As the nation faces growing economic uncertainty, the quest for a stable financial future has never felt more urgent for many Americans.

But with so many economic challenges happening at once, charting a confident path to wealth protection can seem like a daunting task.

Fortunately, economist John Exter (1910–2006) — a hard money advocate and former precious metals expert for The Fed — created a useful model to help us understand the risks America is facing and how best to prepare.

And, though his chart was developed in the 1970s…

“Exter’s Inverted Pyramid of Risk” still rings true today – perhaps even more so.

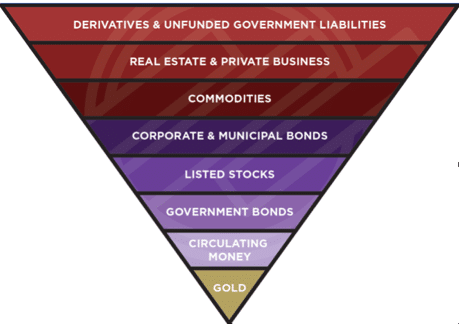

From top to bottom, the layers of the inverted pyramid are organized from most risky and least liquid to least risky and most liquid.

The widest, most leveraged layer at the top includes Derivatives and Unfunded Government Liabilities. And these assets carry the highest risk and volatility.

Below this layer, you’ll see Mortgage-Backed Securities, Private Business Equity, Real Estate, and Non-Monetary Commodities. This is the layer with assets that collapsed during the 2008 financial crisis.

Next, you’ll find Stocks, Corporate Bonds, and Municipal bonds. These assets are attractive to many investors due to the higher potential for profit. But they also carry higher interest rate risks, purchasing-power risks, and default risk than the layer beneath it, which consists of assets issued by governments or corporations to pay cash in the future like…

US Government Bonds and Treasury Bills. As you may know, many investors are pouring cash into T-bills right now because they have never defaulted. Yet these historically stable investments still carry high-interest rate risks and purchasing-power risks.

Next to last, we see Federal Reserve Notes, aka “cash,” and digital money backed by the full faith and credit of the government. Cash is more stable than the layers above but still carries inflation and devaluation risks. (John Exter called the Fed’s printed fiat currency “IOU Nothings.”)

Finally, at the bottom of the pyramid, we find physical gold…

…the only liquid asset in the diagram with no counterparty risks or credit risks.

Unlike all paper assets above it, gold can’t default, go bankrupt, be arbitrarily devalued or drop to zero in value.

And understanding why capital flows into gold during times of economic crisis is a key to knowing why owning gold now may be the wisest financial decision you can make.

Here’s how it works:

During a credit expansion phase, when interest rates are low and “money is cheap,” investment capital tends to flow “up” the inverse pyramid into higher-risk, lower-liquidity assets.

During periods of economic uncertainty when interest rates are high, capital flows “down” the pyramid as investors flee to the perceived safety of higher-liquidity, lower-risk assets – like bonds, cash and gold.

As this happens, these lower-risk, high-liquidity assets absorb that fleeing capital, which tends to increase their value due to increased demand.

This is what happened after the 2008 crisis.

Before the crisis, companies like AIG had issued 30 to 40 times more insurance than they could cover. When their assets fell by some 30%, they couldn’t pay securities holders for their insurance.

As a result, investors started dumping their contracts as fast as possible to avoid getting crushed if AIG suddenly went under.

And, according to “The Financial Crisis Inquiry Report” by the National Commission on The Causes of the Financial and Economic Crisis in the United States… as the risk layers collapsed, “Nearly $11 trillion in household wealth … vanished, with retirement accounts and life savings swept away.”

In the wake of the crisis, however, gold owners rejoiced as fleeing capital flowed into gold for protection and drove its price to record highs by 2011.

The question is, why did the crisis and gold rally catch so many Americans by surprise?

According to the government’s report, “…the leverage was often hidden—in derivatives positions, in off-balance-sheet entities, and through ’window dressing’ of financial reports available to the investing public.”

And financial institutions took huge risks where “Like Icarus, they never feared flying ever closer to the sun.”

In other words, the mounting trouble was invisible to most Americans. And the financial institutions taking unnecessary risks were overconfident.

For non-gold owners whose financial future depended solely on the performance of those assets and whose savings were tied solely to the US dollar, the consequences were unfortunate.

That’s why understanding the risks outlined by Exter’s Pyramid and keeping your eyes open to what’s happening in the economy right now is so important.

Especially as the dollar continues to lose value …

For this reason, many gold owners who understand the capital flow outlined in Exter’s Pyramid, choose not to store all their savings in dollars or stake their entire financial futures on riskier, less-liquid assets.

And we also know… if history repeats and a monetary crisis seeps the nation, a flood of investors in higher layers may rush toward the perceived stability of gold to help protect their wealth and preserve purchasing power.

This means a massive flow of paper capital would then chase a small supply of physical gold — and put tremendous upward pressure on gold’s price again.

This is how gold can act like insurance for your money.

So, what’s next for the US economy?

Will financial intuitions and investors holding less liquid and riskier assets near the top of the pyramid “fly too close to the sun” again and trigger another fall?

At this point, it’s difficult to forecast. But we don’t need to foresee the future to understand a core message of the inverted pyramid for 2023 and beyond:

Forging a more confident, grounded path to wealth protection in an uncertain economy includes diversifying your savings with gold.

Because, as John Exter said, “We are in a world of irredeemable paper money – a state of affairs unprecedented in history.”

Or call 888-529-0399 to schedule a free consultation with an experienced Gold Specialist. There’s no obligation.

August 17, 2023

Physical Gold vs Paper Gold: Which Is Best for Wealth Protection?

The post The Inverted Pyramid of Risk appeared first on Gold Alliance.