Even if you were just a child during the 1970s, that decade is likely imprinted in your memory as a time of economic hardship. Long lines at the gas station and exploding prices at the grocery store were one thing; another was the millions of Americans who were pushed into unemployment.

Part of the financial crisis was caused by the oil embargo, which today would have been defined as a “supply chain disruption,” but the main blame for the crisis could be placed on the Federal Reserve. The central bank, encouraged by the abandonment of the Gold Standard, implemented easy-money policies and increased the money supply to reach its goal of full employment. Or, in the words of a prominent economist, it was “the greatest failure of American macroeconomic policy in the postwar period.” The result? Rapidly rising inflation, business closures that caused high unemployment, crashing stock and bond markets, and slow economic growth: Stagflation.

Are we headed towards another “lost decade”?

To feel what it was like to manage finances during the 1970s, imagine a decade-long recession where your chances of keeping your job, your business, and your income are low, combined with rising prices for goods and services. Ten years where you have little control over and hope for your financial future. When we were in the stagflation phase of the 1970s, things were so bad that people were missing good-old inflation.

We could be headed that way again. Here’s the writing on our wall.

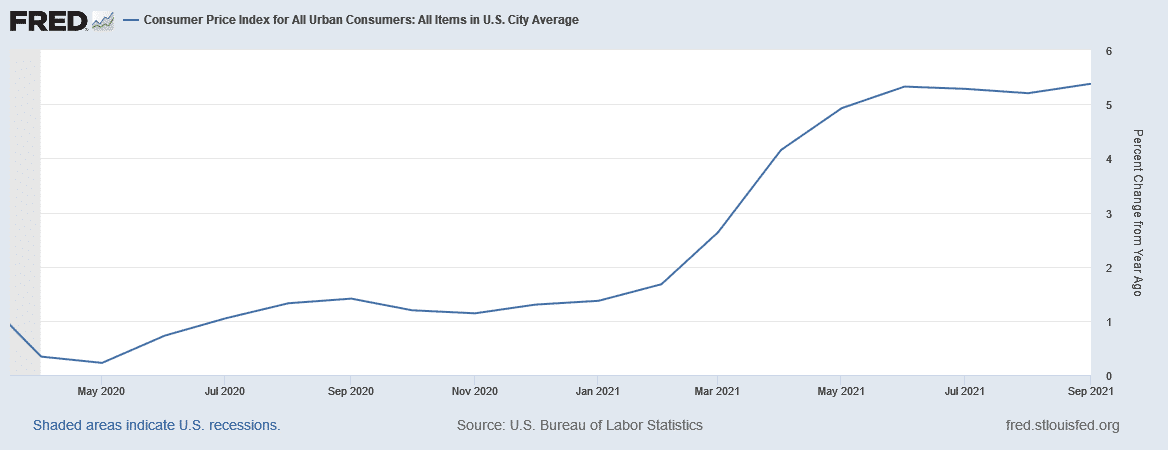

The US inflation rate climbs again

Although the Fed is talking about tapering its quantitative easing — its generous accommodation of the financial markets — those plans have yet to be set in stone, and the central bank could diverge because of the ever-looming pandemic and the slowing economy. Either way, trillions upon trillions of dollars have already been injected into the financial markets, and interest rates remain near zero with no concrete plans of a rate hike.

The Fed is taking the same course of action as in the 1970s but on a much larger scale today. Back then, it led to rapidly rising inflation, and today we’re seeing rising prices as well. Since the beginning of 2021, inflation has increased to over 5%, and the latest data shows another uptick in prices to another 30-year high.

And the outlook for further inflation is harsh:

- On top of the trillions in stimulus spending during the pandemic, Biden’s Build Back Better agenda, which some analysts call “The Welfare Plan,” will add another $3.5 trillion to our money supply, which means even more inflation.

- Severe supply-chain disruptions and the highest oil prices in almost a decade are causing inflation in the distribution chain: The Producer Price Index rose by 8.6%, and this increase in costs will almost certainly push consumer prices higher on everything from groceries and gas to electronics and cars.

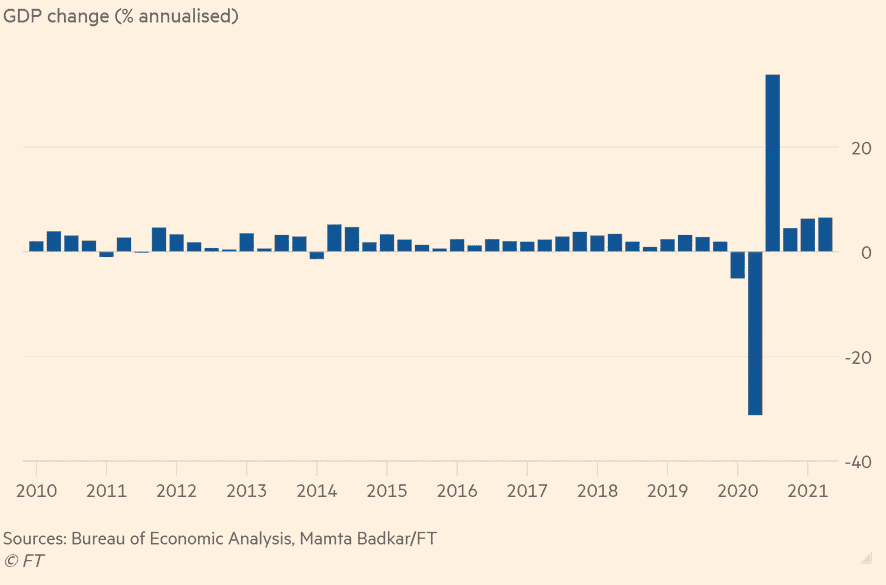

The economy is slowing down

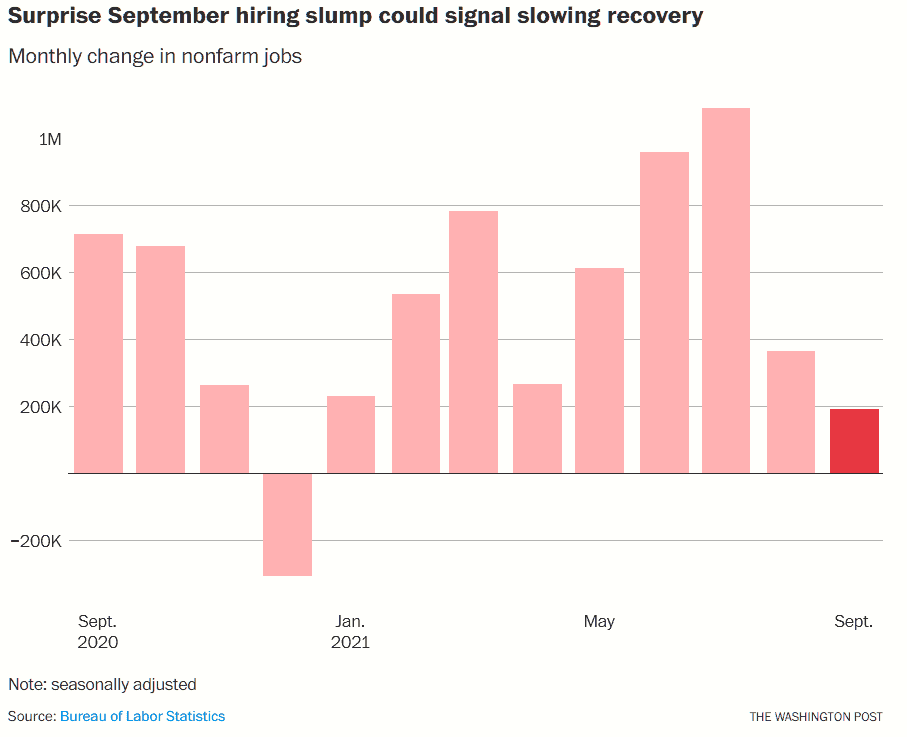

When the pandemic hit the US and we went into lockdown, the economy was immediately impacted, followed by a rapid recovery when states started easing restrictions, as seen in the chart below.

Since then, the recovery has cooled. Goldman Sachs recently lowered their forecast for the US economy, saying that “we’ll see more of a substantial slowdown” through 2022 due to inflation and supply chain bottlenecks.

Unemployment remains elevated

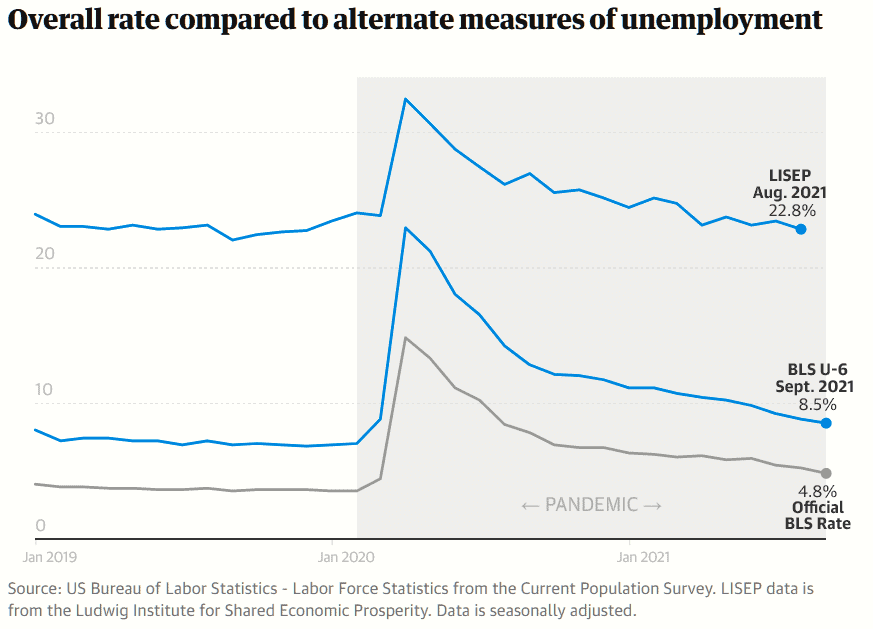

Since the unemployment rate exploded last year, millions of Americans have returned to work. However, the unemployment rate remains high at 4.8%, and the latest hiring numbers saw a troubling slowdown. Millions of Americans remain outside of the labor force despite lots of job openings, and the end of unemployment benefits in September did little to nothing to stimulate employment.

But the 4.8% unemployment rate is just the official number from the Bureau of Labor Statistics. It doesn’t account for the large number of people who have given up looking for work, those stuck in low-wage, low-hour jobs, or those who want full-time jobs but are stuck working part-time. If we look at true unemployment, we’re closer to 23% unemployment:

Stagflation vs. gold

The trifecta of rising inflation, slowing economic growth, and high unemployment could propel us into another period of stagflation that could ravage the financial future of millions of Americans and ruin their retirement dreams. It may sound harsh, but it was the reality during the “lost decade.”

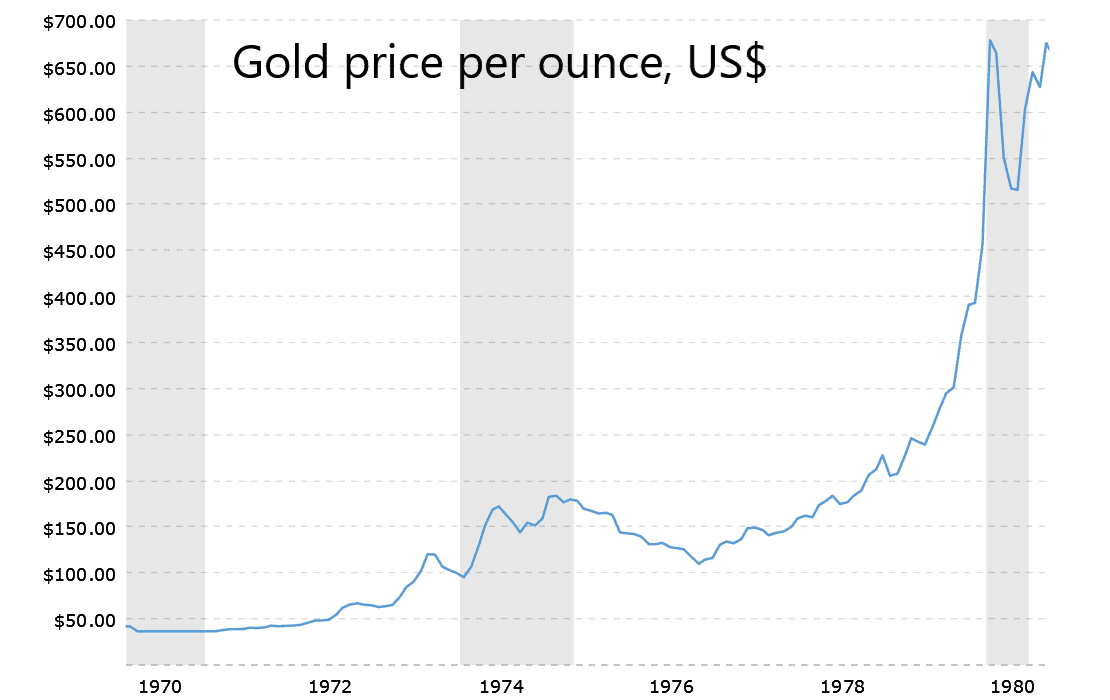

There are many benefits to adding physical gold to your portfolio ( if you’re not familiar with them, read this article). But the need to protect your portfolio from stagflation requires looking at what happened to precious metals prices during the 1970s — gold went up 8-fold, and silver went up 11-fold.

As the economy and the markets were crashing, investors were running to gold, the only safe haven they knew would work in times of crisis. Gold and silver experienced price increases that took them into bubble territory.

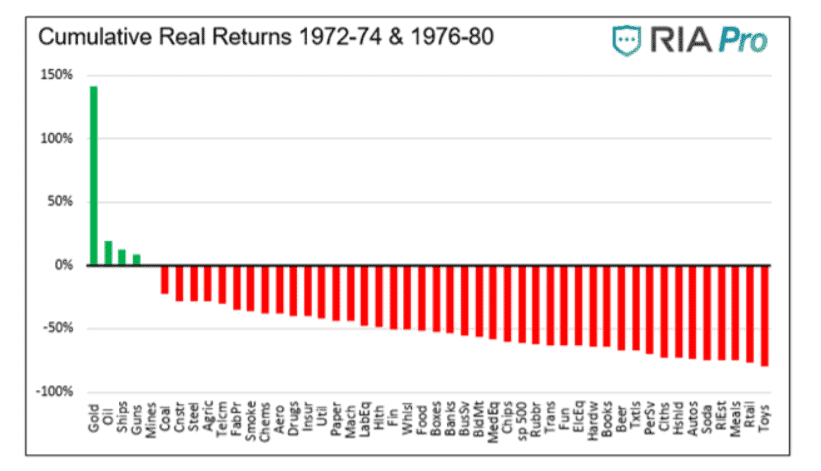

This is what we see in history time after time. When the economy cools down and when inflation runs hot, investors run to the tangible, safe, and secure and away from paper and digital derivative assets. All this is history telling us that owning gold during a time of inflation and stagflation is a way to grow your portfolio beyond belief. The chart below shows you how gold performed compared to all other assets in “real terms,” with the stock markets at the time crashing by more than 50%. Look how gold becomes the most significant growth asset during this time of crisis.

There is nothing economically worse than stagflation for a nation and its people. This is a time of purchasing-power theft on an unimaginable scale, and the 1970s are telling us that there is no cure to stagflation like holding a portion of gold in your portfolio.

The post How Gold Performs During Stagflation appeared first on Gold Alliance.