Blog

Check out these expert insights into gold, silver, IRAs, 401ks, and precious metals.

How Russian Crude Finds Its Way to American Gas Stations

The message was clear: Russian oil was no longer welcome in America. “This package is about bringing every tool of economic pressure to bear on Vladimir Putin and his oligarch cronies,” said Democrat Sen. Ron Wyden after Congress passed the ban on Russian energy...

New Bill Calls for Return to Gold Standard

Once upon a time, the US dollar was “sound money” — its value was pegged to a fixed weight of gold, not debt as it is today. Back then, the government wasn’t able to “print” unlimited “dollars” out of thin air. They had to buy gold equivalent to around 25% of what...

The New Rush to Gold – Why Central Banks Are on a Record-Breaking Gold-Buying Spree

If investors always try to “follow the Smart Money,” like hedge funds and renowned, sophisticated investors, then one question comes to mind: Who, or what, does the Smart Money follow? The answer is the “Smartest Money” — central banks. Every day, we read about how...

Another Crack in the Dollar’s Dominance?

The dollar remains the world’s reserve currency, but Russia and China are signaling a significant shift away from the greenback. Now the Bank of Israel seems to show these efforts are somewhat successful as it’s reducing its exposure to the dollar (and the euro). In...

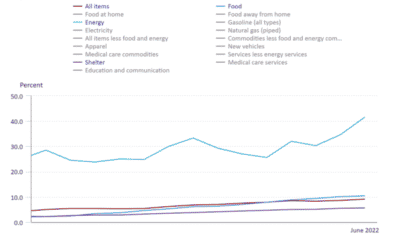

Inflation shock— what can the Fed do?

On July 13, the Bureau of Labor Statistics released the latest inflation data, which shows that the Fed remains unable to reign in spiking prices. For the year ending in June, the consumer price index rose 9.1%, the highest since 1981. Three categories are the main...

Russia Reacts to Financial Sanctions

Recently, I wrote about my concerns about the weaponization of the dollar in response to the Russian invasion of Ukraine. US and EU leaders implemented unprecedented financial sanctions against Moscow to cripple the Russian economy and force them to end the war. So...

The Courage During the Battle of Baltimore

On July 4th, we celebrate the independence of the United States from Great Britain. The Revolutionary War lasted eight years and cost the lives of approximately 6,800 soldiers. In the end, through blood and sacrifice, our country was born, based on the belief “that...

Is a Recession Coming?

The US economy has suffered one blow after another over the past couple of years, and recession warnings are mounting — from Deutsche Bank, the World Bank, and Morgan Stanley to Elon Musk and Jamie Dimon. And, according to a CNBC survey, 80 percent of small-business...

The Social Security Sinkhole

For several months, we have written about the risk a coming financial and economic meltdown due to uncontrolled inflation, the dollar facing increased competition, and the global impacts of the coronavirus pandemic and the Russia–Ukraine war. Towards the end of 2021,...

Are the Market Wheels Coming Off?

For several months, we have written about the risk a coming financial and economic meltdown due to uncontrolled inflation, the dollar facing increased competition, and the global impacts of the coronavirus pandemic and the Russia–Ukraine war. Towards the end of 2021,...

Is Gold Too Expensive?

“Should I wait for the price of gold to come down or buy silver now?” asked a friend recently after complaining that the price of gold was too high. Like many Americans, he worried that the stock market was dangerously over-priced and that a painful reckoning was...

8 Reasons Why Gold Is the Ideal Money

Despite investor enthusiasm, the current bull market in stocks is running out of steam. Many companies, including Walmart and Microsoft, are cutting their profits forecasts for 2022. Many economists expect stagflation or a US recession because the Federal Reserve is...

The Pillars of This Bull Market Are Crumbling

Despite investor enthusiasm, the current bull market in stocks is running out of steam. Many companies, including Walmart and Microsoft, are cutting their profits forecasts for 2022. Many economists expect stagflation or a US recession because the Federal Reserve is...

Memorial Day – Remember and Honor

On March 4, 1865, President Abraham Lincoln stood on a muddy street, delivering his second inaugural address. The Civil War was coming to an end, and the President gave a paragraph of his speech to the unification of the North and South after years of bloody fighting:...

What’s Going On in the Markets? Why Asset Classes Have Dropped in Value

We have seen a general retraction in prices of asset classes over the last several weeks. One explanation that analysts have provided as to why gold and the major stock markets moved in tandem is what analysts refer to as a “liquidity drawdown.” Why did large hedge...

The Federal Reserve Flirtation with Inflation

In the 1920s, a British chemical manufacturer combined water, mineral oil, and beeswax to produce Brylcreem, a popular hair cream. The product’s jingle — “A little dab will do ya!“ — constantly played on radio and television stations. Has this slogan, repeated over...

The Triffin Dilemma – Why the US Dollar Is Up Against Fate

The financial sanctions imposed by the West on Russia are extensive and unprecedented, and they are devastating the Russian economy and reigniting the Cold War of the 1960s and 1970s. As an unintended consequence of the sanctions, questions are being raised regarding...

Gold & Freedom: Why Gold Ownership Brings Freedom

During my 20 years of military service, I developed a deep passion for freedom and liberty. More specifically, it stems from my deployments and stations abroad, where I saw tyranny and the effects it has over the population. Howard Buffett and the link between...

Waiting to Act — How the Fed’s Passive Approach Could Cost You Big

The inflation rate in the United States soared to 8.5% in April 2022, its highest level in over 40 years. The current surge reminds many of the 1970s’ and 1980s’ era of long hair, disco, Vietnam protests, and 15% inflation. Pressured by President Nixon to keep...

How to Spot Hidden Asset Inflation and Reduce Risk

For years, the US Federal Reserve has pumped trillions of dollars into the economy to support the increasing national debt without raising interest rates. The Fed justified this action with the claim that the increased money supply has minimally affected the inflation...