We all know that China is a growing power on the world stage. The US is still the biggest economy in the world, but The Red Dragon is catching up to us. China plays a fundamental role in world trade and in global economics. It’s also a huge player on the gold markets, and it seems like it’s using that position to hoard gold.

Here’s how China is building its gold reserves, what its agenda could be, and how it would impact us.

One of the world’s largest gold importers

In 2021, China’s net gold imports through Hong Kong soared to 334.1 tonnes from 40.9 tonnes in 2020, according to figures released recently by the Swiss export customs department and Hong Kong Census and Statistics Department.

A large part of the Chinese gold imports is coming from Switzerland (which is the gold hub of the world as three-quarters of all gold goes through Swiss refineries). While Swiss exports of gold to China tripled, shipments of gold to the US dwindled, falling from 508 tonnes in 2020 to just 113 tonnes in 2021.

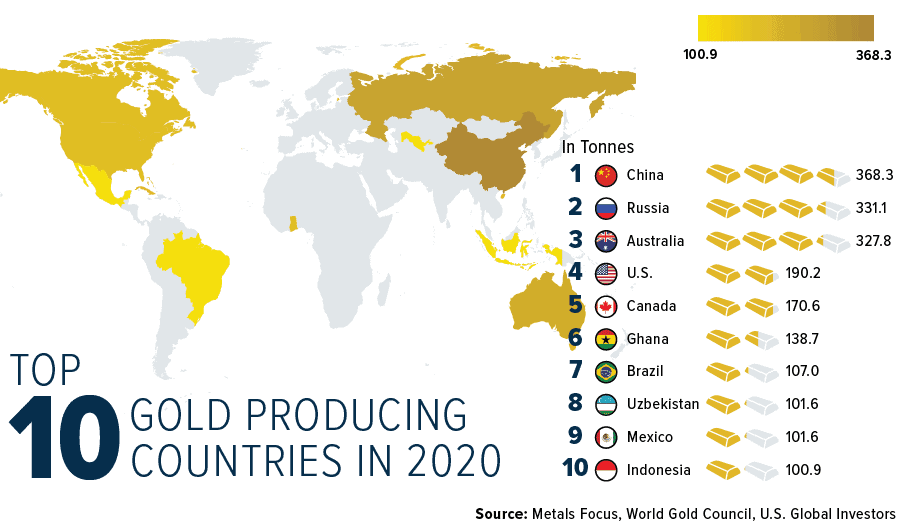

… and the world’s largest gold producer

Not only is China one of the largest gold importers, but it also produces the most gold in the world, ahead of Russia, Australia, and the US.

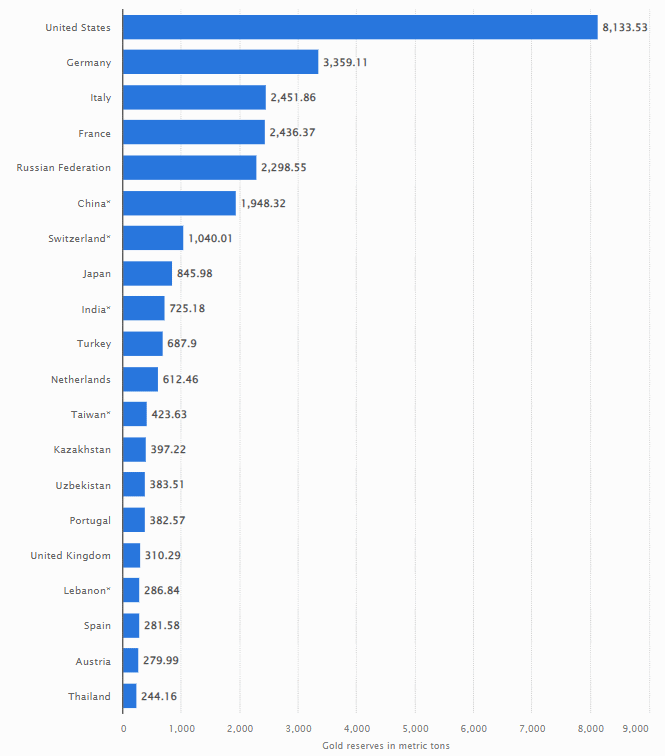

What China’s gold reserves look like

Officially, China is holding 1,948 tonnes of gold, less than one-quarter of the US gold reserves. Here’s a comparison of gold holdings officially reported by the countries themselves.

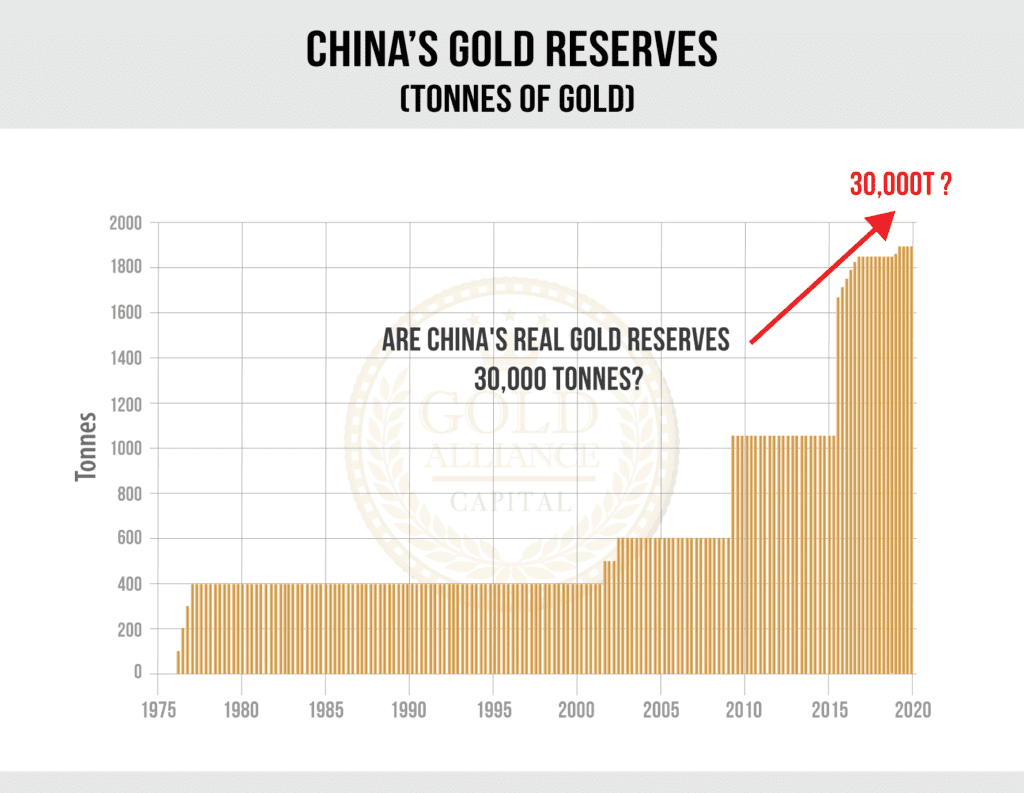

Let’s dive into China’s official gold holdings. China is reporting that since 2000, it has added 1,500 tonnes to its gold reserves. This is impressive in its own right, but considering China’s gold production and imports, we would be wise to question the official data.

So how much gold does China actually have?

Estimates of China’s real gold reserves vary, and Beijing is keeping some data secret, but let’s look at the data we do have access to.

Over the past 20 years, China has produced roughly 6,500 tonnes of gold, and it keeps all the gold it’s mining — the export of domestically mined gold is not allowed. We also have numbers from the Shanghai Gold Exchange (SGE). Whether the gold is imported, mined outside of China by Chinese-owned companies, or recycled, most of it enters China through the SGE (including the gold imported via Hong Kong). Since 2008, China has withdrawn around 20,000 tonnes from the SGE.

If we add the amount of privately held gold, some analysts estimate that China’s total gold holdings are upwards of 30,000 tonnes.

This includes both state-owned and privately owned gold, but it’s estimated that around half of it is owned by the state. That would put Beijing’s gold holdings at close to 15,000 tonnes — twice the US gold reserves.

Now, there could be many reasons why China isn’t open about its gold reserves, just like the US isn’t revealing how much gold we have at Fort Knox. For one, it could be part of China’s hidden agenda.

What could the reasons be behind China’s gold hoarding?

While our own central bank is still researching the creation of a digital dollar, China has already started the roll-out of the e-yuan, which is currently accessible to 10% of its population. The digital yuan can also be used for shopping in the Olympic Village during the Winter Olympics — undoubtedly a publicity stunt aimed at China’s own citizens and, perhaps more importantly, you, me, and the rest of the world.

But to truly give the e-yuan global appeal, the world needs to have faith in the currency. The yuan needs credibility and security, and backing it with gold would give it both, especially in a world filled with money printing.

One theory is that China is hoarding gold in order to back its physical yuan and e-yuan with the precious metal. To launch a gold-backed currency, Beijing will need huge gold reserves. This is not science fiction — China is basically doing what we did with our dollar when it was under the Gold Standard.

A yuan backed by gold means that its holders know that it cannot be inflated and that China is being held accountable to it, much like our government was before it had to cut the ties between the dollar and gold to allow it to print all the money it needed.

This would give the yuan the push it needs to become dominant in the world economy and most likely surpass the dollar as the world’s reserve currency. The gold shackles would be embraced by China as it knows that down the road it can always unshackle itself — by then, the reserve currency status would be fulfilled. That position would grant China a long list of benefits, including these:

- China would no longer have to exchange its currency for another currency to trade, and the exchange fees would fall on their trading partners.

- China would be exposed to lower exchange rate risk, especially when it comes to commodities, which are often quoted and settled in the world reserve currency.

- The liquidity of the yuan would be boosted since more transactions would take place in the currency. Loans are more easily provided, and financial assets can be priced more easily, giving Chinese companies better access to capital.

- The demand for the yuan would rise, which would increase the trust in the currency. This, in turn, would make yuan-backed securities more attractive, and China would be able to more easily export its debt.

How could it impact you if the yuan becomes the world’s new reserve currency?

If China is indeed hoarding gold as part of a plan to launch a gold-backed yuan and dethrone the dollar as the world’s reserve currency, the US would lose the benefits listed above, with severe repercussions for our economy, our businesses… and, in-turn, for each one of us.

The dollar is already weakening, and if the greenback gets pushed behind China on the world stage, it could quickly lead to significantly lower demand for dollars and dollar-backed securities. As a result, we’d no longer be able to sell off our debt to the rest of the world.

As a result, businesses would pass the exchange fees and transaction costs on to consumers. Companies would have a tougher time accessing to debt, which means they would likely have to pay higher interest rates — another expense they would pass on to consumers. This would result in a laundry list of economic challenges for the US, with rapid inflation being particularly difficult to curb amid the rising costs.

In short, strengthening the yuan by backing it with gold would very likely weaken the dollar and quickly lead to a decline in our standard of living.

How serious is China about its e-yuan and about pushing the dollar off its throne? Only time will tell, but when you’re looking at China hoarding gold, keep in mind the golden rule throughout history: He who has the gold makes the rules.

The post Why Is China Hoarding Gold? appeared first on Gold Alliance.