Learn how to protect your retirement savings.

Gold, the Dollar, and Where Our Faith Is Leading Us — Part 2

For 5,000 years, humans were using gold as their god-given money supply. We did it because gold is a debt-free asset and because it has intrinsic value — a real cost to bring out of the ground. Gold cannot be worth nothing. This made gold an eternal store of wealth.

In Part 1, we discussed the historic shift from gold as money to the paper dollar, a debt instrument with no intrinsic value that only requires a political decree to contrive into existence. The monetary system with the dollar in its center is called a fiat currency system. Fiat is Latin for “let it be” meaning “‘force” because a ruler is forcing its will on its population to use a valueless representation of wealth as money.

This historic move required us to shift our faith from the natural order of things and sound money principles to trusting our money supply with the Federal Reserve — a secretive and fallible human organization. The government needs money. It asks the Fed to conjure up debt and money for its needs, and the Fed has taken this Godly privilege of dictating our money supply and ran with it… Entitlement programs? Wars? Pandemic? Faltering financial institutions? Struggling bond market? No problem. The Fed will print money as a solution to every financial stress or government requirement.

This has enabled our leadership to be recklessly unaccountable. We are seeing decades of non-stop government deficit spending, which has created the largest amount of debt any country has ever carried in history — debt that never will or can be repaid.

Debt accelerates in a fiat currency system

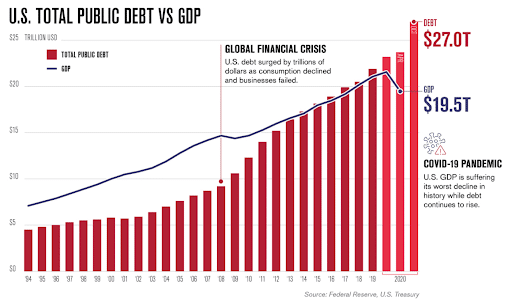

We are so used to living in a fiat/debt-based monetary system that we think it’s normal. But it’s not. It’s a modern, unnatural financial construct that consistently reduces your wealth. In our system, debt grows, but its growth accelerates. Notice in the chart below how our debt grows faster and faster, and since 2008 we have entered a stage of acceleration where the debt is growing much faster than our GDP growth.

The reason for the acceleration is that debt is required to create paper money, but it does not create the money to repay the interest on that debt. Where are we going to get the money to pay that interest? Create more debt, which will produce the money to repay the interest on the previous debt, with a smaller principal, but not the money to repay the interest on the new debt… So we need the Fed to add more and more money to our money supply to pay for ever-growing interest payments. It’s a debt (death) spiral… or a Ponzi scheme.

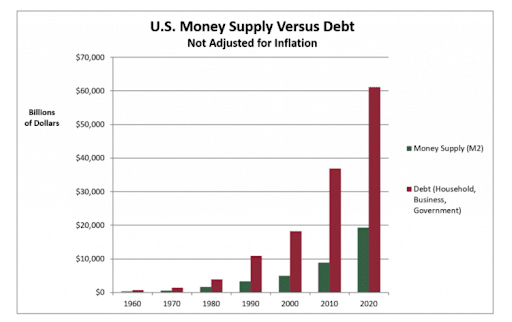

In the 1960s, growing our money supply by $1 required $2 in debt. In 2010, the same $1 added to our money supply required $4 in debt. This means more and more debt is being created since our money supply has to grow in its futile chase after the faster-growing debt.

How a debt-based economy is making you poor

Accelerating debt is not a curious side effect of our monetary system. It is the root cause of our financial woes. It causes you to “get robbed” without knowing it via different mechanisms that reduce the value of your money. You still have money, but it’s worth less and eventually becomes worthless.

How does this happen? Enter inflation. Every few months, we get an announcement from the Fed with their target inflation rate, and we are so happy if they meet it and even happier if they are just shy of it. “Low inflation is good,” they tell us.

Ask yourself: Why do we need inflation? The simple answer is that we don’t. It’s a toxic side effect of the ever-growing money supply required to pay off the ballooning debt. Inflation is the loss of purchasing power of each individual dollar because more and more dollars are being created to pay for the growing debt, diluting the value of the previous dollars in the system. More dollars are chasing after the same amount of goods, so the prices of the goods go up. Inflation robs us blind.

Remember how a decade ago the Fed used to print hundreds of millions of dollars? Then a few years later, they had to print billions, and now it’s trillions. With all that money, our financial ability did not change one bit. Actually, it did. It changed for the worse. As a direct result of inflation, the average American today is broke compared to their grandparents. In the 1960s, a family with 6 children could be supported by their father alone on a construction worker salary with the mother being a homemaker and raising the family, all while owning their home and a car. Today, this sounds like science fiction. It is impossible. Period.

When the inflation in the 1970s soared and a single salary was not enough to cover a family’s needs, married women had to join the workforce to bring more revenue for their families. This was not an act of rebellion or liberation. It was a financial necessity. But as our debt and the resulting inflation grew, even two salaries were no longer enough for a family. In the 1990s, Americans cut down their savings, and that too was not enough. In the 2000s, an average family with two salaries and no savings started going into debt — car leases, home mortgages, education loans. Today, that too is not enough. The average American is the spitting image of our country. Broke and running on a Ferris wheel of debt that cannot stop.

Before anyone takes comfort in the idea of all of us being in the same lousy financial boat, we are not. Unless you are part of a privileged few, you are being robbed one more time.

The financial elite is taking your money

Unlike a typical debt scenario — where you take a loan, get the cash, and carry the debt — when the Fed borrows on our behalf, the debt and the cash go to different places. We, the people, end up with trillions of dollars in national debt, which we all have the burden of carrying. Meanwhile, the banks receive trillions in cash from the Fed. Here’s a fact for you to chew on: Our banking system now has more than $3.5 trillion dollars in cash reserves they never had before as a result of the massive money printing and stimulus spending since 2020. Did you or will you get any of it? No. Only the privileged, large corporations and the wealthy can access this cash through the banking system. When one entity (the elite) can take cash at close to no cost (as interest rates are close to zero) while pushing its associated debt on another entity (all of us), you get historic income inequality.

But it’s much worse than me complaining that it’s not fair.

When money is accessed at an unnaturally low cost (0% interest), it rewards unhealthy leveraging and debt-taking for our largest corporations. A CEO of a large public company, such as a bank, an insurance company, or an automaker, is not rewarded today for being fiscally conservative. If the CEO moves his corporation to take on enormous amounts of debt at ultra-low cost and buys back the corporation stocks to raise its price, The CEO can take home huge bonuses on his “success.” Since this is done now across most public companies, you have the off-the-chart short-term valuations of corporations that drive the value of your IRA portfolio up. So everyone is happy with the “funny money” valuations. But if we ask our CEO, “Since you spent your money in an unproductive manner, how will your corporation be paying off the debt?” he’ll respond: “Let my future successor and my stock investors worry about the small details while I relax in my home in the Hamptons.”

In addition to encouraging our largest corporations to take on debt, our political and financial elite encourage them to take unreasonably large risks required for large rewards. If the CEOs’ risky decisions work out, his corporation wins. And if the decisions fail, the Fed will bail the corporation out because the country “needs” these important “too big to fail” corporations.

We, of course, pay for the bail-out. This means that the CEO can make more money by making risky decisions rather than making calculated, cautious, and good decisions. This is a classic moral hazard that undermines capitalism. Capitalism requires unsuccessful corporations to die so that successful companies can get the funds they need to grow. Instead, our debt is used to fund companies making horrible mistakes that should lead to their extinction. The proof? Since 2008, we have printed trillions of dollars, so why is the economy not thriving? Because money is given to corporations making risky decisions and using the funds for unproductive purposes.

When the Fed was created, there was no intention that they’d print money like they currently do. Having a gold standard was the monetary restraint. Severing the link between gold and the dollar has unleashed the Fed and our government to inflate our money supply without any objective restraint. This created inflation, which is robbing us, and allocated funds to enrich the financial elite at our expense.

Under the gold standard, we were a thriving capitalist nation that was the guiding light for the entire world for 200 years based on hard work ethics and ingenuity. Once we got addicted to an unrestrained exploding debt system, like a junky, we can’t stop. We became reliant on continuous paper money injections handed out to the elite, pulling us all into a pit of debt that hard work or ingenuity will never pull us out of.

A great financial reset is coming

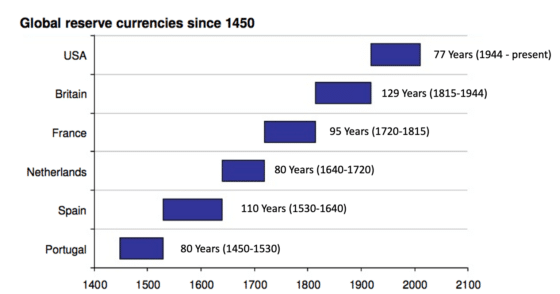

The question financial historians asked themselves in 1971 when we moved to a fiat/debt-based monetary system was not whether it would last but how long it would last. Today, the wheels are falling off of our financial system, and we are moving forward on the fumes of blind faith in the Fed. Due to our government’s loss of financial restraint and control, we see accelerated money printing and debt that grows faster than our GDP. In my opinion, we are in the last stage of the fiat currency cycle, and we will see a massive financial reset during this decade. History shows us that empires like ours that had reserve currency status moved to fiat/debt-based monetary systems to see them crumble. Not one has made it over time. So, the only question is: How prepared are you when it falls apart?

Back your wealth with gold if you can

The faith in the Fed will be shaken to its core, and loss of faith in the dollar is coming, so having a portion of your wealth in gold, like our country did when it was thriving under the gold standard, will save you from the effects of this monumental financial reset. Most people won’t have this layer of protection because they will believe in the Fed until it’s too late or because they are unable to since they are living from paycheck to paycheck, trapped in a system gone bad.

The growth in the value of gold during a financial reset is unimaginable. Jim Rickards, a respected financial analyst and author, places the future value at $15,000 an ounce or 8 times its current price. This exact rate of growth in the price of gold happened during the 1970s.

Everything works in cycles, and the cycle that values financial security over risk is coming. When a reset happens, the value of paper currency can go all the way down to near zero. Here’s what happened in the early 1900s in Germany when they experienced hyperinflation. A clear example of how investing a portion of your wealth in gold can protect you from financial disasters.

Great fortunes will be made with financial security assets and lost with risk assets. Gold will take a center stage in any successful financial strategy during this time.

Joseph Sherman

CEO, Gold Alliance

The post Gold, the Dollar, and Where Our Faith Is Leading Us — Part 2 appeared first on Gold Alliance.