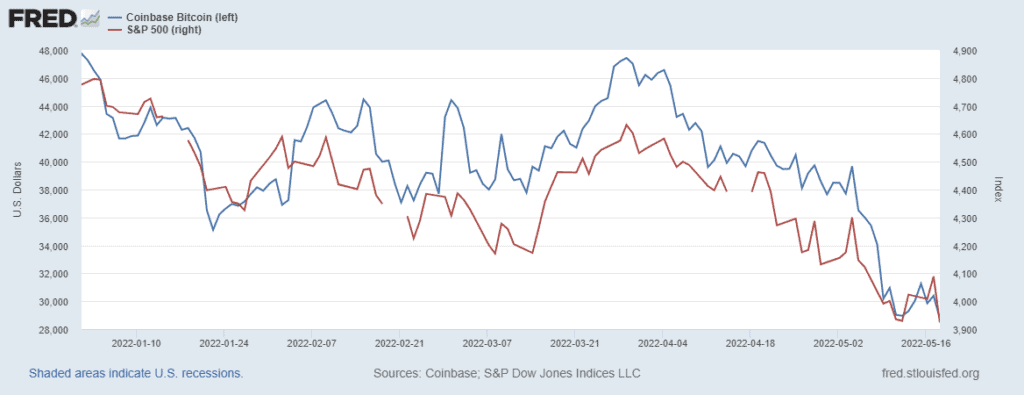

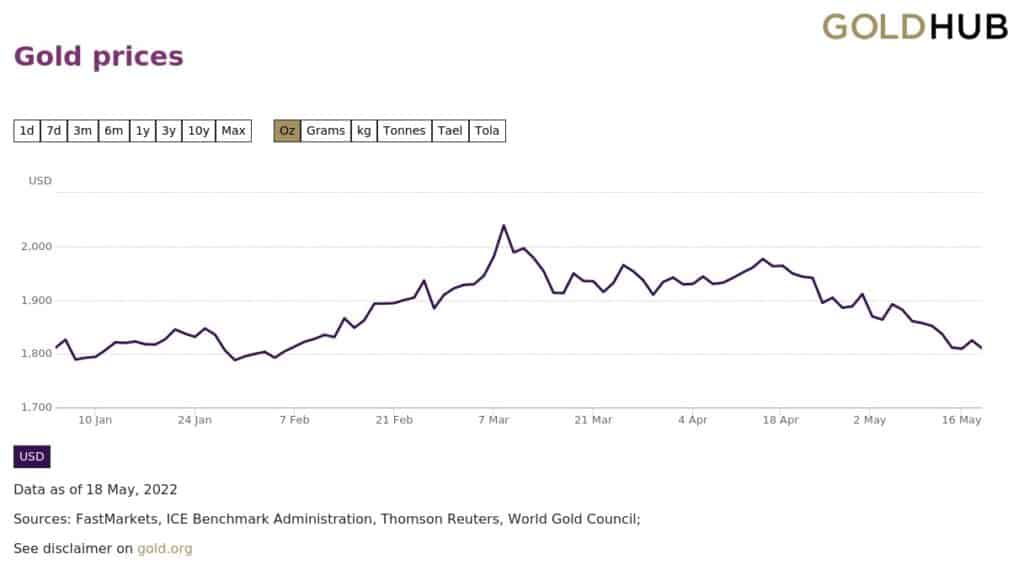

We have seen a general retraction in prices of asset classes over the last several weeks.

One explanation that analysts have provided as to why gold and the major stock markets moved in tandem is what analysts refer to as a “liquidity drawdown.”

Why did large hedge funds and sovereign funds liquidate assets?

When stock markets went down at the speed and magnitude we’ve seen over the last several weeks — in what is generally known to the public as a “pan” selloff (pan = panic) — it forced large hedge funds and sovereign funds that held large equity positions “on margin” to liquidate, including their holdings in metals, crypto, and other asset classes within their portfolio, to shore up funds to meet margin calls.

This liquidation is generally known to the public as a “liquidity drawdown” (both bad AND good assets decline in price).

Another explanation analysts have provided is that the US dollar has been “the cleanest shirt” in the currency laundry basket over the last several weeks. Recently, it hit 20-year highs. This put temporary pressure on other asset classes, including precious metals.

These phenomena that have caused people to wonder “what’s going on?” are why historical patterns where precious metals prices generally rise have not been applicable temporarily during general stock market volatility — in this case, selloffs.

As Bob Iaccino, chief market strategist at Path Trading Partners, said: “This is the nature of tradable assets… when assets are sold, all assets are sold.”

A buying opportunity for gold?

While past performance is not indicative of future performance, major stock market selloffs have in many cases been a historical buying opportunity for precious metals.

As an example, during the 2008 stock market CRASH, metals went down for a few months only to rebound quickly, and within two years gold more than doubled in price and silver quadrupled. In March of 2020 when the stock market had a mini crash, gold and silver went down only to rebound, and within five months gold had appreciated 26% and silver more than tripled.

If you are a day trader or even a short-term trader, you should not look at physical gold and silver. But if you are a passive buy-and-hold investor looking for a historical long-term hedge against general stock market volatility and a historically proven hedge against inflation, then these trends over the last several weeks did not fundamentally change the buy-and-hold strategy, only a potential new buying opportunity.

The post What’s Going On in the Markets? Why Asset Classes Have Dropped in Value appeared first on Gold Alliance.