be right.

Reason #1: The demand for gold is rising fast

As we reported in June, official surveys show the number of Americans who think gold is the best long-term investment has doubled. And the World Gold Council (WGC) reports the total US demand for gold hit its highest quarterly level since 2010.

At the same time, the world’s biggest central banks are buying more gold and at a faster rate than they have in over 50 years and show no signs of stopping.

The WGC says central banks just bought the most gold on record for Q1 — almost triple last year’s first-quarter purchase.

Louise Street, senior market analyst at the WGC, says “central bank buying is likely to remain strong and will be a cornerstone of demand throughout 2023.”

And Forbes says this strong central bank gold buying “may fuel a new gold rush.”

Especially since…

Reason #2: The world’s gold supply may be stagnating

According to the WGC, the world’s gold demand and supply increased at the same pace in Q1 of 2023 compared to Q1 of 2022.

Total global gold demand for Q1 was 1% higher than in 2022. And the gold supply kept pace, rising 1% as well.

And if central banks continue their massive gold buying, what will happen to the world’s gold supplies?

Last year, demand for gold surged 18%, but supply crept up by just 2%, says the WGC.

Now, many experts and analysts believe and the world’s gold mines may have reached their maximum possible gold output.

Meanwhile, the worldwide demand for gold is rising fast…

Central banks are buying…

And if the basic economics of supply and demand hold true, what do you think will happen to the price of gold?

Reason #3: The rise of CBDCs

As we discussed recently, the controversy over the Fed’s proposed Digital Dollar is heating up.

Proponents say CBDCs will modernize the US financial system and offer a convenient way to pay bills. Opponents say digital money would end our financial privacy.

Republican Congressman Tom Emmer and presidential candidate Ron DeSantis agree and warn CBDCs aren’t about convenience but about “surveillance and control.”

So far, 125 countries have either launched their CBDC or are in some phase of development. And nobody is sure what will happen if the US government’s proposed digital dollar goes live. But if the world’s financial systems switch to digital currencies, the privacy afforded by physical gold could make it an attractive option.

And with central banks buying more gold than ever, demand increasing and supply stagnating… it’s easy to see how the price of gold could potentially rise.

Reason #4: A possible banking crisis brewing in the background

It’s been a relatively quiet couple of months since the nation faced 3 of the 4 largest bank failures in US history.

But a study by Social Science Research Network finds 186 US banks are still vulnerable to an SVB-like crash.

And Wall Street on Parade says giants JPMorgan and Citigroup are using the same accounting maneuvers as SVB.

Louise Street says the WGC saw a noticeable surge in gold demand when Silicon Valley Bank collapsed.

So, what could happen if depositors started fleeing from two of the largest US banks, just like they fled from SVB?

The Fed’s recent “stress tests” show major banks are “resilient.”

But the future is unwritten.

If another bank collapses, investors may have already hedged their savings with gold because…

Reason #5: Analysts still expect a recession

The repeated recession warnings are beginning to lose their bite, and some investors may think the threat has passed.

But Fortune reports, “Such thinking … risks a grave error for investors, according to some of the world’s biggest bond managers from Fidelity International to Allianz Global Investors. They’re sticking to their forecasts for a downturn and advise hedging any bets on risk assets.”

Darrel Cronk, president of Wells Fargo Investment Institute, agrees and says overwhelming evidence shows a “recession is at our doorstep.”

And “Deutsche Bank says an economic downturn is 100% inevitable,” according to USA Today.

Recessions, and recession worries, have historically led to increased gold demand and pushed prices higher. And now, with demand rising, the gold supply stagnating, the rise of CBDCs and a possible banking crisis brewing in the background…

This may be the best time in history to purchase gold.

———————-

Don’t let economic events outside of your control affect your financial future. Click here to get a FREE Gold Information Kit or call 888-529-0399 to speak with a Gold Specialist now.

June 29, 2023

IRS Court Win and New Fed Programs Put Privacy Watchdogs on High Alert

June 15, 2023

Controversial “Anti-CBDC” Bill Joins Fight to Block Fed’s Plans

The post 5 Reasons Gold May Soar to Record Highs appeared first on Gold Alliance.