With inflation pushing metal prices up, will silver rise to new heights?

Many people don’t know this but silver is actually one of the better investments you can make during times of economic instability. It should come as no surprise then when you hear that that many financial experts think silver hitting an all-time high is becoming increasingly likely and it could actually hit as high as $100 an ounce. In this article, we will be taking a look at the factors involved in the price of silver, what could cause silver to rise, and when these triggers could happen possibly resulting in the metal hitting $100 an ounce.

What is the Current Price of Silver?

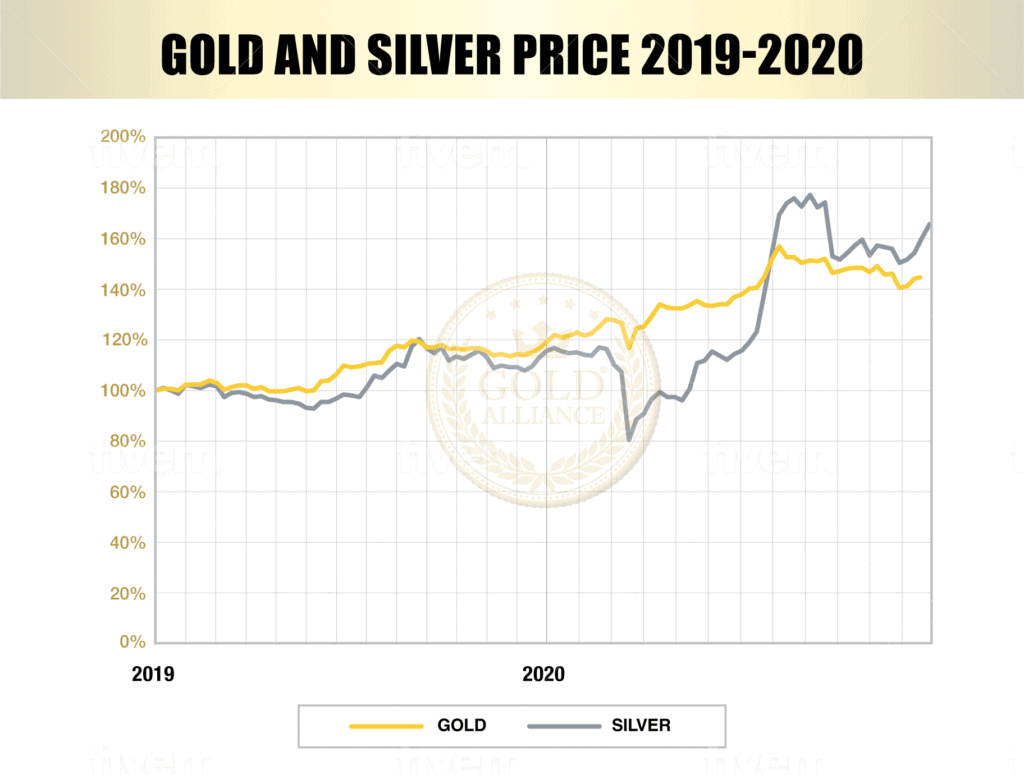

As of the time of publication of this article in 2022, the current price of silver is around $23 an ounce. This is around half of it’s all-time high of $50 an ounce in 1980. Coming off of the pandemic in 2021 the price of silver has been steady. However when looking back over the past 5 years, we can see that the price of silver per ounce has risen over 30%.

What Could Make Silver Reach $100 an Ounce?

While the cost of silver would need to increase by more than 400% to reach $100 an ounce, it isn’t completely unlikely. Here is a glance at what could drive silver to $100 an ounce:

1) Uncertainty in the Stock Market

While the cost of silver is usually uncorrelated with the stock market, precious metals prices historically will rise as equity values sink. If the stock market sees a correction or drop in performance, the price of silver could rise. Stocks indexes were at an all-time high back in December of 2021 but in early 2022 they took a dip which may be indication that the stock market is over-valued, also supported by the Buffett Indicator. If people lose confidence in the market, history tells us that they may turn to silver as an investment option instead.

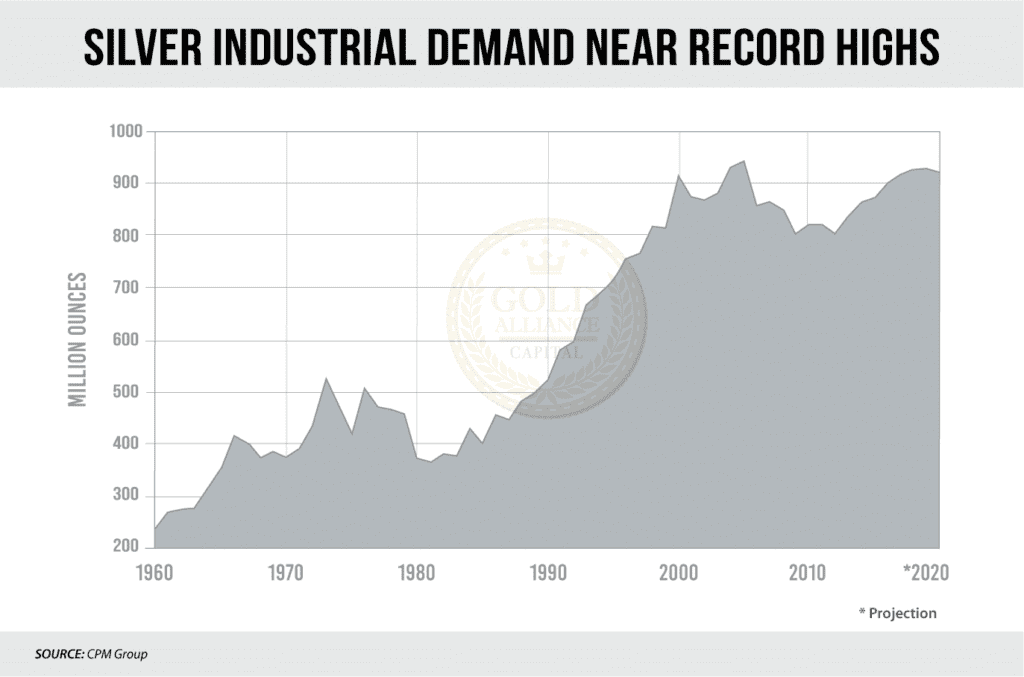

2) Rising demand for green energy and electronics

Global demand for silver is reaching all time highs as the precious metal is used in many emerging industries such as solar power and other important green initiatives used to fight climate change. It is also used in the making of mobile phones, which is soaring worldwide as almost everyone in modern day utilizes one as part of their daily lives. Due to these factors, it is expected that the demand for silver will continue to rise steadily for much of the foreseeable future.

3) Rising inflation in the US

One of the biggest contributors to the potential rise in silver costs per ounce is inflation. During the Inflation Crisis in the 1970s, the cost of silver per ounce skyrocketed from $12.40 to $50 in only ten years. This was over a 400% increase in the cost of the precious metal.

If we are staring down another ‘70-level inflation event over, it could take less than a decade for silver to reach $100 per ounce if the right factors come into play.

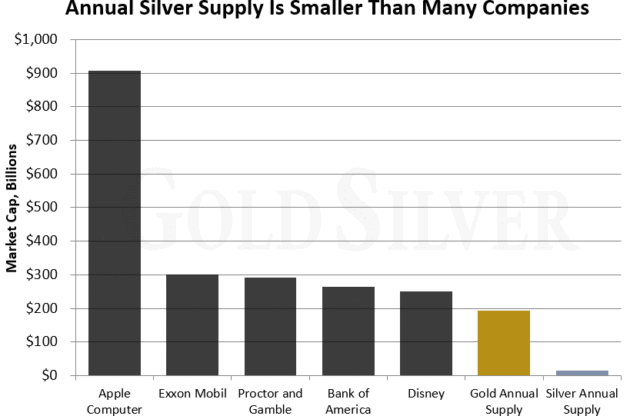

4) Struggling mining and supply production

Although the demand for silver is continuing to rise, the production of silver took a big hit during the pandemic. Many of the silver mines were forced to shut down and this most of them are still not back to full working capacity yet. Although new measures have recently been taken to get the many mines back up and running safely, much of the production is still struggling with a production bottleneck. The rising demand with a bottlenecked supply is a tell-tale case for silver to rise.

5) Global political instability

Historically, in times of geopolitical tension, gold and silver prices have increased. Right now, Taiwan considers itself an independent nation, while China claims Tawain is a part of the large country. If this tension escalates between China and Taiwan, we could potentially see an exponential increase in the cost of silver per ounce. Additionally, Russia is showing signs of a possible invasion of Ukraine, which would also send shockwaves of market turmoil rumbling through economies worldwide.

6) Global supply chain challenges

The year 2020 saw a significant change in pretty much everything because of COVID-19. One of the impacts of the pandemic has been the challenge of transporting goods all over the world. Since the global supply chain of silver is no longer able to get the precious metal delivered in the same manner as pre-pandemic, many businesses may need to pay higher prices of silver per ounce to meet their production expectations.

Will silver hit $100 an Ounce?

It’s possible silver could hit $100 an ounce is if a market correction occurs while inflation is in double-digit levels for two years straight. The combination of these two factors at the same time could cause the price to soar over 400% as supply struggles to keep up with demand.

When Can Silver Hit $100 an Ounce?

There are some who ask, “When will silver hit $30 an ounce?”, but we are curious when silver will reach $100 an ounce. As stated above, silver will have to increase in price by over 400% in order to reach $100 an ounce. In the 1970s, an increase of this size was seen over the course of a decade.

Here are some key indicators that could put together a hypothetical timeline:

2022 – Inflation runs wild

In an extreme scenario, we could see inflation take the reigns and bring silver prices over the $100 mark. If inflation continues to rise and reaches double digit values through 2022 and 2023, the $100 price of an ounce of silver could be possible.

Consider that in 2021, we saw inflation rates averaging around 5%, which was the highest rate of inflation since 2008. Not only will the inflation raise the price of silver, but more investors could seek precious metals like silver, which could also drive the price up.

2024 – Mountains of US debt causes huge spikes in inflation rates

Even if the Fed figures out how to control our current inflation crisis, the US National Debt is still looming over us. In early February of 2022, our National Debt reached over $30 trillion for the first time ever. When bondholders push the US to pay higher interest rates, those rate hikes could trickle down to the average US consumer. This could also cause a movement where investors may turn to silver as safe haven assets that still contain high growth potential.

2032 – Investors embrace precious metals over the next 10 years due to an overheated stock market

As the stock market gets more and more overheated and overvalued, investors might be looking for different ways to protect their portfolios from a serious market crash. They’ll specifically look toward safe haven assets that have been underperforming over the last 20 or 30 years. That’s where silver comes in. Because silver is under 50% of its all-time high, it is possible that we could see the precious metal rebound and outperform the US stock market in the coming years.

What is the best way learn more about silver?

Interested in learning more about how you can acquire silver for your portfolio? To learn more, contact our Account Executives. They are standing by to assist you in acquiring silver for your Precious Metals IRA or direct purchase. Contact us today at (888) 734-7453, and don’t forget to ask how you can get a copy of the 2022 Silver Rising Guide to help you determine if silver is the right asset for you.

The post Will Silver Hit $100 an Ounce and How Likely is it? appeared first on Gold Alliance.